June 2025's Select Stocks That Could Be Trading Below Estimated Value

Over the last 7 days, the United States market has risen by 1.2%, contributing to an overall increase of 11% over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this context of positive market performance and growth expectations, identifying stocks that may be trading below their estimated value can present intriguing opportunities for investors seeking potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $31.70 | $63.09 | 49.8% |

| Verra Mobility (VRRM) | $24.37 | $47.81 | 49% |

| StoneCo (STNE) | $14.35 | $28.57 | 49.8% |

| Roku (ROKU) | $80.48 | $160.52 | 49.9% |

| Reddit (RDDT) | $115.03 | $229.38 | 49.9% |

| Provident Financial Services (PFS) | $17.08 | $34.04 | 49.8% |

| Lyft (LYFT) | $15.56 | $30.50 | 49% |

| Ligand Pharmaceuticals (LGND) | $115.39 | $225.70 | 48.9% |

| Brookline Bancorp (BRKL) | $10.60 | $20.86 | 49.2% |

| Berkshire Hills Bancorp (BHLB) | $25.31 | $49.33 | 48.7% |

Here's a peek at a few of the choices from the screener.

Mr. Cooper Group (COOP)

Overview: Mr. Cooper Group Inc. operates as a non-bank servicer of residential mortgage loans in the United States, with a market cap of approximately $8.67 billion.

Operations: The company's revenue is derived from two main segments: Servicing, which accounts for $1.62 billion, and Originations, contributing $532 million.

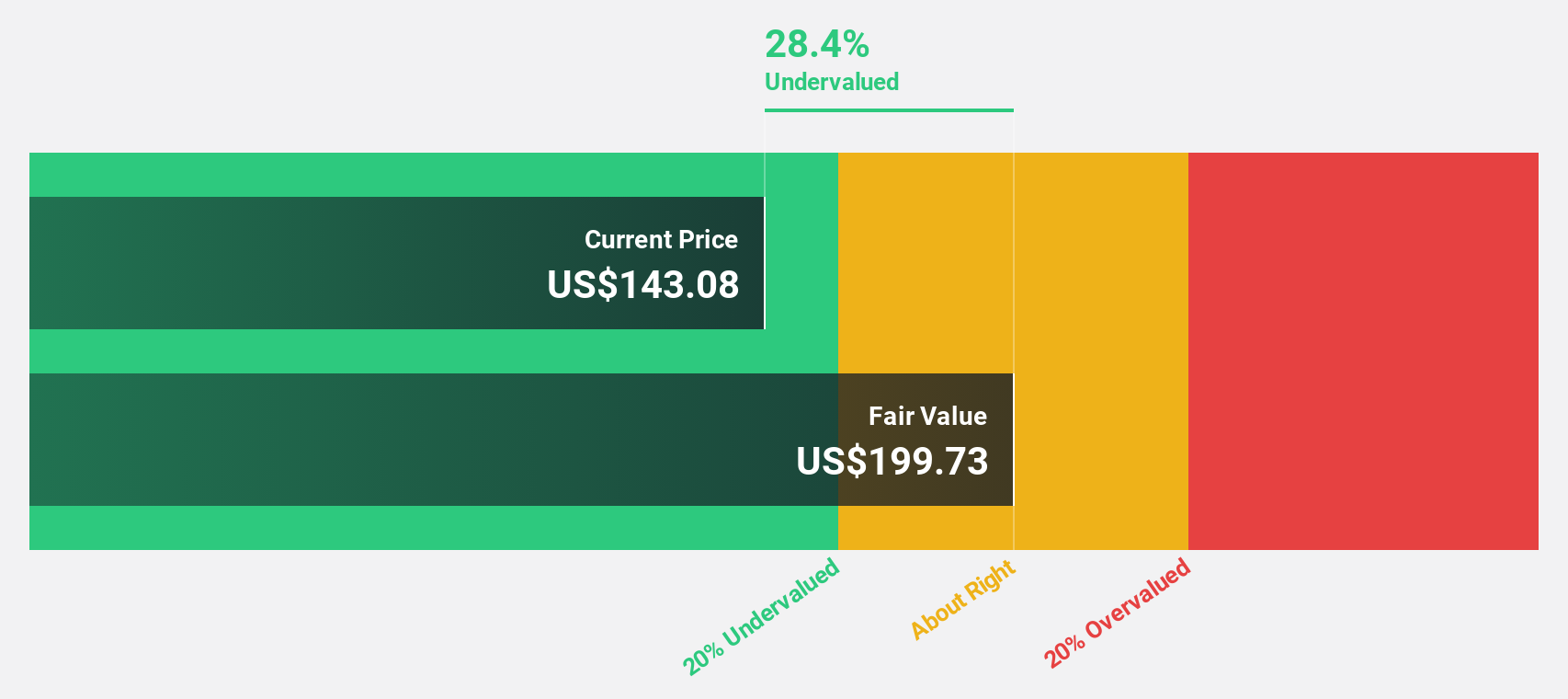

Estimated Discount To Fair Value: 26.6%

Mr. Cooper Group is trading at US$142.78, significantly below its estimated fair value of US$194.53, highlighting its undervaluation based on discounted cash flow analysis. Despite a recent drop in net income to US$88 million for Q1 2025, the company's earnings are expected to grow substantially at 24.9% annually, outpacing the broader U.S. market's growth rate of 14.4%. However, debt coverage by operating cash flow remains a concern amidst high-quality non-cash earnings.

- The analysis detailed in our Mr. Cooper Group growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Mr. Cooper Group's balance sheet health report.

Roku (ROKU)

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of $11.80 billion.

Operations: The company's revenue is primarily derived from its Platform segment, which generated $3.65 billion, and its Devices segment, which contributed $603.44 million.

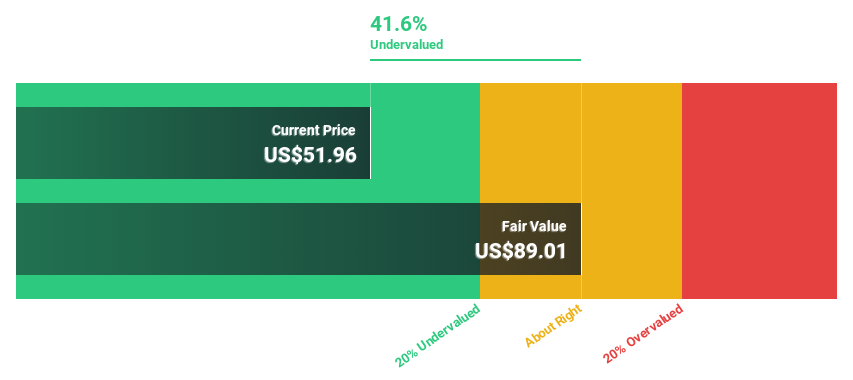

Estimated Discount To Fair Value: 49.9%

Roku is trading at US$80.48, considerably below its estimated fair value of US$160.52, indicating potential undervaluation based on discounted cash flow analysis. The company reported a Q1 2025 net loss of US$27.43 million but expects to reduce this loss significantly by year-end while projecting annual revenue growth of 9.9%, surpassing the U.S. market average of 8.6%. Recent product innovations may enhance Roku's competitive positioning in the streaming device market.

- The growth report we've compiled suggests that Roku's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Roku.

Hims & Hers Health (HIMS)

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally, with a market cap of approximately $12.37 billion.

Operations: The company's revenue primarily comes from its online retail segment, which generated approximately $1.78 billion.

Estimated Discount To Fair Value: 45.8%

Hims & Hers Health is trading at US$57.56, well below its estimated fair value of US$106.29, highlighting potential undervaluation based on cash flow analysis. The company reported Q1 2025 sales of US$586.01 million and net income of US$49.49 million, reflecting strong financial performance and profitability this year. With forecasted earnings growth of 22.6% annually over the next three years, Hims & Hers is positioned for robust expansion compared to the broader U.S. market average growth rate.

- Our earnings growth report unveils the potential for significant increases in Hims & Hers Health's future results.

- Delve into the full analysis health report here for a deeper understanding of Hims & Hers Health.

Summing It All Up

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 167 more companies for you to explore.Click here to unveil our expertly curated list of 170 Undervalued US Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal