UK Growth Companies With High Insider Ownership You Should Know

In the current climate, the UK market has been experiencing fluctuations, with the FTSE 100 index recently closing lower due to weak trade data from China. As global economic challenges persist, investors are increasingly looking towards growth companies with high insider ownership as these firms often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| QinetiQ Group (LSE:QQ.) | 13.2% | 70.7% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| Judges Scientific (AIM:JDG) | 10.6% | 23.1% |

| Invinity Energy Systems (AIM:IES) | 11.2% | 81.7% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 20.3% | 55.0% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 112.4% |

Let's review some notable picks from our screened stocks.

Brickability Group (AIM:BRCK)

Simply Wall St Growth Rating: ★★★★☆☆

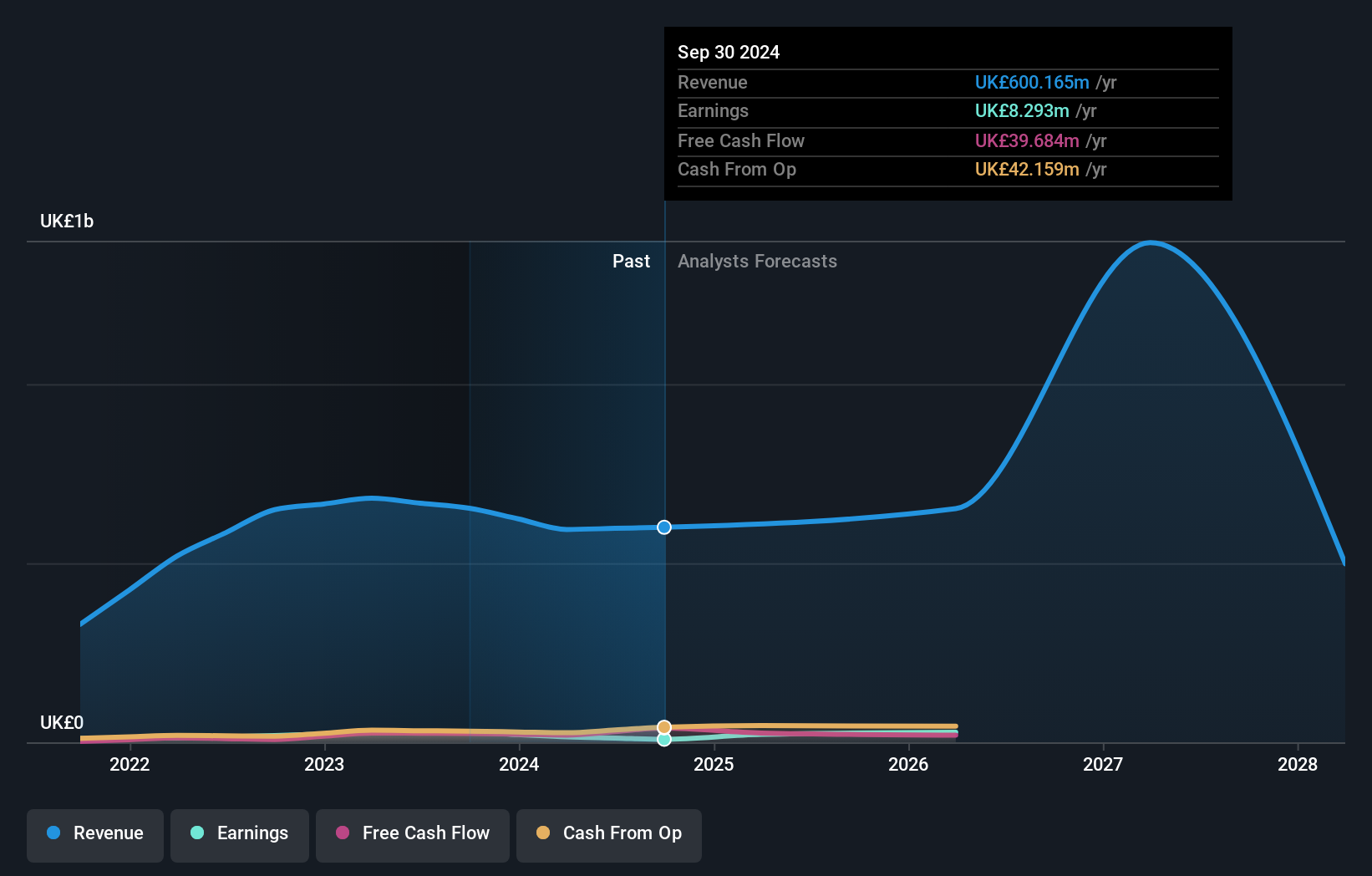

Overview: Brickability Group Plc, along with its subsidiaries, supplies, distributes, and imports building products in the United Kingdom and has a market cap of £223.56 million.

Operations: The company's revenue segments consist of £90.55 million from importing, £88.22 million from contracting, £63.21 million from distribution, and £380.56 million from bricks and building materials.

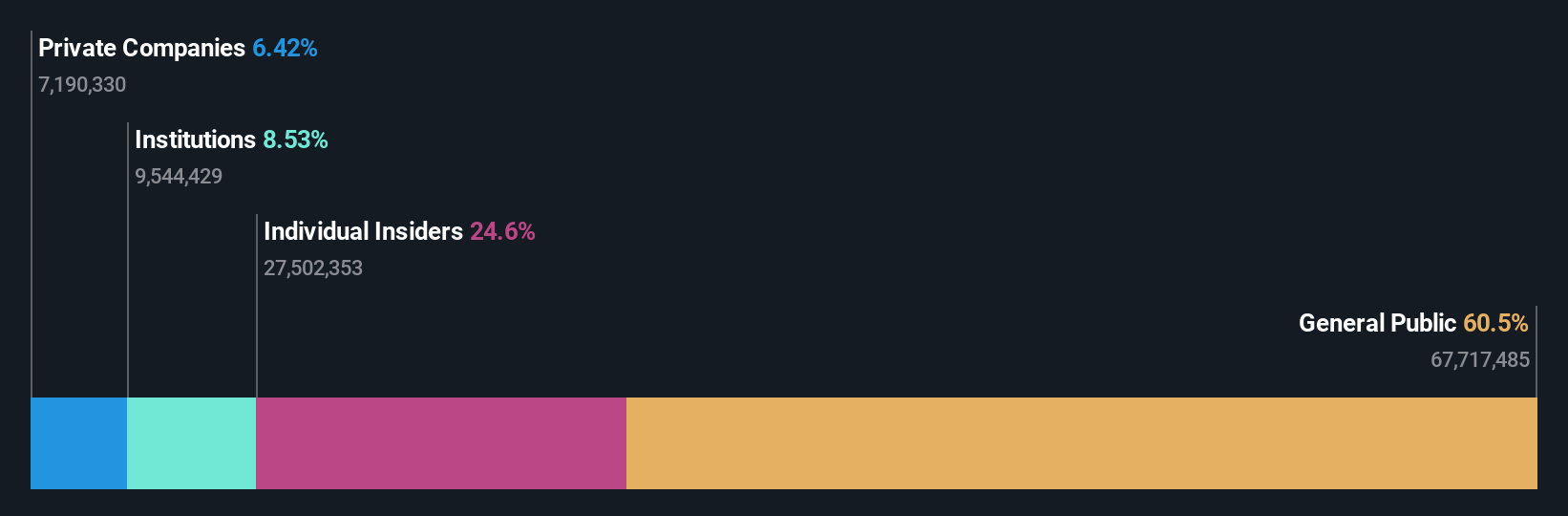

Insider Ownership: 24.6%

Earnings Growth Forecast: 39.6% p.a.

Brickability Group's revenue is forecast to grow faster than the UK market, with earnings expected to rise significantly at 39.6% per year, outpacing the market's 14.4%. However, profit margins have declined from last year. Trading below its estimated fair value may present an opportunity for investors. Recent board changes include appointing Katie Joy Long as an independent Non-Executive Director, potentially strengthening M&A strategies and corporate governance. Revenue guidance for FY2025 indicates a modest increase to £637 million.

- Click here to discover the nuances of Brickability Group with our detailed analytical future growth report.

- Our valuation report unveils the possibility Brickability Group's shares may be trading at a premium.

Faron Pharmaceuticals Oy (AIM:FARN)

Simply Wall St Growth Rating: ★★★★★★

Overview: Faron Pharmaceuticals Oy is a clinical-stage drug discovery and development company with a market cap of £295.70 million.

Operations: Faron Pharmaceuticals Oy does not currently report any revenue segments in millions of € as it operates primarily in drug discovery and development at the clinical stage.

Insider Ownership: 20.3%

Earnings Growth Forecast: 55.0% p.a.

Faron Pharmaceuticals is positioned for significant growth, with revenue projected to increase by 55.4% annually, surpassing UK market expectations. Despite negative shareholders' equity and past shareholder dilution, the company is expected to achieve profitability within three years. Recent clinical trials of bexmarilimab in high-risk myelodysplastic syndromes show promising results, supporting further development and potential FDA approval processes. Trading significantly below estimated fair value could indicate an attractive entry point for investors seeking exposure to innovative biotech solutions.

- Click here and access our complete growth analysis report to understand the dynamics of Faron Pharmaceuticals Oy.

- Our comprehensive valuation report raises the possibility that Faron Pharmaceuticals Oy is priced higher than what may be justified by its financials.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★★☆

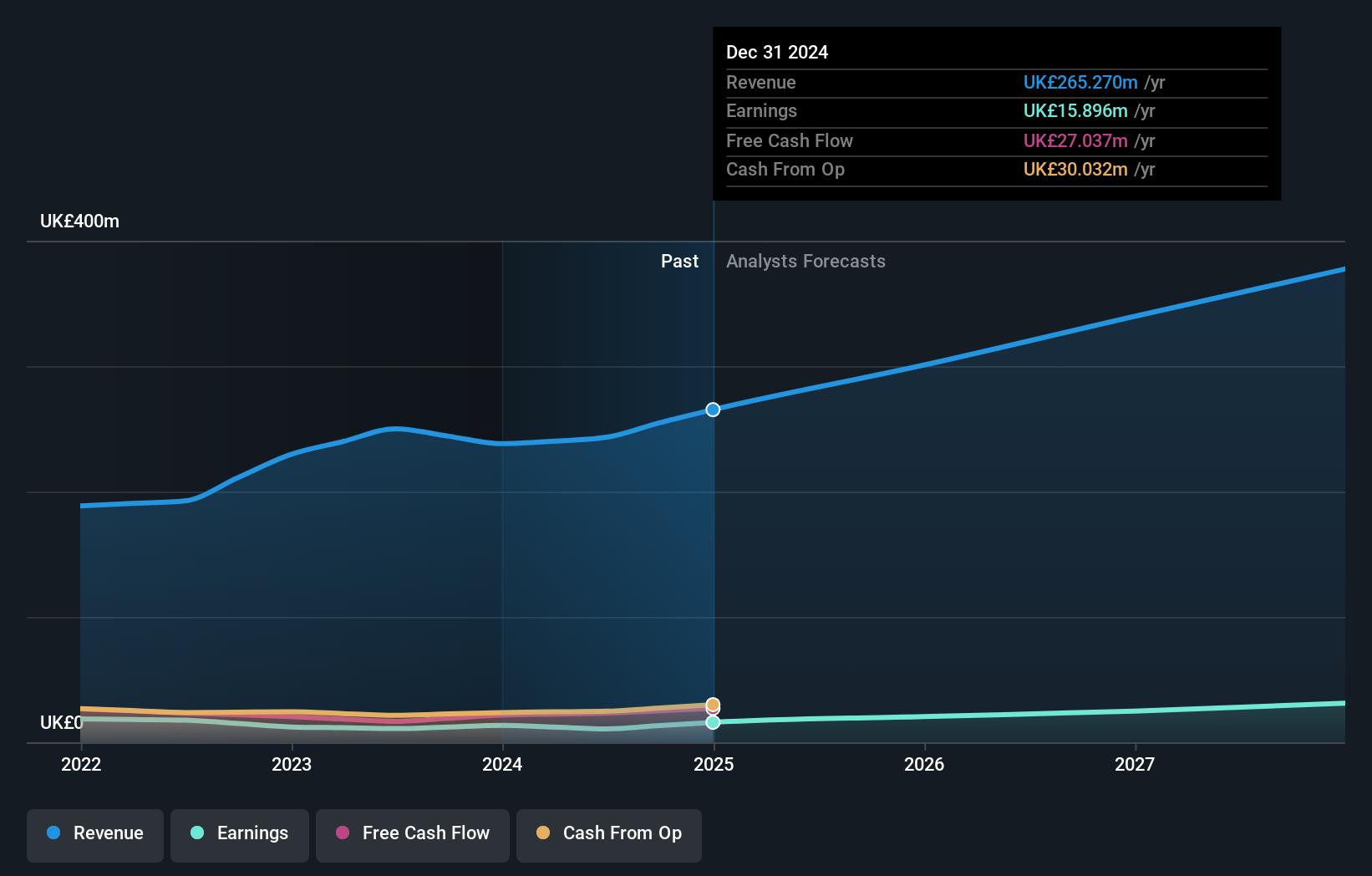

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market cap of £493.79 million.

Operations: The company generates revenue of £265.27 million from its provision of financial services segment in the UK.

Insider Ownership: 19.8%

Earnings Growth Forecast: 20.3% p.a.

Mortgage Advice Bureau (Holdings) shows promising growth potential, with earnings expected to increase by over 20% annually, outpacing the UK market. Recent earnings reported a net income rise to £16.08 million. Insider activity indicates more buying than selling recently, although not in substantial volumes. The company's revenue is forecasted to grow at 10.7% per year, faster than the overall UK market rate but below high-growth thresholds. Analysts suggest a potential stock price increase of 26.2%.

- Navigate through the intricacies of Mortgage Advice Bureau (Holdings) with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Mortgage Advice Bureau (Holdings)'s share price might be on the expensive side.

Taking Advantage

- Investigate our full lineup of 62 Fast Growing UK Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal