Top Dividend Stocks To Consider In June 2025

Over the last 7 days, the United States market has risen by 1.2%, contributing to an impressive 11% increase over the past year, with earnings anticipated to grow by 14% annually in the coming years. In this context of robust market performance and optimistic growth projections, identifying strong dividend stocks can be a strategic way for investors to potentially benefit from both income and capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.92% | ★★★★★☆ |

| Universal (UVV) | 5.36% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.00% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.77% | ★★★★★★ |

| Ennis (EBF) | 5.34% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.11% | ★★★★★☆ |

| Dillard's (DDS) | 6.45% | ★★★★★★ |

| CompX International (CIX) | 4.81% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.09% | ★★★★★★ |

| Chevron (CVX) | 4.72% | ★★★★★★ |

Click here to see the full list of 147 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

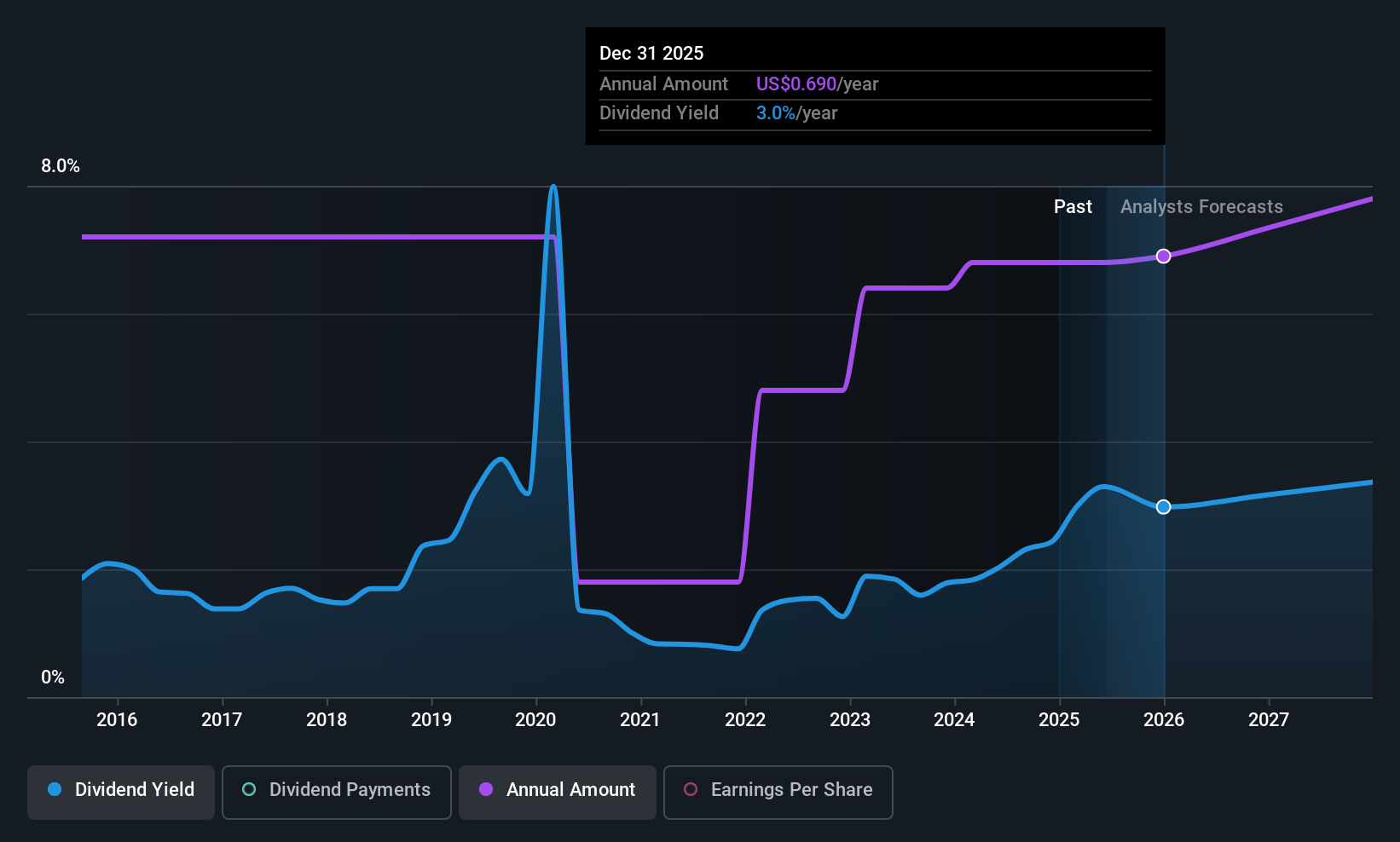

Halliburton (HAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Halliburton Company offers products and services to the global energy industry, with a market cap of approximately $18.70 billion.

Operations: Halliburton's revenue is primarily derived from its Drilling and Evaluation segment, which generated $9.56 billion, and its Completion and Production segment, which brought in $12.99 billion.

Dividend Yield: 3.1%

Halliburton's dividend payments, with a payout ratio of 28.4%, are well covered by both earnings and cash flows, but the dividends have been volatile over the past decade. The current yield of 3.06% is below the top quartile of US dividend payers. Despite trading at a discount to estimated fair value and peers, Halliburton faces challenges with high debt levels. Recent contracts in the UK North Sea could bolster future financial stability and growth prospects.

- Unlock comprehensive insights into our analysis of Halliburton stock in this dividend report.

- Our valuation report here indicates Halliburton may be undervalued.

Macy's (M)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macy's, Inc. is an omni-channel retail organization that operates stores, websites, and mobile applications in the United States with a market cap of approximately $3.36 billion.

Operations: Macy's, Inc. generates revenue primarily through its retail department stores, which contributed $22.80 billion.

Dividend Yield: 6%

Macy's dividend yield of 6% places it among the top 25% of US dividend payers, with dividends covered by earnings (35.1% payout ratio) and cash flows (77.7%). However, its dividend history is unstable and has decreased over the past decade. Recent financials show declining sales and net income, while a shelf registration filing indicates potential capital raising activities. Macy's strategic share buybacks may support shareholder value amidst these challenges.

- Click to explore a detailed breakdown of our findings in Macy's dividend report.

- In light of our recent valuation report, it seems possible that Macy's is trading behind its estimated value.

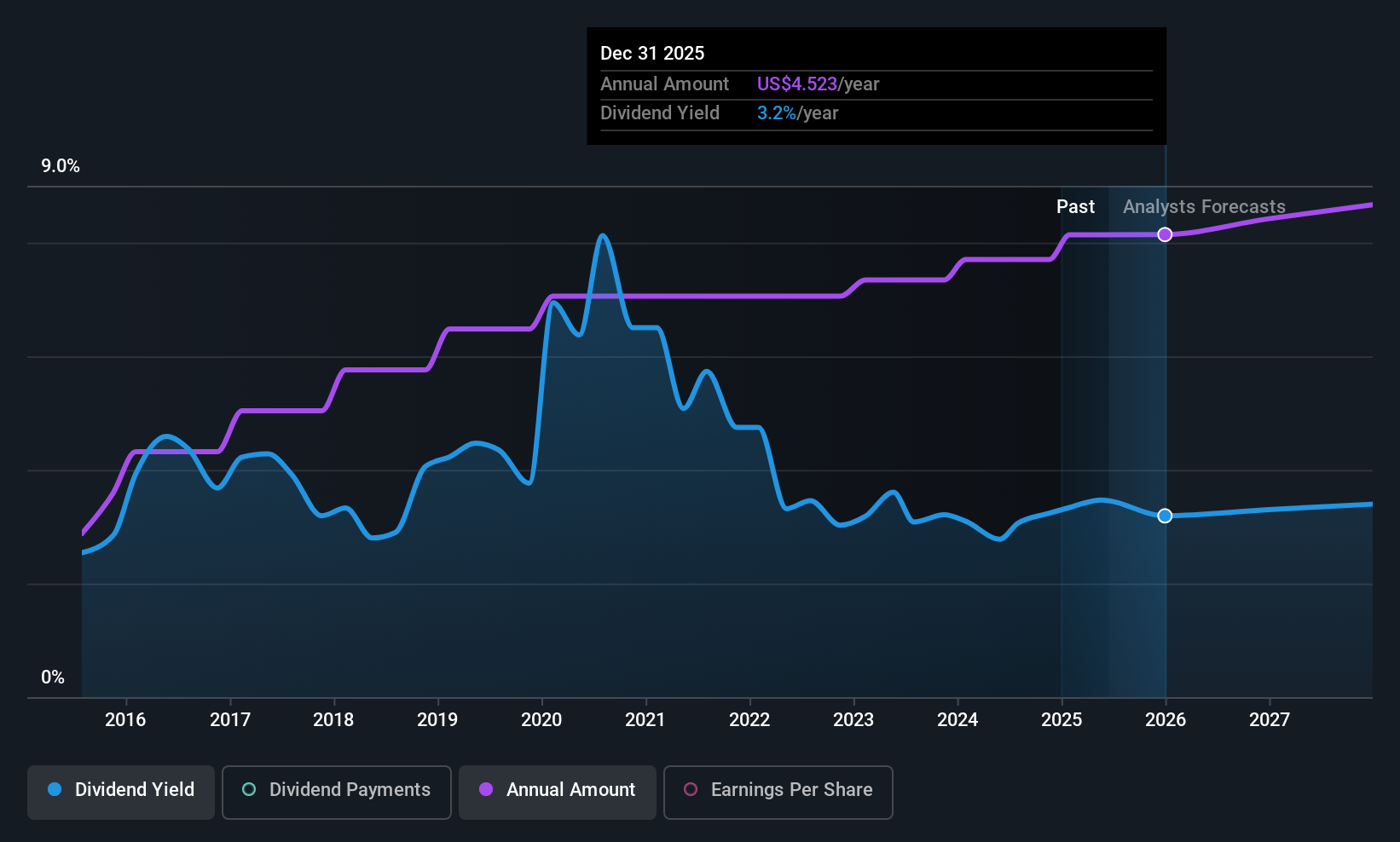

Valero Energy (VLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valero Energy Corporation is involved in the manufacturing, marketing, and selling of petroleum-based and low-carbon liquid transportation fuels and petrochemical products across various regions including the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally; it has a market cap of approximately $41.32 billion.

Operations: Valero Energy Corporation's revenue is primarily derived from its Refining segment, which accounts for $122.48 billion, followed by Ethanol at $4.61 billion and Renewable Diesel at $4.56 billion.

Dividend Yield: 3.4%

Valero Energy's dividend of US$1.13 per share remains stable and reliable over the past decade, though its yield of 3.37% is lower compared to top-tier US dividend payers. Despite a high payout ratio of 149.2%, dividends are well covered by cash flows with a low cash payout ratio of 29.3%. Recent financials reveal a net loss and reduced profit margins, but strategic share buybacks could bolster shareholder value amidst these challenges.

- Take a closer look at Valero Energy's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Valero Energy shares in the market.

Next Steps

- Explore the 147 names from our Top US Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal