Carrier Global (NYSE:CARR) Confirms Quarterly Dividend of US$0.23 Per Share

Carrier Global (NYSE:CARR) recently affirmed a quarterly dividend of $0.225, which may have lent confidence to investors amid broader market resilience despite global tensions affecting markets like the Dow. While CARR's 8.94% price rise last quarter aligns with the positive market trend that gained 12% over the year, other factors likely supported its performance. These include an impressive increase in net income, launched product innovations to bolster its market position, and strategic investments in U.S. facilities. These developments might have contributed positively to the company's shareholder returns amidst fluctuating market conditions.

The recently announced quarterly dividend of US$0.225 by Carrier Global may reinforce investor sentiment by showcasing the company's commitment to returning cash to shareholders, despite wider market volatility. Over the past five years, Carrier's total shareholder return, including dividends and share price appreciation, was very large, highlighting robust performance and shareholder value creation. In the past year, Carrier outperformed both the US market, which returned 11.2%, and the US Building industry, which returned 8.1%. This long-term success provides context to understand the short-term price movement, where it recently rose 8.94% last quarter and stands 9.3% below the analyst consensus price target.

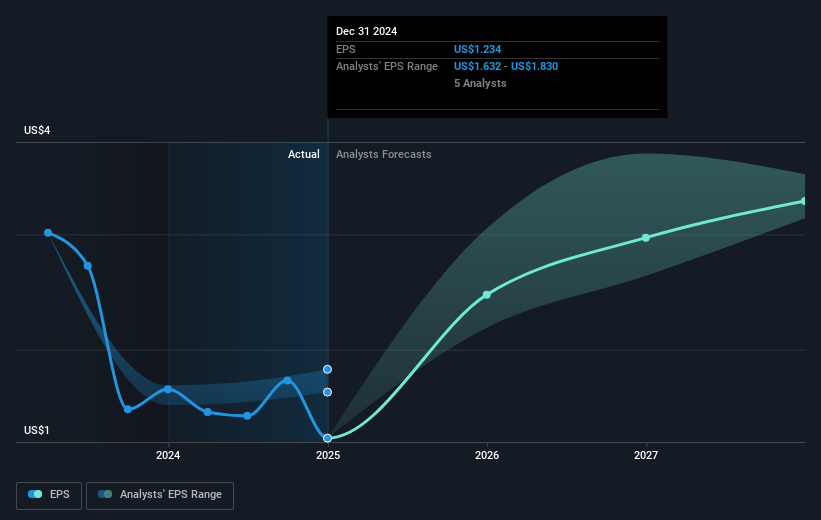

The new product innovations, coupled with strategic US facility investments, are expected to drive revenue and earnings growth. With a projected annual revenue growth of 5.3% and profit margins increasing from 6% to 10.4% over three years, these advances could enhance shareholder returns and meet analyst expectations. However, issues like tariff risks and regional challenges present potential revenue and profitability barriers. Carrier's current share price of US$70.19, compared to the fair value price target of US$77.4, suggests potential growth aligned with analyst perceptions. Investors should tactically assess these factors to understand the future outlook for Carrier's returns in light of current market conditions and company initiatives.

Examine Carrier Global's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal