Huikang Technology's Shenzhen Stock Exchange IPO “accepted”. The company is leading the industry in the field of ice machines

The Zhitong Finance App learned that on June 12, Ningbo Huikang Industrial Technology Co., Ltd. (“Huikang Technology”) Shenzhen Stock Exchange's main board IPO review status was “accepted”. Caitong Securities is its sponsor, and the company plans to raise 1,796.55 billion yuan. The company has strong market competitiveness and leading position in the field of ice machines.

According to the prospectus, the company is deeply involved in the refrigeration field. It is a national high-tech enterprise with R&D, production and sales of refrigeration equipment as its core business. Its main products include ice makers, refrigerators, freezers, wine cabinets, etc., which are mainly used in the civil and commercial fields. It has successfully covered more than 80 countries and regions around the world, including major markets such as China, the United States, Canada, Australia, Mexico, Germany, Sweden, and Brazil.

According to the certification of the China Light Industry Machinery Association, from 2022 to 2024, the company's ice machine products ranked first in domestic sales market share and domestic commercial market share ranked first; ice machines ranked first in the global market share, and the global civilian market share ranked first. It is one of the main drafting agencies for national and industry standards. The company actively transforms R&D results into patents. As of December 31, 2024, the company has obtained 161 patent authorizations, including 20 invention patents.

In terms of procurement, the company mainly uses the procurement model of “procurement based on sales and production”; in terms of production, for its own brand business, the company schedules production based on future sales forecasts to guarantee a certain amount of inventory; for ODM business, the company adopts a “sales to fix production” model based on customer orders; in terms of sales, the company is deeply involved in the refrigeration equipment field, has accumulated rich industry experience and formed a “ODM as the main focus, and OBM as a complement” business model. During the reporting period, issuers' ODM model sales accounted for 81.10%, 83.59%, and 88.19%, respectively.

At the same time, the company adheres to its own brand development strategy, strengthens sales of its own brands through online e-commerce platforms, and actively expands its own brand business for ice makers such as “HICON Huikang” and “WATOOR”. The company's OBM business revenue showed an upward trend during the reporting period. The company's core product, ice makers, have been ranked first in the domestic online retail market segment for many years, forming strong competitiveness in the domestic market and a stable business model.

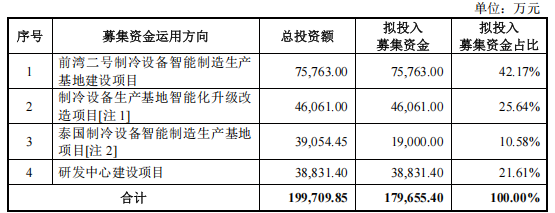

After deducting the issuance fee, the funds raised in this offering will be invested in the following projects:

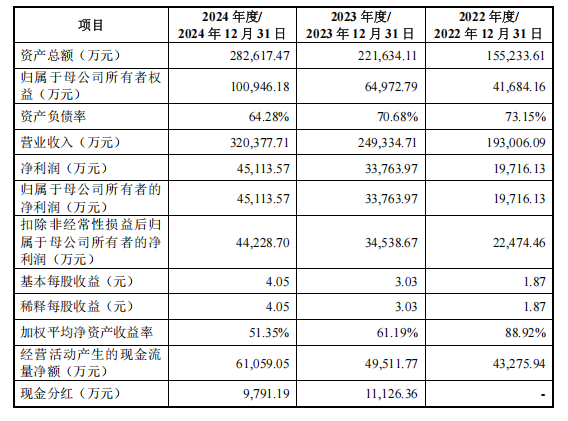

On the financial side, in 2022, 2023, and 2024, the issuer's revenue was 1,930 million yuan, 2,493 million yuan, and 3.204 billion yuan respectively; net profit attributable to shareholders of the parent company after deducting non-recurring profit and loss was 225 million yuan, 345 million yuan, and 442 million yuan respectively; total assets were 1,552 billion yuan, 2,216 million yuan, and 2,826 billion yuan respectively; and equity attributable to owners of the parent company was 417 million yuan, 650 million yuan and 1,009 million yuan, respectively.

Risk factors include export business being affected by exchange rate fluctuations, international trade frictions, changes in export tax rebate policies, and falling international market demand; domestic market development faces increased competition, and shares may be squeezed by traditional home appliances and emerging companies; doubts about the sustainability of performance growth; trade frictions between China and the US, exchange rate fluctuations, domestic competition and rising costs and expenses, etc., which may lead to a decline in performance.

Wall Street Journal

Wall Street Journal