Seagate Technology Holdings (NasdaqGS:STX) Announces Early Exchange Offer Results and Terms Amendment

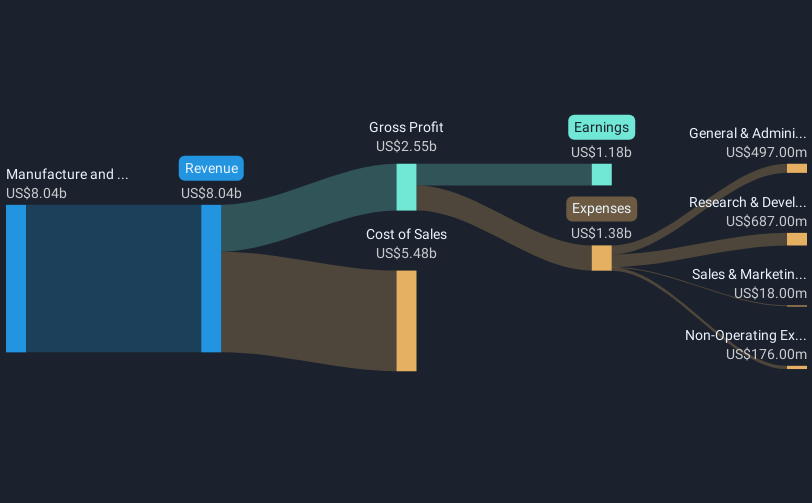

Seagate Technology Holdings (NasdaqGS:STX) experienced a notable price movement of 48% in the last quarter, coinciding with the disclosure of early results from its debt refinancing initiative, which included exchange offers for its outstanding notes. This financial maneuver potentially signaled a positive restructuring step, contributing to investor confidence. Additionally, impressive quarterly earnings showed a significant surge in net income and EPS, reinforcing a positive outlook. Concurrently, broader market indices like the S&P 500 and Nasdaq reported gains due to easing global trade tensions and tame inflation data, potentially adding credibility to Seagate's robust share performance.

With Seagate Technology Holdings seeing a significant price movement and impressive quarterly earnings, the recent updates on their debt refinancing initiative and net income surge indicate a potential for continued investor confidence and financial stability. These developments align with the broader market's performance, as both the S&P 500 and Nasdaq witnessed gains, potentially lending support to Seagate's strong share momentum. Over the past five years, Seagate has delivered an impressive total return of almost 200%, reflecting the company's sustained growth and profitability.

In comparison to the US Tech industry, which had a negative return over the past year, Seagate outperformed significantly. This outperformance, paired with demand for their new Mozaic drives, further underpins positive revenue and earnings forecasts. However, the company's continued reliance on cloud demand and evolving manufacturing strategies will be crucial to maintaining these growth prospects. Additionally, Seagate's current share price of US$93.90 sits below the analyst consensus price target of US$107.83, suggesting a potential upside should analysts' projections align with actual performance.

Our valuation report here indicates Seagate Technology Holdings may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal