Groupon, Inc.'s (NASDAQ:GRPN) Shares Climb 34% But Its Business Is Yet to Catch Up

Despite an already strong run, Groupon, Inc. (NASDAQ:GRPN) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 128% following the latest surge, making investors sit up and take notice.

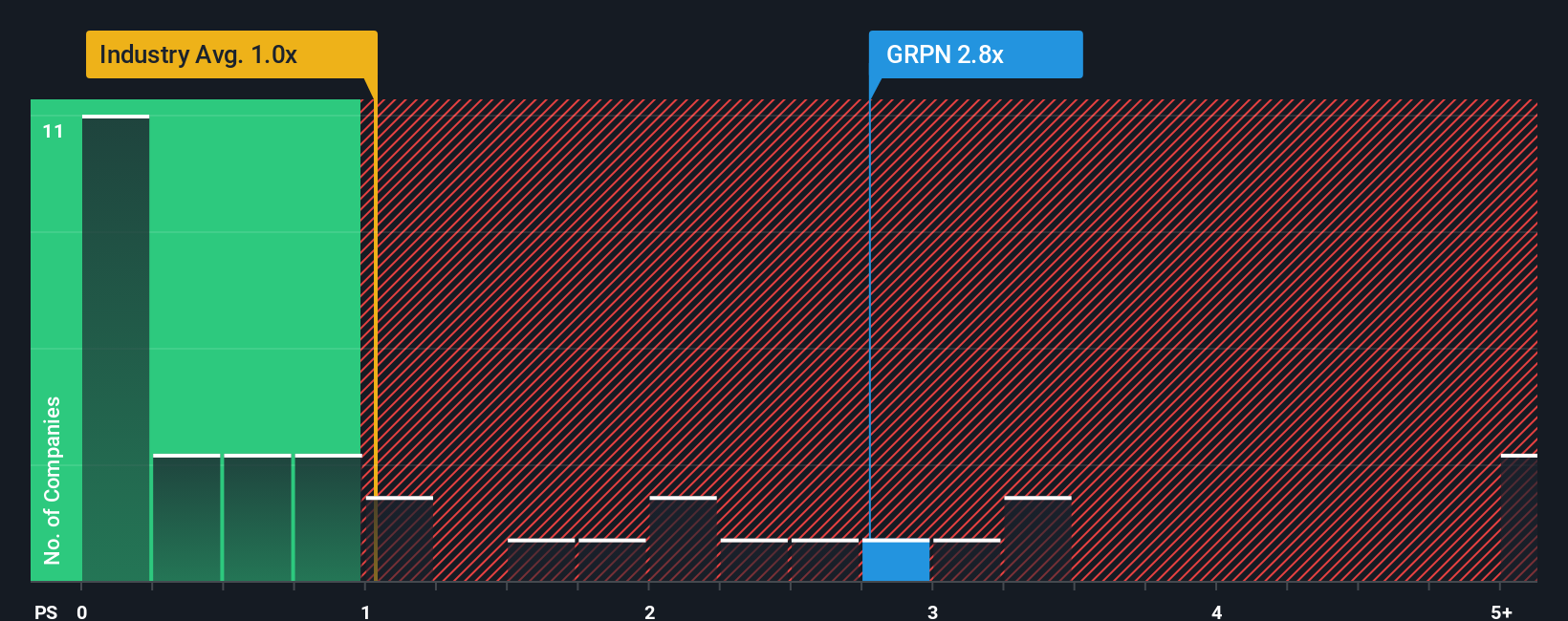

Since its price has surged higher, when almost half of the companies in the United States' Multiline Retail industry have price-to-sales ratios (or "P/S") below 1x, you may consider Groupon as a stock probably not worth researching with its 2.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Groupon

What Does Groupon's P/S Mean For Shareholders?

Groupon could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Groupon will help you uncover what's on the horizon.How Is Groupon's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Groupon's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 43% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.5% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 10%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Groupon's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The large bounce in Groupon's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Groupon currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Groupon that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal