Hershey (NYSE:HSY) Partners With Pro Golfer For New Protein Bar Launch

Hershey (NYSE:HSY) recently partnered with ONE Brands to launch the ONE x Hershey's Double Chocolate Protein Bar, a strategic entry into the growing protein snack category. This initiative aligns with consumers' health-conscious trends, and the marketing campaign featuring golfer Bryson DeChambeau may have piqued investor interest. Over the past week, Hershey's share price moved 3.35%, a performance that aligns closely with broader market gains, as the S&P 500 and Nasdaq reached new highs on easing trade tensions and encouraging inflation data. The move likely reflects the combined effect of market trends and company-specific initiatives.

We've spotted 1 weakness for Hershey you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The partnership with ONE Brands, launching the ONE x Hershey's Double Chocolate Protein Bar, highlights Hershey's efforts to align with health-conscious consumer trends. This move could enhance revenue as it diversifies the product line beyond traditional confections. It may also positively influence earnings forecasts by tapping into the growing protein snack sector, potentially bolstering market share.

Over the past five years, Hershey's total return, including dividends, was 42.54%, indicating longer-term growth. However, in the past year alone, the company underperformed compared to the US market and the US Food industry, revealing challenges in a competitive landscape. The recent 3.35% share price increase aligns in the short term with the broader market rally but remains nuanced when compared with previous performance trends over longer durations.

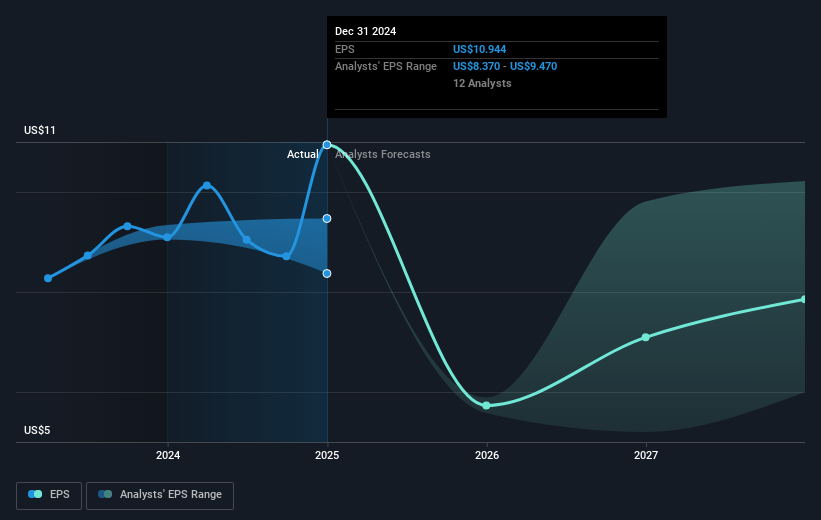

The analysts' price target for Hershey is US$165.73, just 2.6% below the current share price of US$170.01. This suggests that the market, on average, considers Hershey to be fairly priced given current expectations. While forecasts predict a modest growth in revenue and earnings, factors such as high cocoa prices and competition could influence these projections, stressing the importance of Hershey's recent moves in product diversification and cost management.

Assess Hershey's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal