Analyst Expectations For Dave's Future

8 analysts have shared their evaluations of Dave (NASDAQ:DAVE) during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

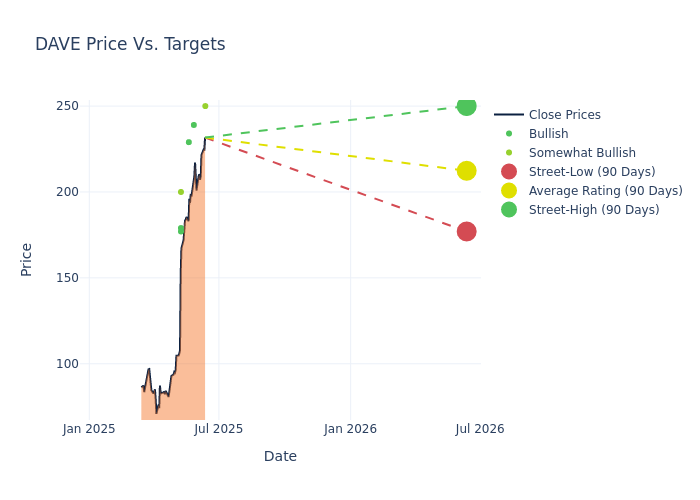

In the assessment of 12-month price targets, analysts unveil insights for Dave, presenting an average target of $200.12, a high estimate of $250.00, and a low estimate of $125.00. Witnessing a positive shift, the current average has risen by 32.03% from the previous average price target of $151.57.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Dave's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Gary Prestopino | Barrington Research | Announces | Outperform | $250.00 | - |

| Hal Goetsch | B. Riley Securities | Raises | Buy | $239.00 | $206.00 |

| Mark Palmer | Benchmark | Raises | Buy | $229.00 | $202.00 |

| Devin Ryan | JMP Securities | Raises | Market Outperform | $200.00 | $125.00 |

| Jacob Stephan | Lake Street | Raises | Buy | $177.00 | $118.00 |

| Mark Palmer | Benchmark | Raises | Buy | $202.00 | $145.00 |

| Joseph Vafi | Canaccord Genuity | Raises | Buy | $179.00 | $130.00 |

| Devin Ryan | JMP Securities | Lowers | Market Outperform | $125.00 | $135.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Dave. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Dave compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Dave's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Dave's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Dave analyst ratings.

All You Need to Know About Dave

Dave Inc is a financial services company. It is engaged in offering banking app that offers its customers banking, financial insights, overdraft protection, building credit and finding side gigs.

Dave: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Positive Revenue Trend: Examining Dave's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 46.65% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: Dave's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 26.68%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Dave's ROE excels beyond industry benchmarks, reaching 15.06%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Dave's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.37% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.38, Dave adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal