Revenues Not Telling The Story For Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) After Shares Rise 31%

Lexicon Pharmaceuticals, Inc. (NASDAQ:LXRX) shares have continued their recent momentum with a 31% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 62% share price drop in the last twelve months.

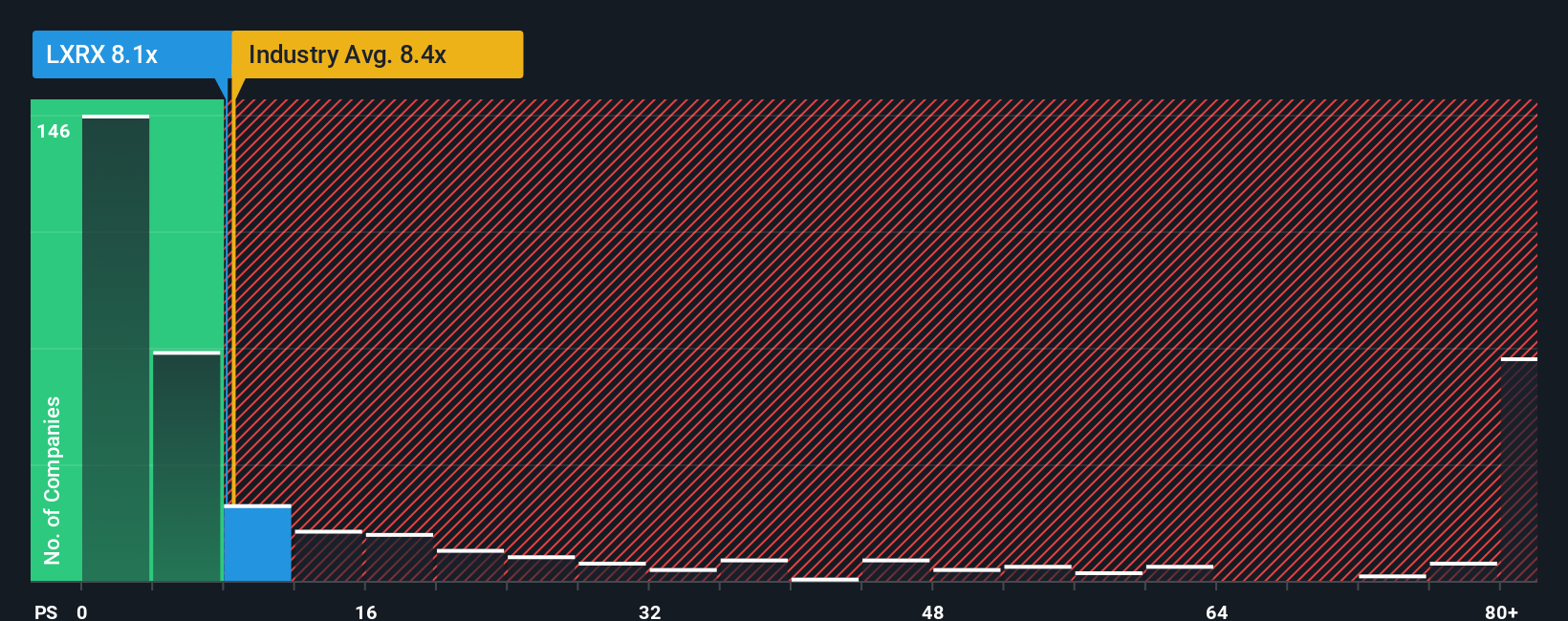

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Lexicon Pharmaceuticals' P/S ratio of 8.1x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 8.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Lexicon Pharmaceuticals

How Lexicon Pharmaceuticals Has Been Performing

Recent times haven't been great for Lexicon Pharmaceuticals as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lexicon Pharmaceuticals.How Is Lexicon Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, Lexicon Pharmaceuticals would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 112% each year, which is noticeably more attractive.

In light of this, it's curious that Lexicon Pharmaceuticals' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Lexicon Pharmaceuticals' P/S

Its shares have lifted substantially and now Lexicon Pharmaceuticals' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Lexicon Pharmaceuticals' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 3 warning signs for Lexicon Pharmaceuticals you should be aware of, and 2 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal