N R Agarwal Industries Limited (NSE:NRAIL) Stock Catapults 32% Though Its Price And Business Still Lag The Industry

N R Agarwal Industries Limited (NSE:NRAIL) shareholders have had their patience rewarded with a 32% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

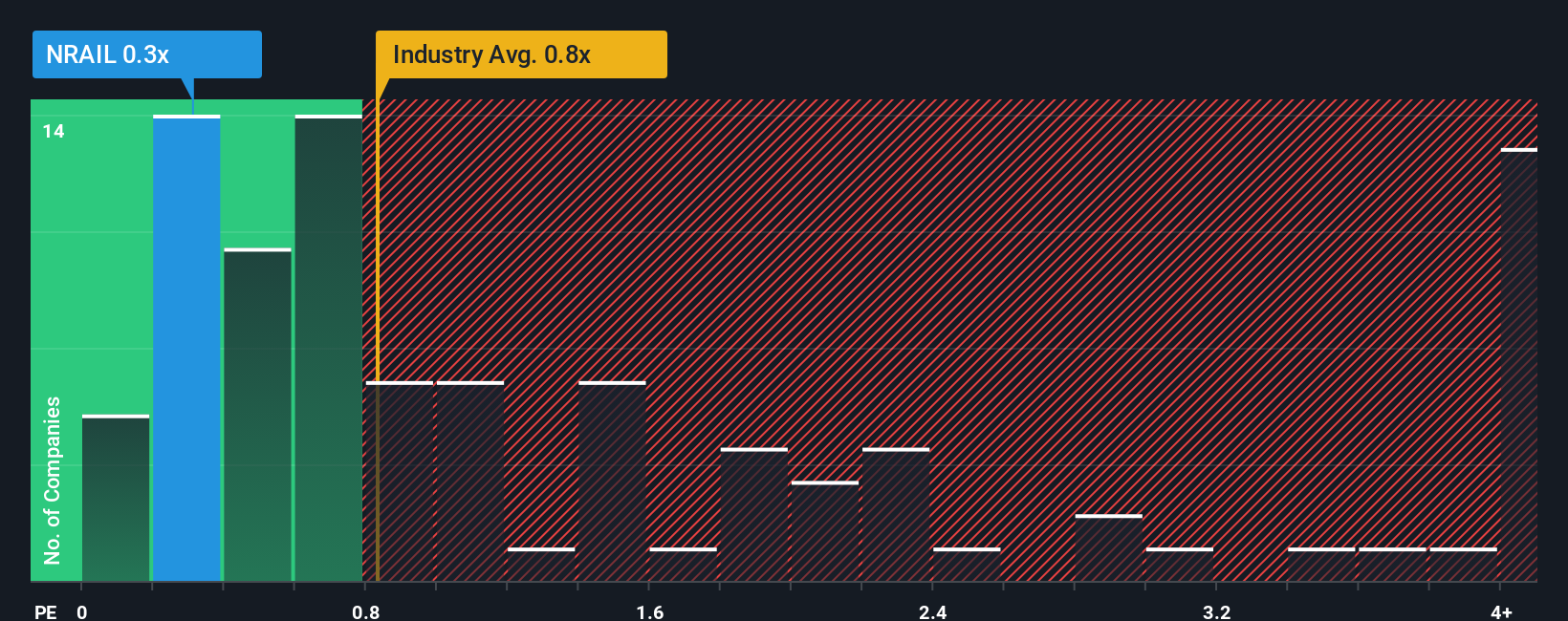

In spite of the firm bounce in price, given about half the companies operating in India's Packaging industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider N R Agarwal Industries as an attractive investment with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for N R Agarwal Industries

How Has N R Agarwal Industries Performed Recently?

The revenue growth achieved at N R Agarwal Industries over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on N R Agarwal Industries will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on N R Agarwal Industries' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as N R Agarwal Industries' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

This is in contrast to the rest of the industry, which is expected to grow by 12% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why N R Agarwal Industries' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift N R Agarwal Industries' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of N R Agarwal Industries revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 5 warning signs for N R Agarwal Industries you should be aware of, and 2 of them can't be ignored.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal