What 8 Analyst Ratings Have To Say About Labcorp Hldgs

In the preceding three months, 8 analysts have released ratings for Labcorp Hldgs (NYSE:LH), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

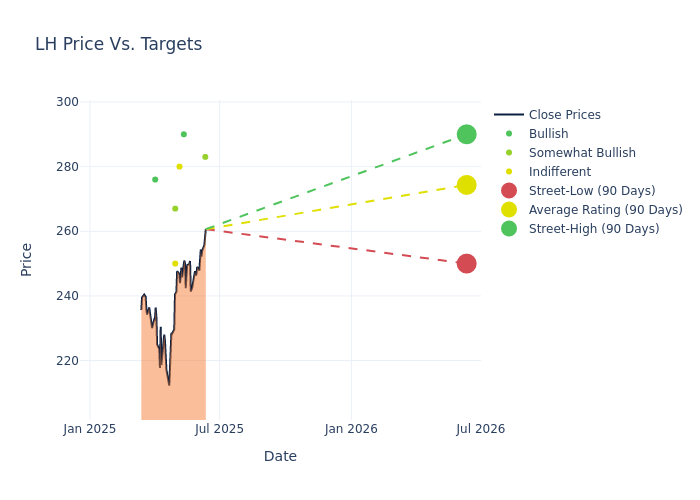

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $270.0, along with a high estimate of $290.00 and a low estimate of $240.00. Marking an increase of 2.61%, the current average surpasses the previous average price target of $263.14.

Investigating Analyst Ratings: An Elaborate Study

The perception of Labcorp Hldgs by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ricky Goldwasser | Morgan Stanley | Raises | Overweight | $283.00 | $270.00 |

| David Macdonald | Truist Securities | Raises | Buy | $290.00 | $274.00 |

| David Westenberg | Piper Sandler | Raises | Neutral | $280.00 | $260.00 |

| Jack Meehan | Barclays | Raises | Equal-Weight | $250.00 | $240.00 |

| Eric Coldwell | Baird | Raises | Outperform | $267.00 | $253.00 |

| David Macdonald | Truist Securities | Lowers | Buy | $274.00 | $285.00 |

| Jack Meehan | Barclays | Lowers | Equal-Weight | $240.00 | $260.00 |

| Jamie Clark | Redburn Atlantic | Announces | Buy | $276.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Labcorp Hldgs. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Labcorp Hldgs compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Labcorp Hldgs's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Labcorp Hldgs's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Labcorp Hldgs analyst ratings.

Delving into Labcorp Hldgs's Background

Labcorp is one of the nation's two largest independent clinical laboratories, with roughly 20% of the independent lab market. The company operates approximately 2,000 patient-service centers, offering a broad range of 5,000 clinical lab tests, ranging from routine blood and urine screens to complex oncology and genomic testing.

Labcorp Hldgs's Economic Impact: An Analysis

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Labcorp Hldgs displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 5.3%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Labcorp Hldgs's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.36% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Labcorp Hldgs's ROE excels beyond industry benchmarks, reaching 2.6%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.18%, the company showcases effective utilization of assets.

Debt Management: Labcorp Hldgs's debt-to-equity ratio surpasses industry norms, standing at 0.78. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal