3 Dividend Stocks To Consider With Yields Up To 8.4%

The United States market has shown a positive trend, with a 1.3% increase over the last week and a 13% climb in the past year, alongside forecasts of annual earnings growth at 14%. In such an environment, dividend stocks can be attractive for investors seeking steady income and potential capital appreciation, especially those offering competitive yields.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.42% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.98% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.68% | ★★★★★★ |

| Ennis (EBF) | 5.32% | ★★★★★★ |

| Dillard's (DDS) | 6.44% | ★★★★★★ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.98% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.88% | ★★★★★☆ |

| Chevron (CVX) | 4.77% | ★★★★★★ |

| Carter's (CRI) | 9.82% | ★★★★★☆ |

Click here to see the full list of 146 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

PCB Bancorp (PCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PCB Bancorp, with a market cap of $278.08 million, operates as the bank holding company for PCB Bank, offering a range of banking products and services to small and middle market businesses and individuals.

Operations: PCB Bancorp generates revenue through its banking operations, providing financial products and services tailored to the needs of small and middle market businesses as well as individual clients.

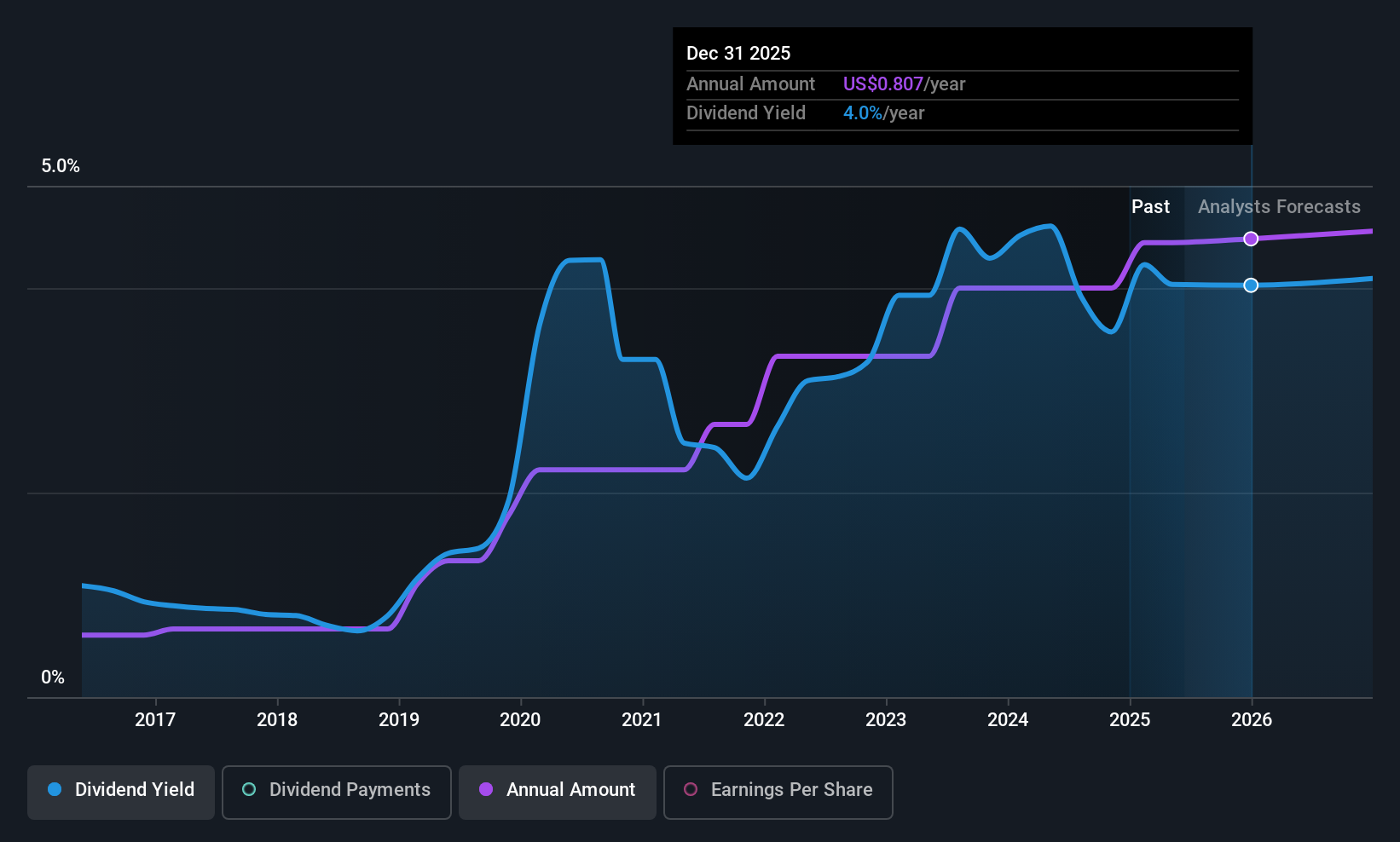

Dividend Yield: 4%

PCB Bancorp's dividend of US$0.20 per share, paid quarterly, is well-covered by earnings with a payout ratio of 37.8%. Despite recent Nasdaq compliance issues due to delayed SEC filings, the company maintains stable and reliable dividends over the past decade. However, its dividend yield of 3.98% is below the top tier in the U.S., and while trading at a significant discount to estimated fair value, future dividend sustainability remains uncertain without complete data on earnings coverage.

- Dive into the specifics of PCB Bancorp here with our thorough dividend report.

- The valuation report we've compiled suggests that PCB Bancorp's current price could be quite moderate.

Artisan Partners Asset Management (APAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Artisan Partners Asset Management Inc. is a publicly owned investment manager with a market cap of $3.34 billion.

Operations: Artisan Partners Asset Management Inc. generates revenue primarily from its investment management industry segment, totaling $1.12 billion.

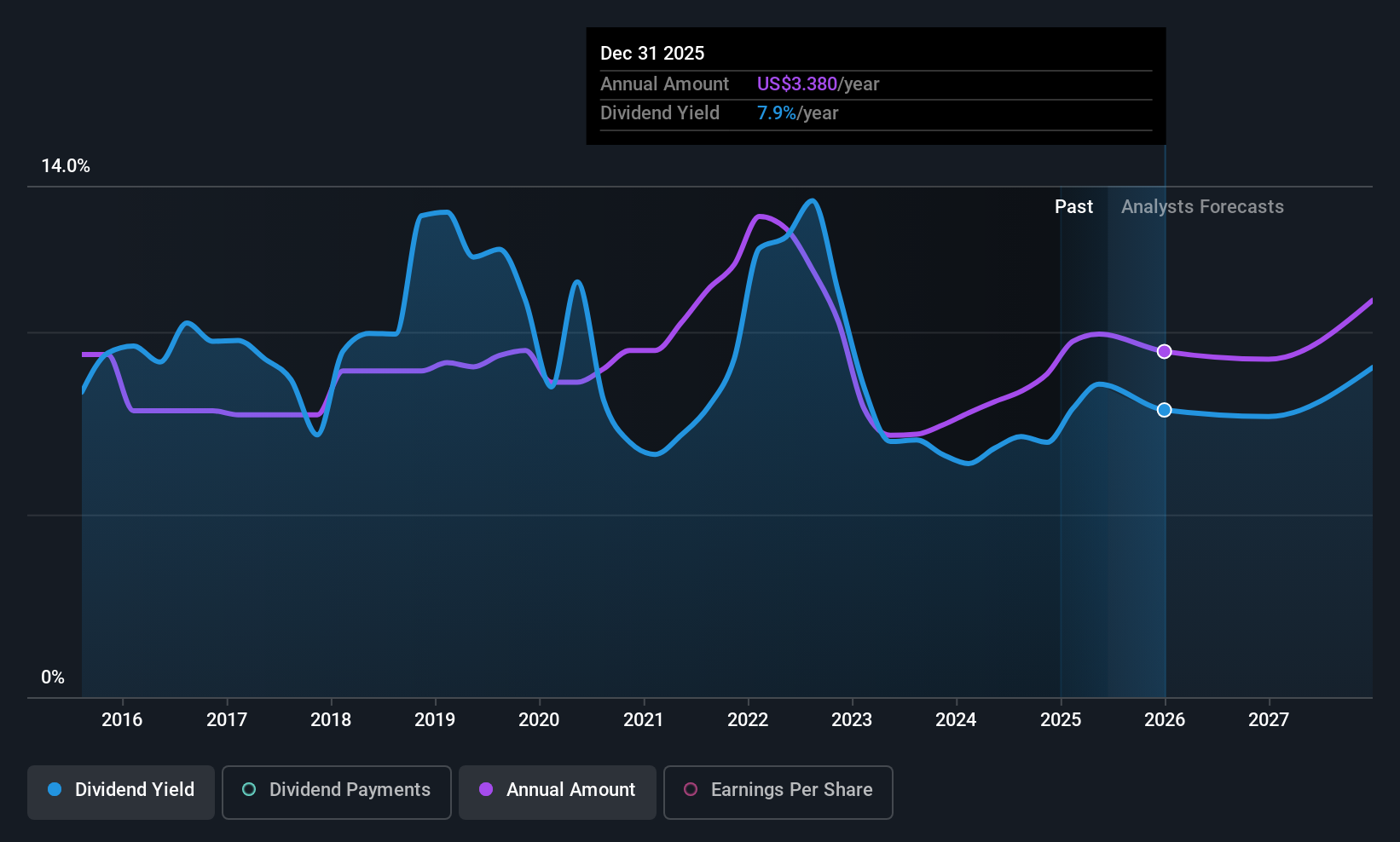

Dividend Yield: 8.5%

Artisan Partners Asset Management's dividend, currently at US$0.68 per share, is covered by both earnings (83.8% payout ratio) and cash flows (75.2% cash payout ratio), but has been volatile over the past decade. Despite a top-tier yield of 8.46%, recent insider selling and a forecasted decline in earnings raise concerns about future stability. The stock trades 25.3% below its estimated fair value, offering potential value for investors despite its unstable dividend history.

- Take a closer look at Artisan Partners Asset Management's potential here in our dividend report.

- Our valuation report here indicates Artisan Partners Asset Management may be undervalued.

United Parcel Service (UPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Parcel Service, Inc. is a package delivery and logistics provider that offers transportation and delivery services, with a market cap of approximately $84.10 billion.

Operations: United Parcel Service, Inc. generates revenue through three main segments: International at $18.08 billion, U.S. Domestic at $60.57 billion, and Supply Chain Solutions at $12.26 billion.

Dividend Yield: 6.4%

United Parcel Service's dividend, yielding 6.4%, ranks in the top 25% of U.S. payers but is not well covered by earnings or cash flow, with payout ratios exceeding 95% and 103% respectively. Despite stable growth over the past decade, high debt levels raise sustainability concerns. Recent board additions and fixed-income offerings totaling over $2 billion may impact financial flexibility, though UPS trades at a discount to its estimated fair value.

- Click to explore a detailed breakdown of our findings in United Parcel Service's dividend report.

- In light of our recent valuation report, it seems possible that United Parcel Service is trading behind its estimated value.

Where To Now?

- Dive into all 146 of the Top US Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal