Sasol (JSE:SOL) Welcomes New Board Directors Amid Leadership Reshuffle

Sasol (JSE:SOL) recently saw a 38% rise in its share price last month, coinciding with several key developments. The appointment of Ms. Xikongomelo Maluleke as an independent non-executive director and a revised dividend policy, emphasizing sustainable debt management, may have bolstered investor sentiment. Additionally, Sasol's partnership with Henkel on environmentally friendly adhesives aligns with market trends favoring sustainability, potentially appealing to eco-conscious investors. While these company-specific changes added weight, broader market trends, such as optimism over U.S.-China trade talks, also likely contributed to the positive movement in Sasol's shares.

You should learn about the 2 risks we've spotted with Sasol.

The recent appointments and policy revisions at Sasol, alongside its partnership with Henkel, could reinforce the company's focus on cost optimization and environmentally aligned growth strategies, potentially impacting future revenue and earnings positively. These moves, emphasizing renewable energy integration and sustainable debt management, might enhance Sasol's operational efficiency and profit margins over time, supporting the narrative of a strengthened operational framework.

Over the past year, Sasol's total shareholder return, including dividends, was a 25.81% decline. Meanwhile, its 12-month price performance shows underperformance compared to both the South African Chemicals industry, which returned a 10.6% decline, and the broader ZA market, which rose 28%. This longer-term perspective underscores the challenges Sasol has faced in navigating market conditions and competitive pressures.

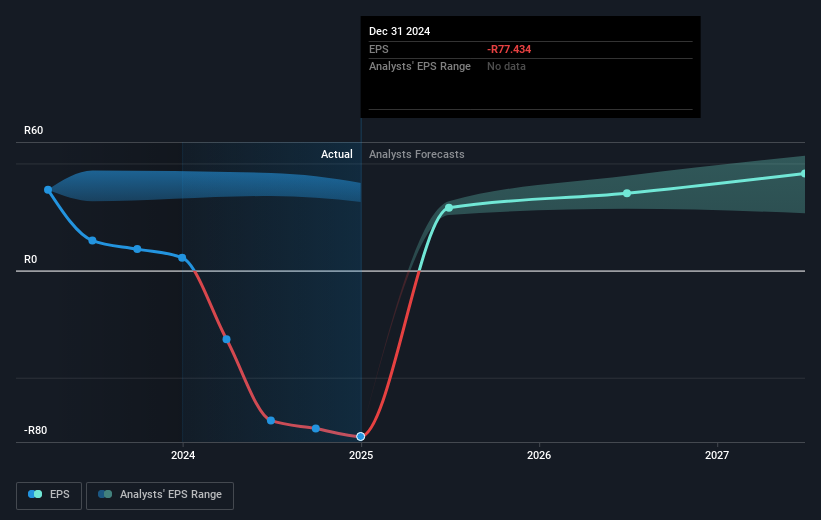

While the company's updated initiatives could improve revenue and earnings forecasts, analysts see Sasol's revenue reaching ZAR 269.6 billion, with expectations for substantial earnings growth by June 2028. The share price, currently at ZAR 83.81, remains below the consensus price target of ZAR 118.78, suggesting potential for upward movement if forecasts are met. Investors should consider how these initiatives might align with their expectations and possible industry challenges.

Gain insights into Sasol's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal