Spotlight On 3 European Penny Stocks With Market Caps Over €20M

As the European market experiences a lift, with the pan-European STOXX Europe 600 Index rising by 0.90% due to slowing inflation and an easing monetary policy from the European Central Bank, investors are keenly eyeing opportunities for growth. Penny stocks, often misunderstood as relics of past market eras, continue to hold potential for those looking at smaller or newer companies that offer affordability and growth prospects. By focusing on strong financials and solid fundamentals, penny stocks can present unique investment opportunities in today's evolving economic landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.86 | SEK504.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.16 | €66.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.61 | €17.24M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.40 | SEK2.3B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.64 | SEK221.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.185 | €301.67M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.982 | €32.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 444 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

DigiTouch (BIT:DGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DigiTouch S.p.A. offers digital marketing and transformation services in Italy, with a market cap of €26.84 million.

Operations: The company generates revenue through three main segments: Technology Services (€24.13 million), Marketing Services (€11.49 million), and E-Commerce Services (€3.24 million).

Market Cap: €26.84M

DigiTouch S.p.A. operates with a market cap of €26.84 million, generating revenue from Technology, Marketing, and E-Commerce services. Despite a slight decline in sales to €40.01 million for 2024, the company maintains high-quality earnings and strong financial health with short-term assets exceeding both long-term and short-term liabilities. Its debt is well-covered by operating cash flow (30.1%), while interest payments are adequately covered by EBIT (3.9x). Although recent earnings growth was negative at -16.7%, long-term forecasts remain positive at 22.59% per year, supported by an experienced board and management team.

- Click to explore a detailed breakdown of our findings in DigiTouch's financial health report.

- Learn about DigiTouch's future growth trajectory here.

Netgem (ENXTPA:ALNTG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Netgem SA develops, operates, and distributes the NetgemTV digital video entertainment platform across France and Europe, with a market cap of €32.88 million.

Operations: Netgem SA has not reported any specific revenue segments.

Market Cap: €32.88M

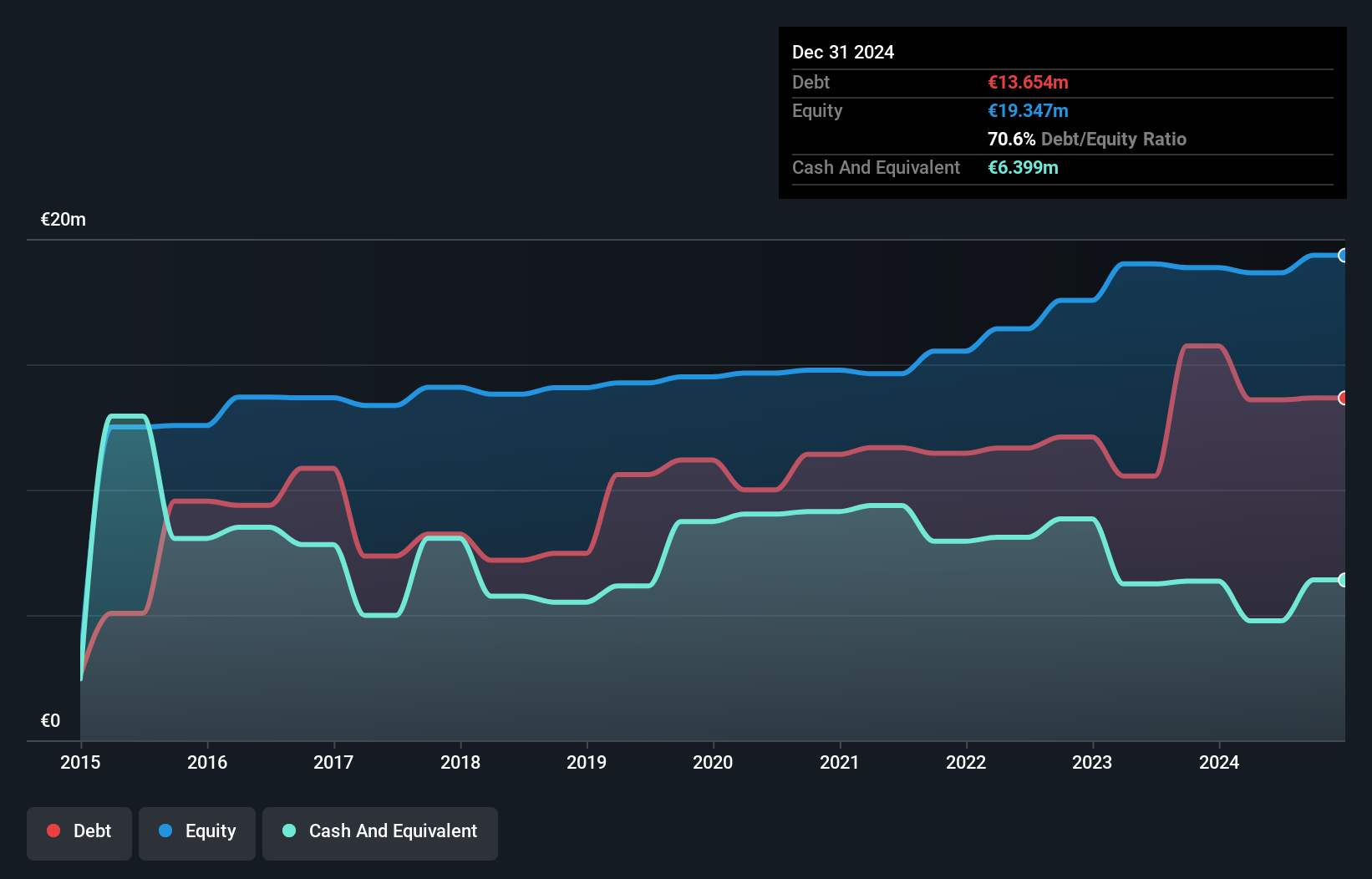

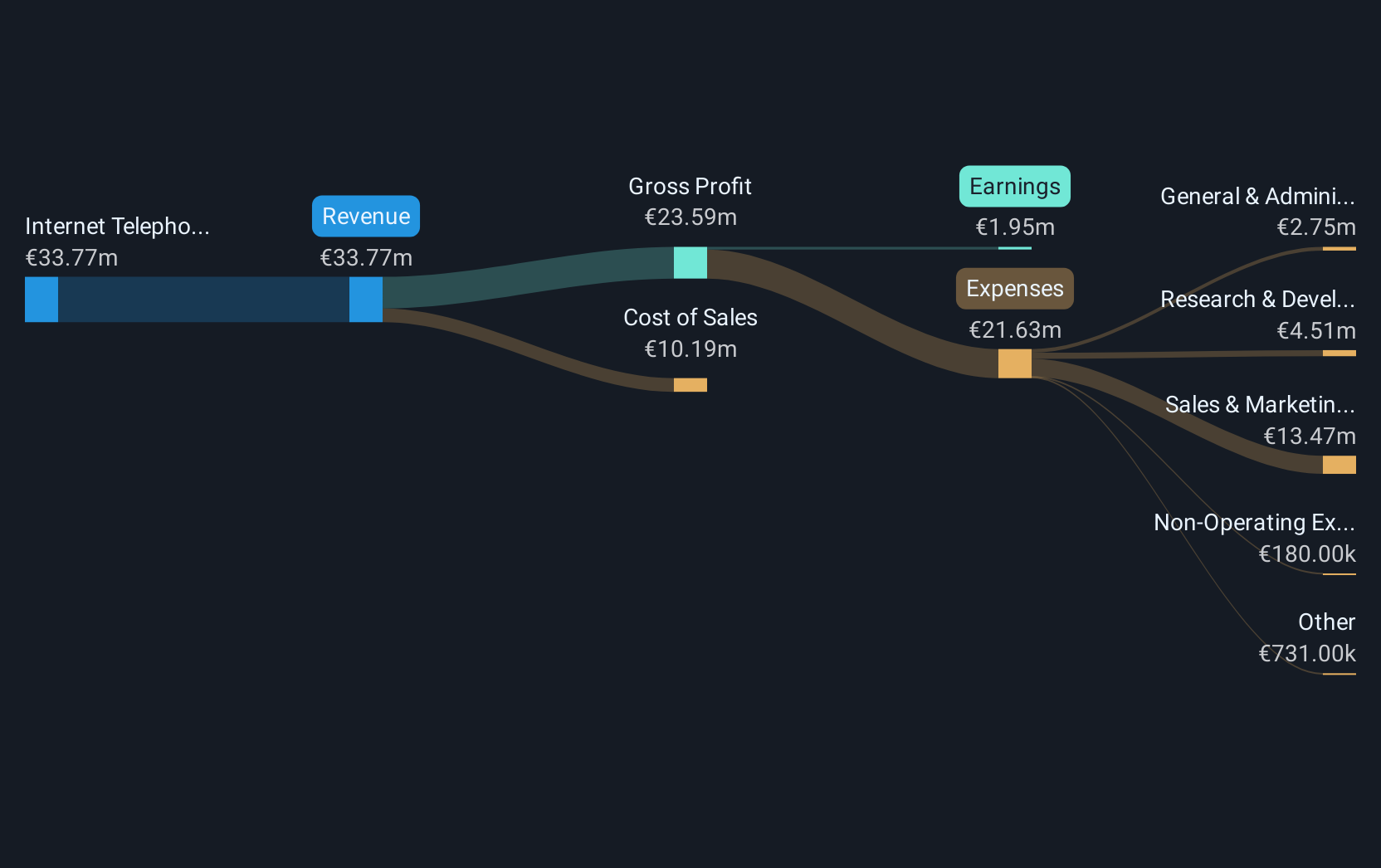

Netgem SA, with a market cap of €32.88 million, reported sales of €33.77 million for 2024, reflecting a slight decline from the previous year. The company has demonstrated strong financial health by reducing its debt-to-equity ratio significantly over five years and maintaining more cash than total debt. Earnings have grown impressively by 261% over the past year, far outpacing industry averages, though return on equity remains low at 7.8%. Despite high-quality earnings and robust interest coverage (69.3x), dividends are not well covered by earnings, suggesting potential sustainability concerns in this area.

- Take a closer look at Netgem's potential here in our financial health report.

- Examine Netgem's earnings growth report to understand how analysts expect it to perform.

SHL Telemedicine (SWX:SHLTN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SHL Telemedicine Ltd. provides telemedicine services across Israel, Europe, and internationally, with a market cap of CHF32.45 million.

Operations: The company generates revenue primarily from its telemedicine services, amounting to $56.78 million.

Market Cap: CHF32.45M

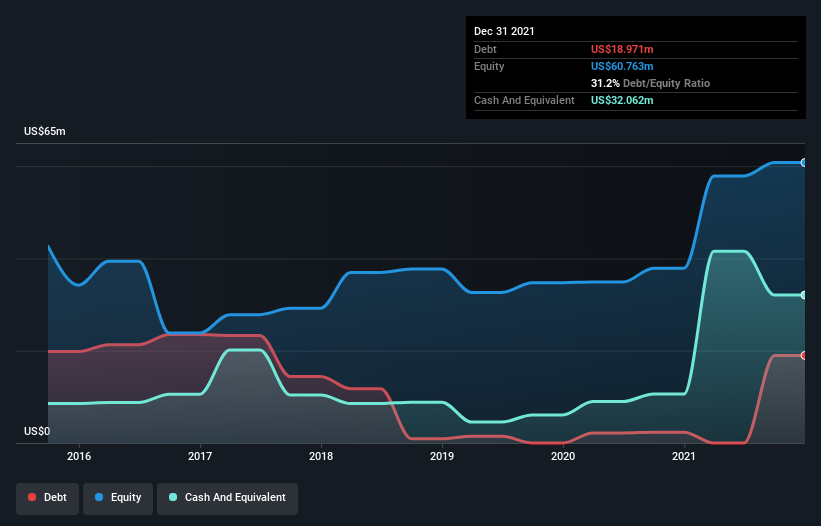

SHL Telemedicine, with a market cap of CHF32.45 million and annual revenue of US$56.78 million, faces challenges despite some financial strengths. The company is unprofitable, with net losses widening to US$28.1 million in 2024 from the previous year. Its short-term assets slightly exceed liabilities, providing some liquidity cushion, but its return on equity remains negative at -70.71%. While the firm has been dropped from the NASDAQ Composite Index and delayed SEC filings raise concerns, it maintains a cash runway exceeding three years even as free cash flow declines significantly each year by historical rates.

- Unlock comprehensive insights into our analysis of SHL Telemedicine stock in this financial health report.

- Examine SHL Telemedicine's past performance report to understand how it has performed in prior years.

Key Takeaways

- Explore the 444 names from our European Penny Stocks screener here.

- Ready For A Different Approach? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal