3 Promising Penny Stocks With Market Caps Over $100M

As the U.S. stock market continues to inch higher, buoyed by encouraging inflation data and positive developments in China-U.S. trade talks, investors are exploring diverse opportunities for growth. Penny stocks, despite their vintage name, remain a relevant investment area offering potential value through smaller or newer companies with strong financial foundations. In this article, we explore several penny stocks that stand out as hidden gems with the potential to deliver impressive returns while maintaining stability amidst current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (SDCH) | $0.04755 | $11.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (IMPP) | $3.02 | $106.34M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.12 | $34.21M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.43 | $531.64M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.13 | $186.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.81 | $182.31M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.72 | $21.94M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.31 | $54.7M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8265 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.12 | $84.5M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 708 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Anixa Biosciences (ANIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anixa Biosciences, Inc. is a biotechnology company that develops therapies and vaccines targeting critical unmet needs in oncology, with a market cap of $109.52 million.

Operations: Anixa Biosciences, Inc. does not report any revenue segments.

Market Cap: $109.52M

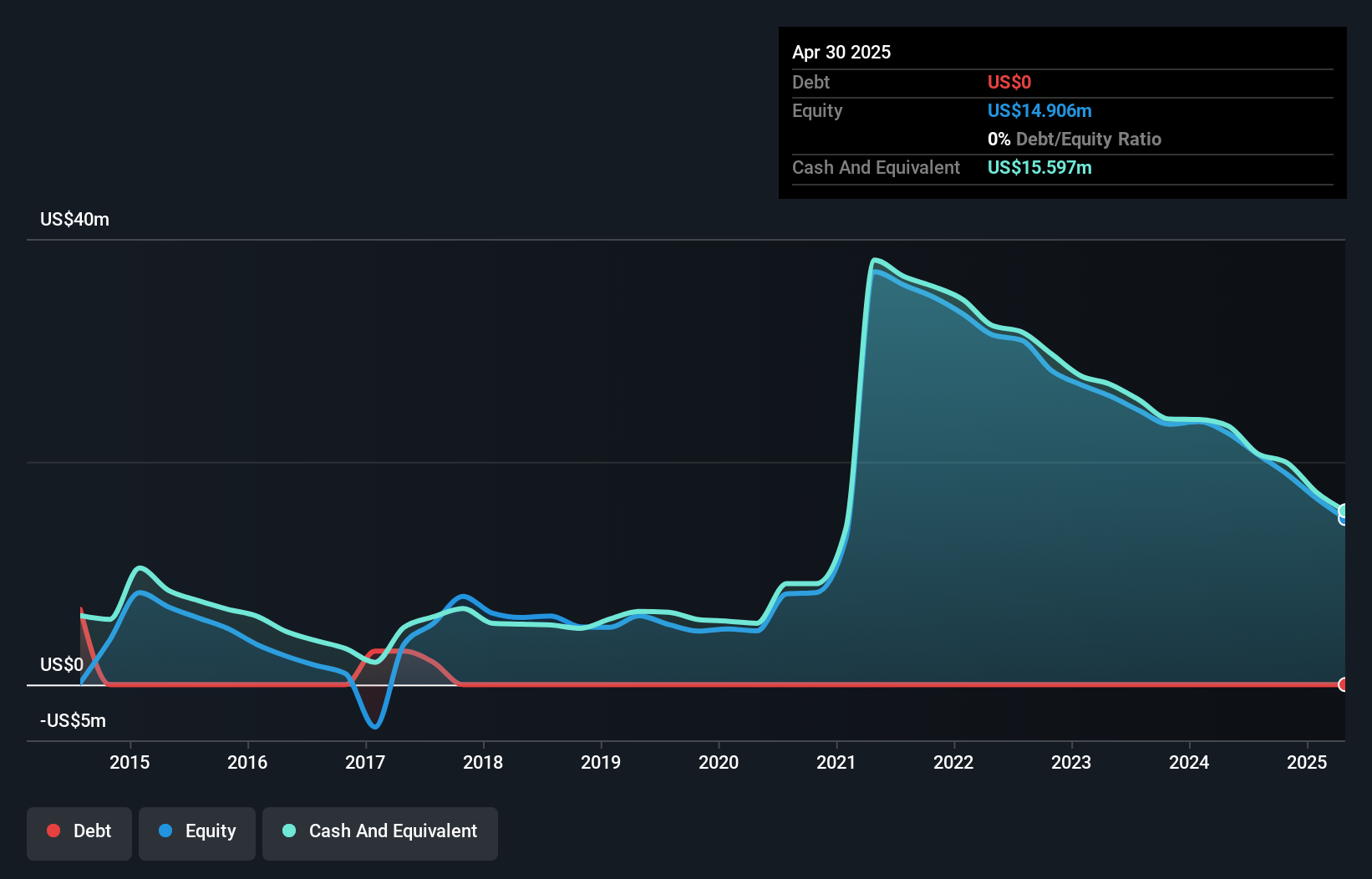

Anixa Biosciences, Inc., with a market cap of US$109.52 million, is a pre-revenue biotechnology firm focusing on oncology therapies and vaccines. The company recently completed enrollment for its Phase 1 breast cancer vaccine trial, funded by the U.S. Department of Defense, showing promising immune response results that may lead to Phase 2 trials. Despite being unprofitable and having increased losses over the past five years, Anixa remains debt-free with sufficient cash runway for over a year. Its management and board are experienced, supporting ongoing innovative efforts in immuno-oncology despite existing financial challenges.

- Dive into the specifics of Anixa Biosciences here with our thorough balance sheet health report.

- Evaluate Anixa Biosciences' prospects by accessing our earnings growth report.

Outdoor Holding (POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Outdoor Holding Company designs, produces, and markets ammunition and components for various customers including sport shooters, hunters, and law enforcement agencies, with a market cap of $161.49 million.

Operations: The company generates revenue from two main segments: Ammunition, contributing $81.62 million, and Marketplace, accounting for $50.36 million.

Market Cap: $161.49M

Outdoor Holding Company, with a market cap of US$161.49 million, is facing financial challenges as it remains unprofitable and has seen increased losses over the past five years. Despite this, the company benefits from experienced board leadership and a strong cash position that exceeds its total debt. Recent executive changes include Steven F. Urvan's appointment as CEO following Jared Smith's resignation, which was not due to any operational disagreements. The company has received a Nasdaq compliance notice due to governance issues but plans to address these concerns promptly while maintaining its current stock listing status.

- Take a closer look at Outdoor Holding's potential here in our financial health report.

- Gain insights into Outdoor Holding's future direction by reviewing our growth report.

CS Disco (LAW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CS Disco, Inc. offers cloud-native and AI-powered legal products for various legal processes, with a market cap of $263.29 million.

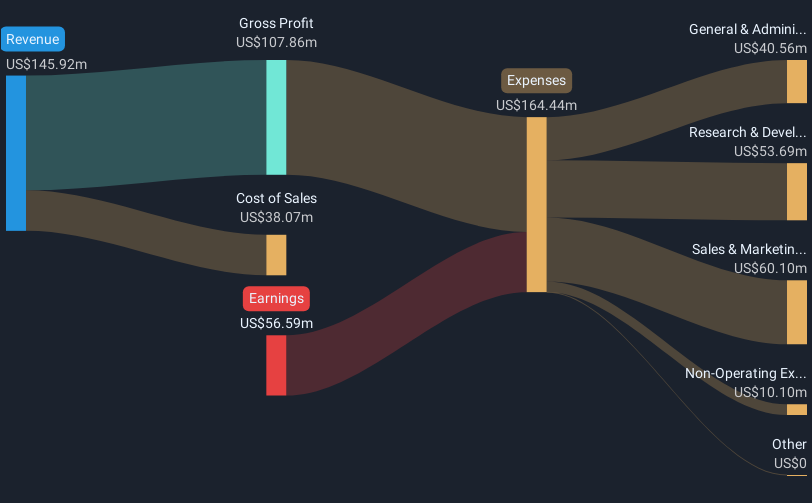

Operations: The company generates revenue from its Software & Programming segment, totaling $145.92 million.

Market Cap: $263.29M

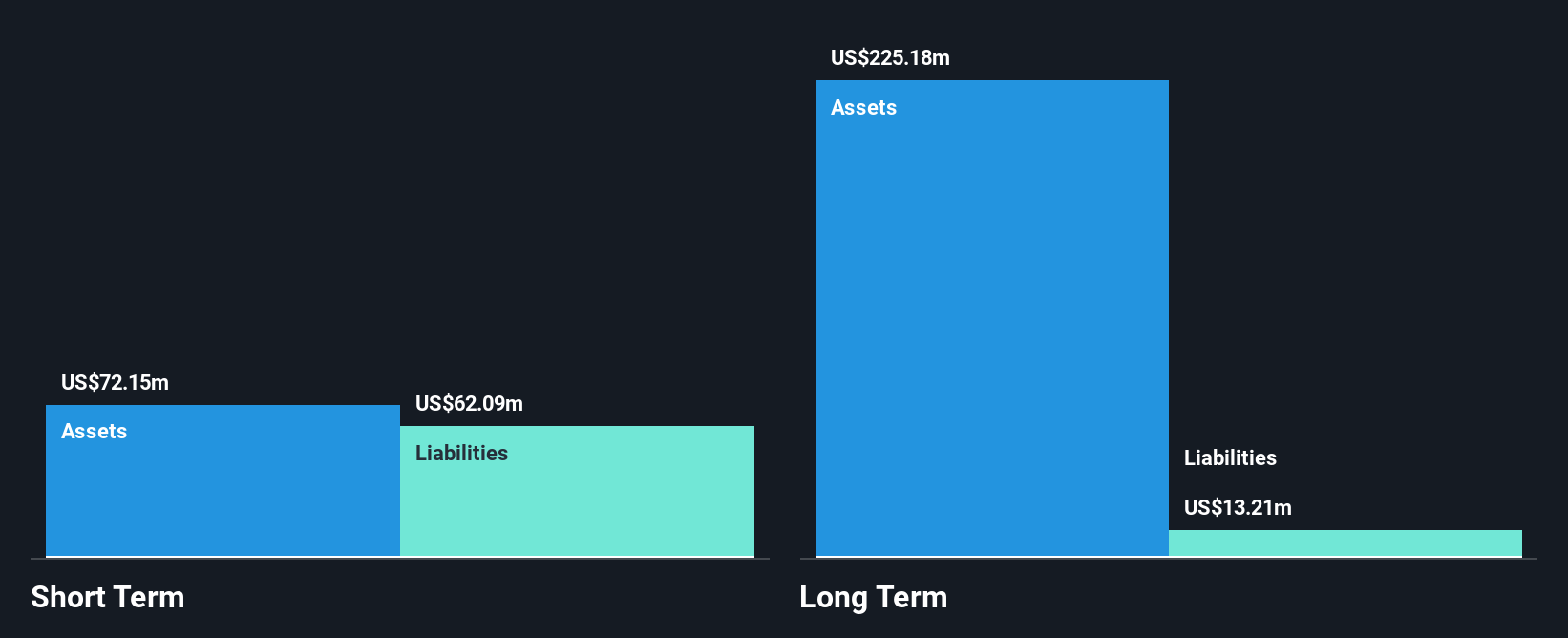

CS Disco, Inc., with a market cap of US$263.29 million, is navigating financial hurdles as it remains unprofitable, with losses increasing at 17.6% annually over the past five years. Despite trading at 78% below its estimated fair value and experiencing significant insider selling recently, the company maintains a strong cash runway exceeding three years without debt obligations. The management team is relatively new but supported by an experienced board averaging 4.2 years in tenure. Recent guidance projects fiscal year revenue between US$146 million to US$158 million, reflecting modest growth expectations amid ongoing challenges in achieving profitability.

- Click here to discover the nuances of CS Disco with our detailed analytical financial health report.

- Review our growth performance report to gain insights into CS Disco's future.

Seize The Opportunity

- Investigate our full lineup of 708 US Penny Stocks right here.

- Contemplating Other Strategies? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal