Eli Lilly (NYSE:LLY) Collaborates With Juvena To Enhance Muscle Health Through AI Technology

Eli Lilly (NYSE:LLY) announced a significant global licensing and research collaboration with Juvena Therapeutics to explore AI-driven drug candidates for muscle health. This innovative move, alongside other significant developments like the Cialis acquisition in Latin America, underscores the company's commitment to expanding its product portfolio and reaching new markets. Over the past month, Eli Lilly's stock rose by nearly 10%, a performance that aligns with the broader upward trend of the S&P 500 and Nasdaq, which have been bolstered by easing trade tensions and favorable inflation data, adding weight to these strategic developments.

We've identified 2 warning signs for Eli Lilly (1 is concerning) that you should be aware of.

The recent collaboration between Eli Lilly and Juvena Therapeutics to explore AI-driven drug candidates for muscle health signals a forward-looking shift in the company's research priorities. This partnership may catalyze future revenue growth by potentially introducing new therapies to the market, strengthening its product portfolio even further in critical areas. Over the past five years, Eli Lilly's total shareholder return, including dividends, was a remarkable 422.87%. Remarkably, over the past year, despite underperforming compared to the broader US market return of 12.8%, Eli Lilly outpaced the US Pharmaceuticals industry, which saw a decline of 7.9%.

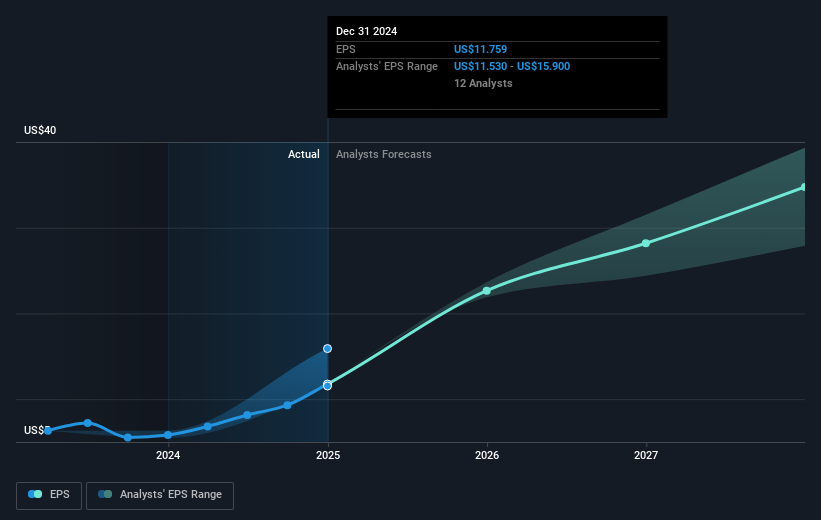

The anticipated positive outcomes from the advanced trials and manufacturing expansions outlined in their latest strategic plans could bolster revenue and earnings forecasts. Recent announcements support analysts’ forecasts of substantial growth, as strategic moves like the Phase III trials for new treatments and the expansion in regions like Latin America suggest robust future revenue streams. This positions Eli Lilly to potentially narrow the gap between the current share price of US$775.12 and the consensus analyst price target of US$981.63. While this indicates a substantial potential upside, investors should independently verify these projections against their own risk assessments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal