GE HealthCare Technologies (NasdaqGS:GEHC) Enhances Diagnostic Confidence With MIM Encore Integration

GE HealthCare Technologies (NasdaqGS:GEHC) saw a 3% increase in its share price over the past week. This move aligns with the broader upward trend of the market, which rose by 1.2% in the same period. The company's announcement of integrating its proprietary features with MIM Encore marks a significant enhancement in delivering precision care, likely adding positive sentiment around the stock. Meanwhile, broader market optimism was evident as indices like the S&P 500 approached record highs, driven by strong corporate earnings and potential trade agreements. These factors collectively contributed to the company's performance over the past week.

We've spotted 1 warning sign for GE HealthCare Technologies you should be aware of.

GE HealthCare Technologies' recent news of integrating proprietary features with MIM Encore could have a meaningful influence on its future market performance. While the immediate effect was a 3% increase in share price over the past week, the longer-term context over the last year shows a total return, including dividends, of 3.23% decline. Relative to the industry, GE HealthCare underperformed, as the US Medical Equipment industry showed a 6.9% gain over the same one-year period. However, company-specific strategies such as partnerships with integrated delivery networks and advancements in imaging technologies might pivot revenue and earnings forecasts positively, overcoming bearish pressures from tariffs and regulatory uncertainties.

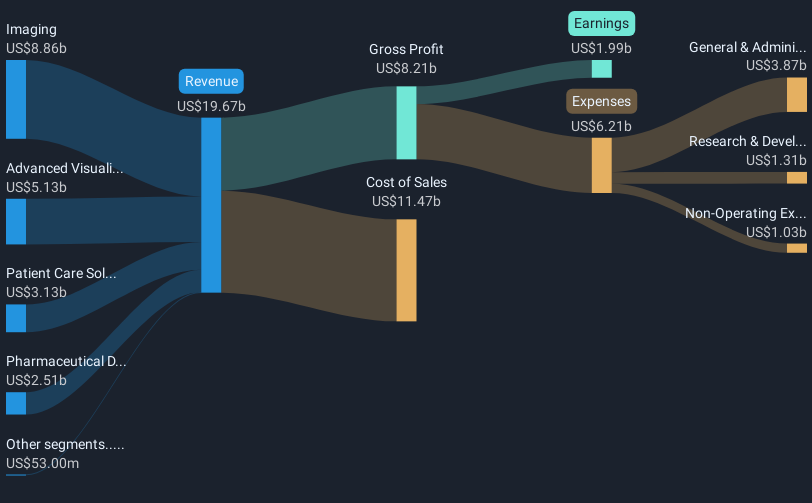

The share price rise needs to be contextualized against analyst consensus, targeting US$88.81, which is 24.5% higher than the current price of US$67.09. This indicates that there may still be significant growth potential based on revenue expansions and acquisitions in diagnostics. Analysts' projections suggest revenue will grow from US$19.8 billion currently to US$22.3 billion by May 2028, with earnings rising from US$2.18 billion to US$2.4 billion, highlighting the expected long-term growth trajectory. The market's response to the recent announcement suggests an optimism that these developments will solidify the company's role in precision care and bolster its financial position in upcoming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal