BlackRock (NYSE:BLK) Joins Consortium for Potential Port Deal with Chinese Firms

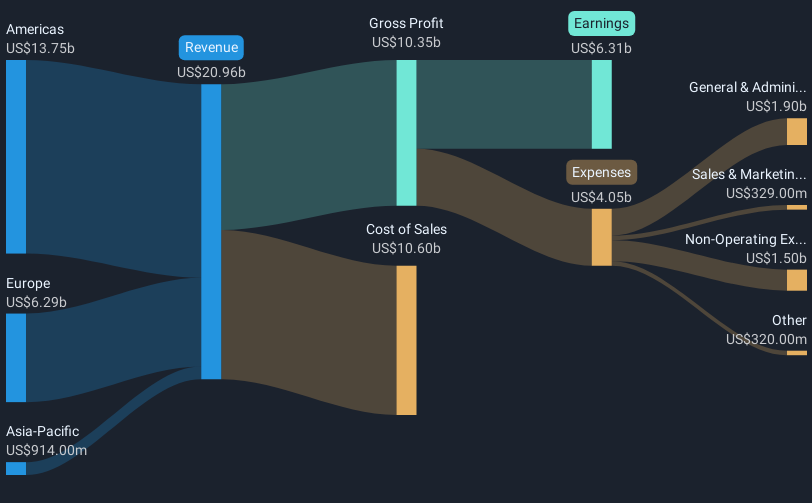

BlackRock (NYSE:BLK) is involved in discussions with a consortium led by Gianluigi Aponte's Terminal Investment Limited Sarl, exploring strategic participation in a port deal. The company's stock price rose 6% over the last quarter, which aligns broadly with the 12% market gain over the past year. BlackRock's substantial revenue growth, despite a decline in net income, coupled with continued dividend payments and share repurchase activities, likely supported the stock's rise. Meanwhile, geopolitical tensions and oil prices influenced market trends but did not substantially detract from the positive trajectory observed in BlackRock's stock.

We've spotted 1 possible red flag for BlackRock you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The potential port deal involving BlackRock could bolster its strategic objectives in private markets and alternative investments. This aligns with the company's narrative of expanding into infrastructure and private credit, potentially driving future revenue growth and margin improvement. However, geopolitical tensions and economic uncertainties could pose risks to these strategies, impacting revenues and earnings going forward. The company's revenue growth forecast of 9.9% annually over the next three years suggests a keen focus on diversifying income streams, but actual outcomes may vary based on external influences.

Over the past five years, BlackRock's total shareholder return, incorporating both share price appreciation and dividends, was 100.41%, providing substantial long-term gains for investors. Despite a stock price rise of 6% over the recent quarter and the share's proximity to analyst consensus price targets, it's pertinent to consider the broader market dynamics. The share's price target of US$1,044 suggests a 10.6% premium over the current level of US$914.97, indicating potential room for appreciation aligned with optimistic analyst expectations. Nonetheless, management's focus on technology and ETFs, coupled with its seasoned management team, could further drive value creation.

Gain insights into BlackRock's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal