Thermo Fisher Scientific (NYSE:TMO) Explores US$4 Billion Diagnostics Sale, Expands mRNA Collaboration

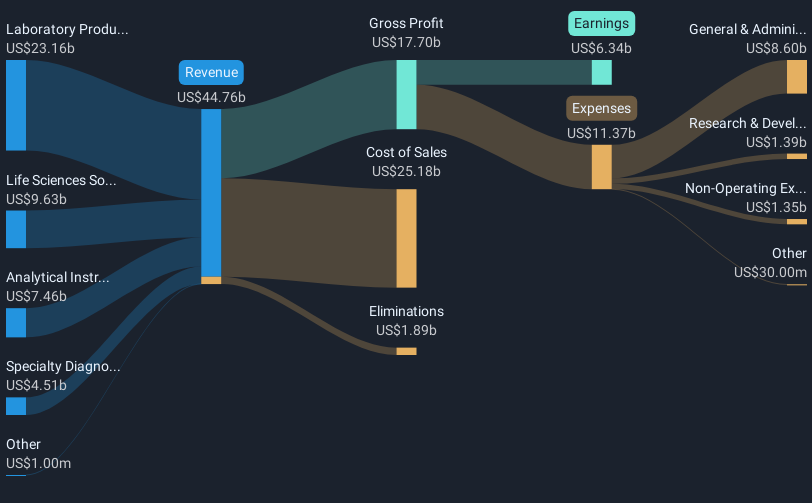

Thermo Fisher Scientific (NYSE:TMO) recently made headlines by entering a collaboration with Ethris GmbH to advance mRNA solutions and putting a $4 billion price tag on part of its diagnostics unit for potential sale. Despite a turbulent market marked by geopolitical conflicts and falling major indexes, the company's share price rose 4% last week. While the overall market saw a modest increase of 1.6% amid complex global dynamics, Thermo Fisher's developments likely weighed in contrast to broader movements. The new partnerships and potential asset divestitures may have provided investors with renewed confidence in the company's strategic direction.

The recent collaboration between Thermo Fisher Scientific and Ethris GmbH to advance mRNA solutions, as well as the planned divestiture of part of its diagnostics unit, aligns with the company's focus on innovation and strategic asset management. These moves may bolster Thermo Fisher's market position and support future revenue growth in bioprocessing and scientific technologies. Over the longer term, Thermo Fisher's total return, including share price and dividends, was 21.04% over the past five years, illustrating a strong performance amidst industry challenges.

In the context of the past year, Thermo Fisher underperformed the US Life Sciences industry and the broader US market, with the industry and market returning significantly differing results. This relative underperformance suggests that while Thermo Fisher's strategic shifts are promising, they have yet to fully materialize in outperforming market benchmarks.

The new initiatives, such as the acquisition of Solventum's filtration business, are expected to impact revenue and earnings forecasts positively. Analysts anticipate revenue growth of 5.4% annually, although risks such as tariffs and demand weaknesses remain. As for the share price, despite a recent rise of 4%, it remains below the analyst consensus price target of US$560.23. This suggests potential upside, with the company's strategic initiatives potentially acting as catalysts. Investors should weigh these factors against the backdrop of broader market dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal