Demystifying Addus HomeCare: Insights From 4 Analyst Reviews

In the latest quarter, 4 analysts provided ratings for Addus HomeCare (NASDAQ:ADUS), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

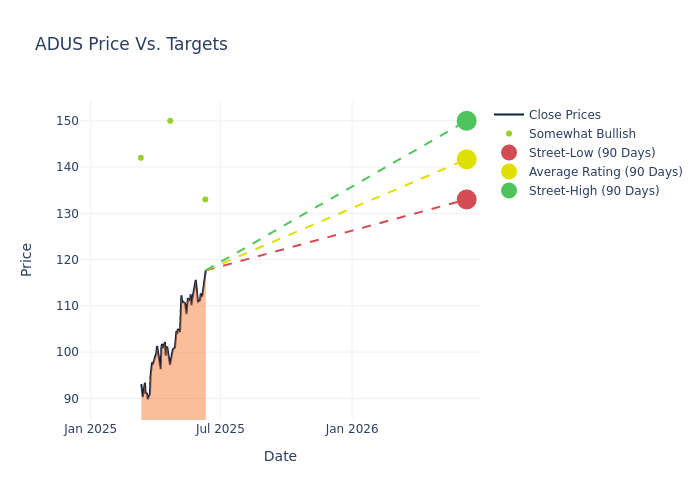

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $141.5, a high estimate of $150.00, and a low estimate of $133.00. Observing a 0.71% increase, the current average has risen from the previous average price target of $140.50.

Interpreting Analyst Ratings: A Closer Look

The perception of Addus HomeCare by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tao Qiu | Macquarie | Maintains | Outperform | $133.00 | $133.00 |

| Tao Qiu | Macquarie | Raises | Outperform | $133.00 | $129.00 |

| Nicholas Jones | JMP Securities | Maintains | Market Outperform | $150.00 | $150.00 |

| Constantine Davides | JMP Securities | Maintains | Market Outperform | $150.00 | $150.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Addus HomeCare. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Addus HomeCare compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Addus HomeCare's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Addus HomeCare's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Addus HomeCare analyst ratings.

Delving into Addus HomeCare's Background

Addus HomeCare Corp is engaged in the provision of in-home personal care services. It operates through the segments such as Personal care segment, which is a key revenue driver, provides non-medical assistance with activities of daily living, primarily to persons who are at risk of hospitalization or institutionalization, such as the elderly, chronically ill and disabled. The Hospice segment provides physical, emotional and spiritual care for people who are terminally ill and their families. Its Home health segment provides services that are primarily medical in nature to those individuals who may require assistance during an illness or after surgery.

A Deep Dive into Addus HomeCare's Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Addus HomeCare displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 20.29%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.29%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Addus HomeCare's ROE excels beyond industry benchmarks, reaching 2.16%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Addus HomeCare's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.51% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.25, Addus HomeCare adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal