Chipotle Mexican Grill (NYSE:CMG) Launches First Temporary Tattoo Collection And BOGO Offer

Chipotle Mexican Grill (NYSE:CMG) recently announced the launch of a limited-edition temporary tattoo collection, coinciding with a BOGO promotion for tattooed fans nationwide on June 13, 2025. This marketing initiative focused on enhancing brand engagement. Over the past month, Chipotle's stock moved up 1.8%, aligning with broader market trends, including eased global trade tensions and benign inflation data that uplifted investor sentiment as reflected in the S&P 500 and Nasdaq indexes achieving significant highs. While Chipotle's initiative likely enhanced consumer interaction and media visibility, its stock performance appears consistent with broader market movements.

Find companies with promising cash flow potential yet trading below their fair value.

Chipotle Mexican Grill's recent initiative to boost brand engagement through a limited-edition tattoo collection and BOGO promotion may enhance consumer interaction and media visibility. However, the potential impact on revenue or earnings forecasts appears minimal, as this promotional strategy may primarily uplift short-term sales rather than long-term financial projections. The company's focus remains on international expansion and technological advancements to sustain future growth.

Long-term, Chipotle's shares have delivered a substantial total return of 145.30% over the past five years, underscoring its growth trajectory. Over the most recent year, however, Chipotle underperformed the broader US market, which returned 12.8%, as well as the US Hospitality industry, which saw an 18% return. This contrast illustrates the challenges the company faces against broader market and industry dynamics, despite its marketing efforts and new initiatives.

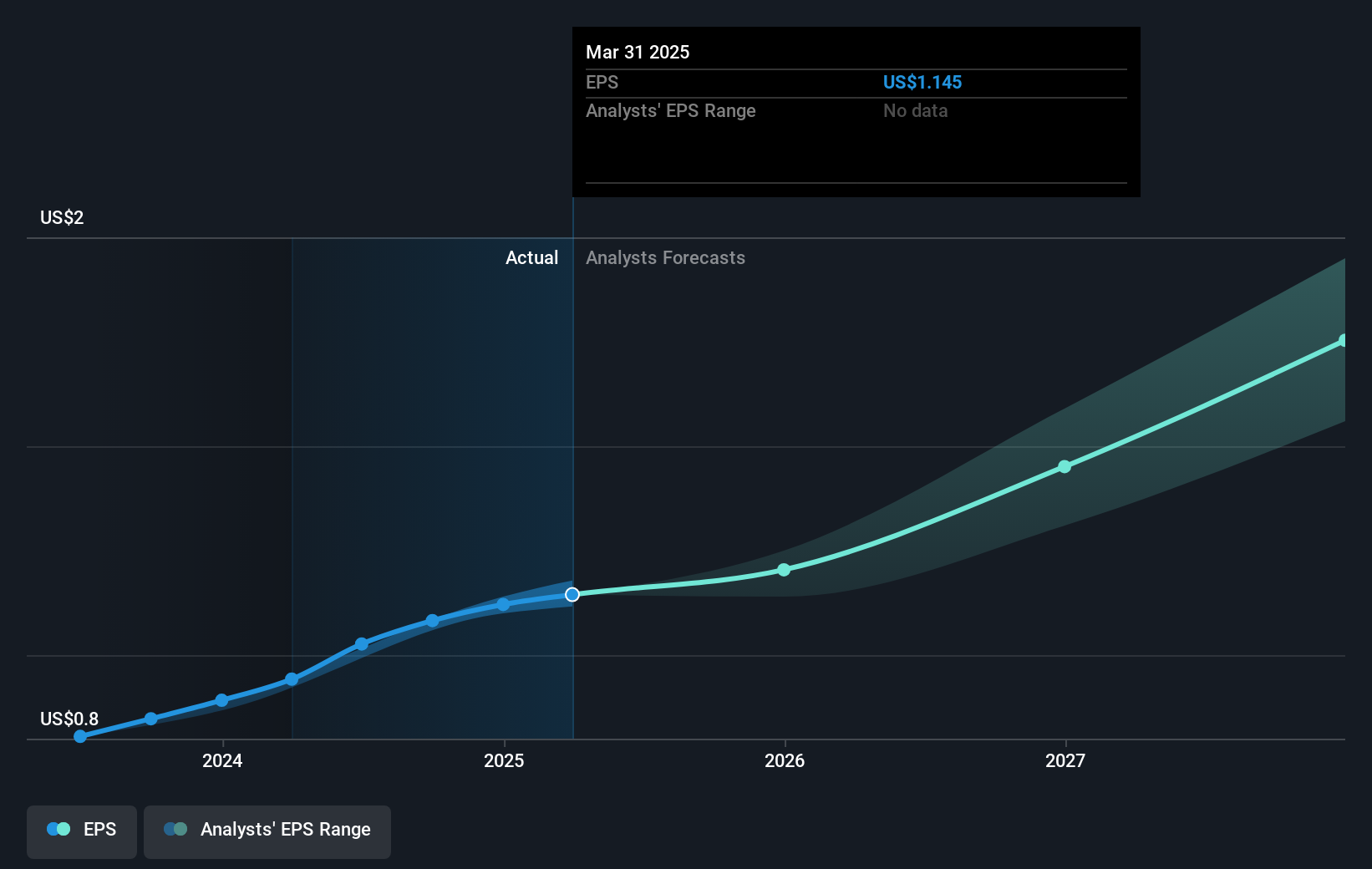

With Chipotle's share price currently at US$50.36, the recent positive movement aligns with a broader market uptrend but remains slightly below the consensus analyst price target of US$57.94, representing a 13.1% potential upside. Investors' evaluation of Chipotle's expansion plans and technological investments will be crucial to meeting or exceeding these estimates. The success of these strategies will significantly influence future revenue and earnings growth, pivotal for sustaining investor confidence and achieving projected analyst targets.

Evaluate Chipotle Mexican Grill's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal