AbbVie (NYSE:ABBV) Achieves FDA Approval for MAVYRET Label Expansion to Treat Pediatric Hepatitis C

AbbVie (NYSE:ABBV) recently secured FDA approval for the expanded use of MAVYRET, a treatment for hepatitis C, which now includes younger patients and those with acute HCV. This development is significant as it broadens treatment options, aligning with ongoing public health goals. Over the last week, AbbVie's stock price moved up 2% amid a broader market rise of 1%. The market optimism, partly driven by overall economic data and progress in trade negotiations, may have supported AbbVie's positive price movement, slightly outperforming the general market uptick during the same period.

We've spotted 5 weaknesses for AbbVie you should be aware of.

The recent FDA approval for the expanded use of MAVYRET adds a crucial dimension to AbbVie's growth narrative, potentially boosting revenue as the drug's addressable market widens to include younger patients and those with acute HCV. This approval aligns well with AbbVie's strategy of enhancing its therapeutic offerings, particularly in significant global health areas. In terms of market performance, AbbVie's stock has delivered a total return of 145.49% over the past five years, reflecting substantial long-term growth. For context, over the past year, AbbVie exceeded the US Biotechs industry, which saw a 10.6% decline.

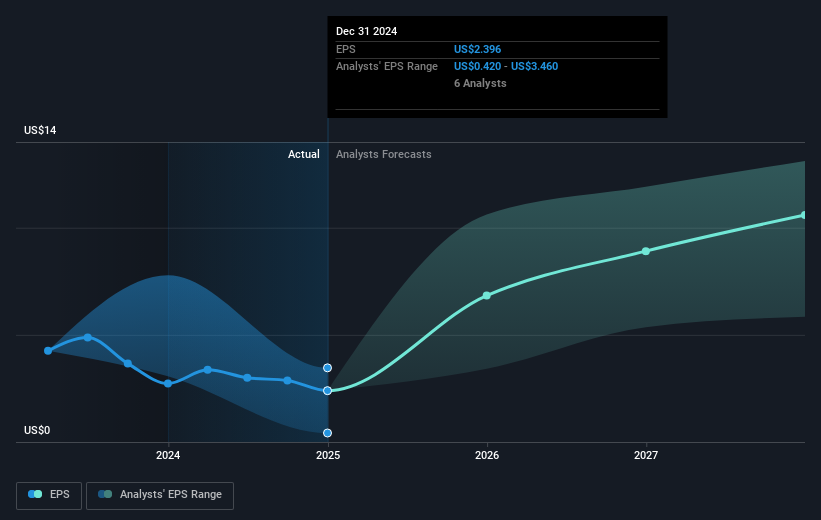

The expanded use of MAVYRET could further bolster revenue and earnings forecasts, as analysts anticipate a 6.8% annual revenue growth over the next three years. Judicially capitalizing on this expanded indication could support such estimates, potentially offsetting some anticipated revenue pressures from biosimilar competition. Currently, AbbVie’s shares are priced at $187.15, compared to the consensus analyst price target of $210.68, representing a potential upside of 11.2%. In summary, while the approval is a positive catalyst for future growth, the total long-term shareholder returns and current pricing in relation to analyst targets offer a nuanced perspective on AbbVie's valuation and growth potential.

The valuation report we've compiled suggests that AbbVie's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal