Revenues Not Telling The Story For China Shuifa Singyes New Materials Holdings Limited (HKG:8073)

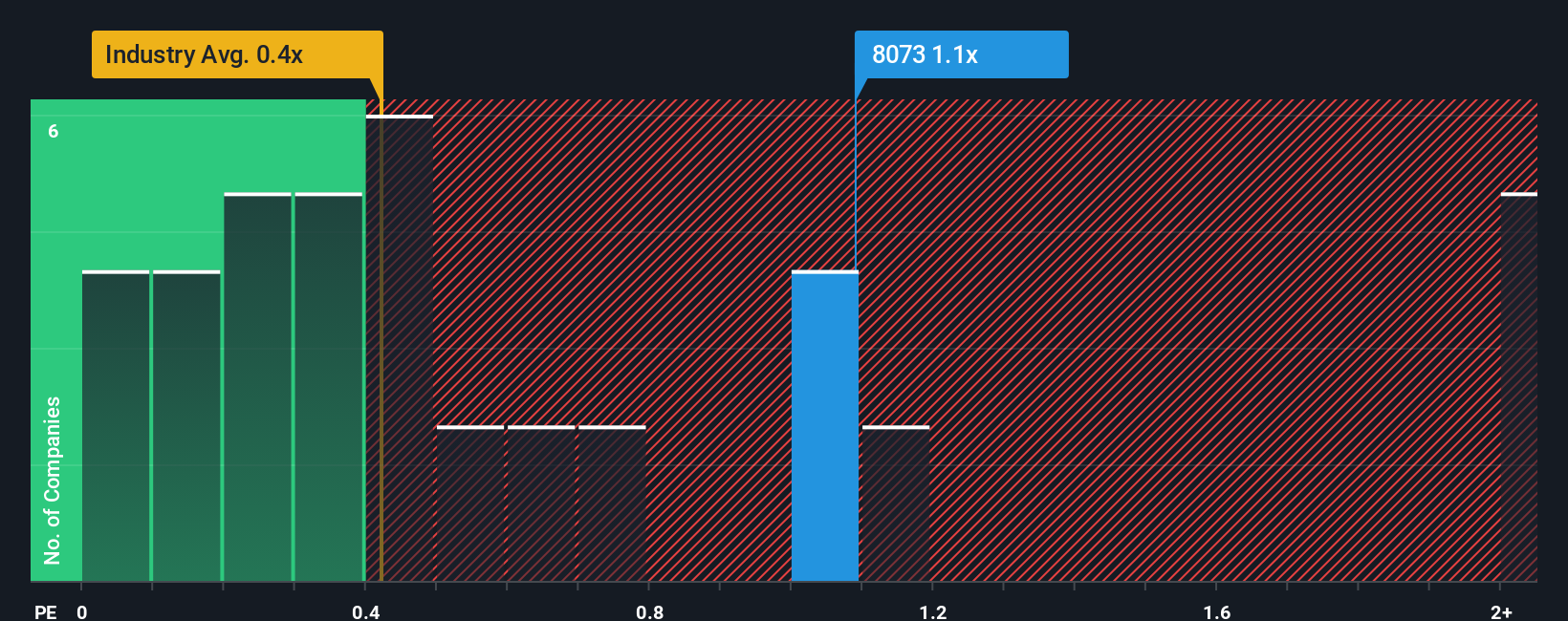

When close to half the companies in the Chemicals industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.4x, you may consider China Shuifa Singyes New Materials Holdings Limited (HKG:8073) as a stock to potentially avoid with its 1.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China Shuifa Singyes New Materials Holdings

What Does China Shuifa Singyes New Materials Holdings' Recent Performance Look Like?

The revenue growth achieved at China Shuifa Singyes New Materials Holdings over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Shuifa Singyes New Materials Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For China Shuifa Singyes New Materials Holdings?

There's an inherent assumption that a company should outperform the industry for P/S ratios like China Shuifa Singyes New Materials Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 17% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 4.3% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that China Shuifa Singyes New Materials Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From China Shuifa Singyes New Materials Holdings' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Shuifa Singyes New Materials Holdings currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Before you settle on your opinion, we've discovered 1 warning sign for China Shuifa Singyes New Materials Holdings that you should be aware of.

If these risks are making you reconsider your opinion on China Shuifa Singyes New Materials Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal