3 Undervalued Small Caps With Insider Buying To Watch Closely

The United States market has seen a positive trend, rising 1.3% in the last week and showing a 13% increase over the past year, with earnings projected to grow by 14% annually. In this environment, identifying small-cap stocks that are perceived as undervalued with notable insider buying can offer intriguing opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 33.17% | ★★★★★★ |

| Southside Bancshares | 9.9x | 3.4x | 49.61% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.5x | 47.61% | ★★★★★☆ |

| Citizens & Northern | 11.1x | 2.7x | 47.64% | ★★★★☆☆ |

| Barrett Business Services | 20.8x | 0.9x | 46.55% | ★★★★☆☆ |

| MVB Financial | 13.5x | 1.8x | 36.58% | ★★★☆☆☆ |

| Cracker Barrel Old Country Store | 21.0x | 0.3x | -630.50% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -59.16% | ★★★☆☆☆ |

| BlueLinx Holdings | 14.9x | 0.2x | -84.02% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -358.43% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

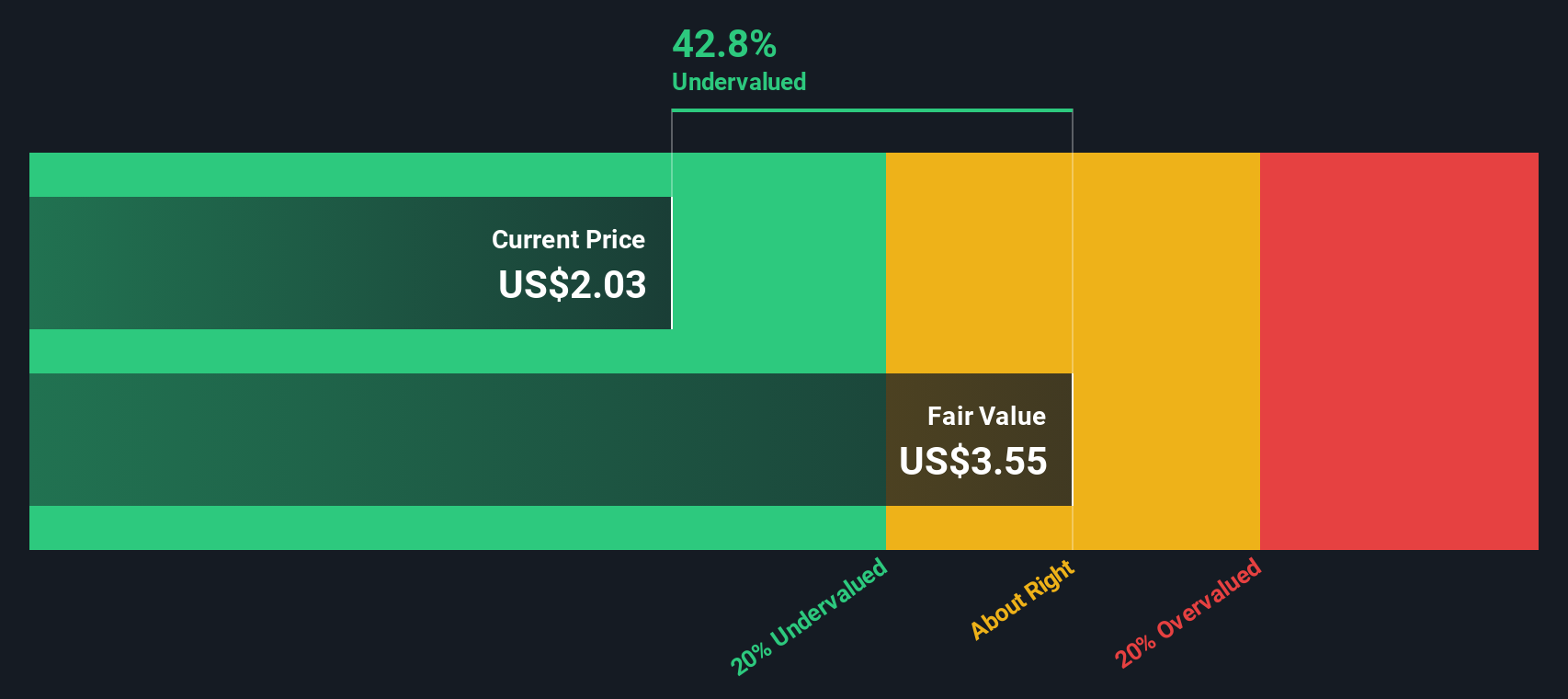

Traeger (COOK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Traeger is a company that specializes in the design, manufacture, and sale of wood pellet grills and related accessories with a market cap of approximately $1.15 billion.

Operations: The company generates revenue primarily from its single-brand consumer products business, with recent figures reaching $602.44 million. The gross profit margin has shown a varied trend, most recently at 41.89%. Key costs include cost of goods sold and operating expenses, which significantly impact net income margins that have been negative in recent periods.

PE: -8.3x

Traeger, a small U.S. company in the outdoor cooking sector, recently reported first-quarter sales of US$143.28 million with a reduced net loss of US$0.78 million from the previous year. Despite high share price volatility and reliance on external borrowing, insider confidence is reflected through recent purchases by insiders over the past few months. The launch of their Flatrock 2 Zone Griddle highlights innovation in product offerings, potentially enhancing market presence and future growth prospects amidst current challenges.

- Click to explore a detailed breakdown of our findings in Traeger's valuation report.

Review our historical performance report to gain insights into Traeger's's past performance.

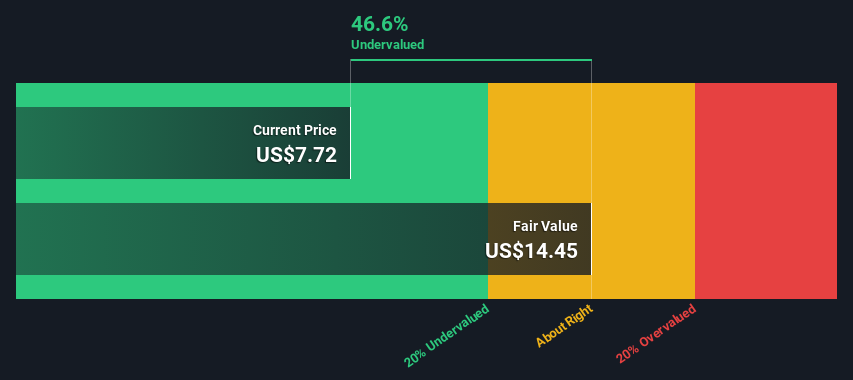

DiamondRock Hospitality (DRH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: DiamondRock Hospitality is a real estate investment trust that owns and operates a portfolio of hotels, with a market cap of $1.68 billion.

Operations: The company generates revenue primarily from hotel ownership, with a recent gross profit margin of 27.68%. The cost structure includes significant components such as COGS and operating expenses, with depreciation and amortization also contributing to the overall expense profile.

PE: 38.8x

DiamondRock Hospitality, a smaller company in the hospitality sector, is drawing attention with recent insider confidence as insiders have been purchasing shares. The company reported Q1 2025 sales of US$163.12 million and net income of US$11.86 million, showing an increase from the previous year despite lower profit margins at 3.7%. Notably, DiamondRock completed a share repurchase program totaling 5.19 million shares for US$41.9 million by May 2025, reflecting strategic financial maneuvers amidst challenges like high external borrowing risks and interest payments not fully covered by earnings.

- Take a closer look at DiamondRock Hospitality's potential here in our valuation report.

Evaluate DiamondRock Hospitality's historical performance by accessing our past performance report.

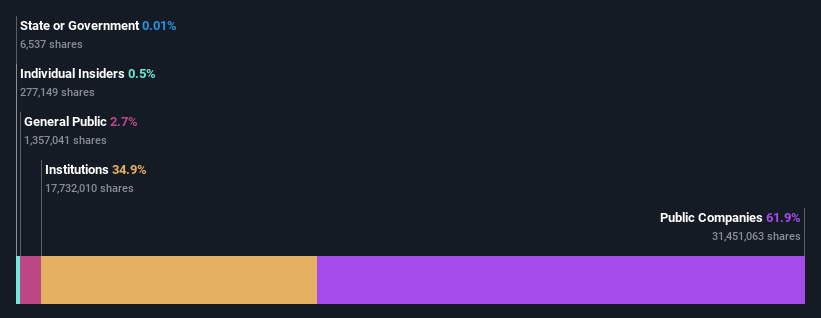

Forestar Group (FOR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Forestar Group is a real estate and land development company with operations focused on residential and commercial properties, boasting a market capitalization of approximately $1.77 billion.

Operations: The primary revenue stream is from real estate, totaling $1.47 billion in the latest period. The cost of goods sold (COGS) was $1.13 billion, resulting in a gross profit of $337.4 million and a gross profit margin of 22.94%. Operating expenses were recorded at $135.6 million, with non-operating expenses at $33.5 million impacting net income figures over time.

PE: 6.2x

Forestar Group, a company with a focus on land acquisition and development, is navigating financial complexities. Recent earnings showed a dip in net income to US$31.6 million for Q2 2025 from US$45 million the previous year, despite sales rising slightly to US$351 million. The company issued US$500 million in senior notes at 6.5% interest due 2033, highlighting reliance on external borrowing as its primary funding source. This financial strategy might reflect insider confidence in future growth potential amidst current challenges.

- Navigate through the intricacies of Forestar Group with our comprehensive valuation report here.

Gain insights into Forestar Group's past trends and performance with our Past report.

Taking Advantage

- Click through to start exploring the rest of the 95 Undervalued US Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal