Elementis plc's (LON:ELM) Shares Leap 25% Yet They're Still Not Telling The Full Story

Elementis plc (LON:ELM) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 8.2% isn't as impressive.

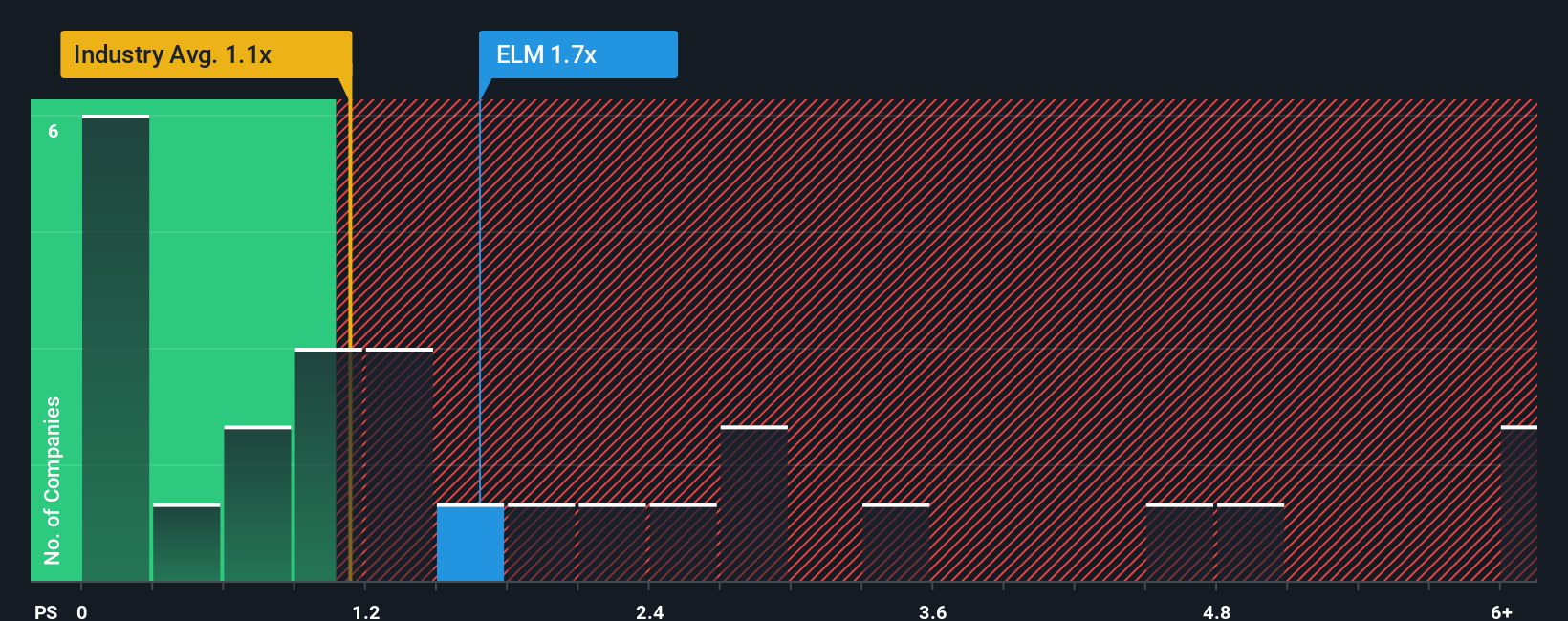

Although its price has surged higher, it's still not a stretch to say that Elementis' price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" compared to the Chemicals industry in the United Kingdom, where the median P/S ratio is around 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Elementis

What Does Elementis' Recent Performance Look Like?

Elementis certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Elementis will help you uncover what's on the horizon.How Is Elementis' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Elementis' to be considered reasonable.

Retrospectively, the last year delivered a decent 3.5% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.4% per annum as estimated by the six analysts watching the company. With the rest of the industry predicted to shrink by 5.2% per annum, it's still an optimal result.

In light of this, the fact Elementis' P/S sits in line with the majority of other companies is unanticipated but certainly not shocking. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. There's still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Elementis' P/S?

Elementis appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

In our view, Elementis appears to be undervalued with its current P/S ratio being lower than anticipated, considering that its revenue projections are not as dismal as the rest of the struggling industry. There's a chance that the market isn't looking too favourably on the potential risks which are preventing the P/S ratio from matching the more attractive outlook compared to its peers. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Elementis that you need to be mindful of.

If you're unsure about the strength of Elementis' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal