Merck (NYSE:MRK) Gains FDA Approval For RSV Treatment, Reports Positive Trial Results

Merck (NYSE:MRK) experienced a 4% price move over the last month, driven by crucial developments in its product offerings. The FDA approval of ENFLONSIA for RSV prevention and the successful clinical trial results for enlicitide decanoate in treating hyperlipidemia have reinforced Merck's portfolio strength. These medical advancements align with broader market trends, where the S&P 500 and Nasdaq recently reached high levels due to optimism surrounding trade talks between the U.S. and China. While the markets generally trended upwards, Merck's specific product-related announcements likely supported its price movement within the broader positive market sentiment.

Be aware that Merck is showing 1 possible red flag in our investment analysis.

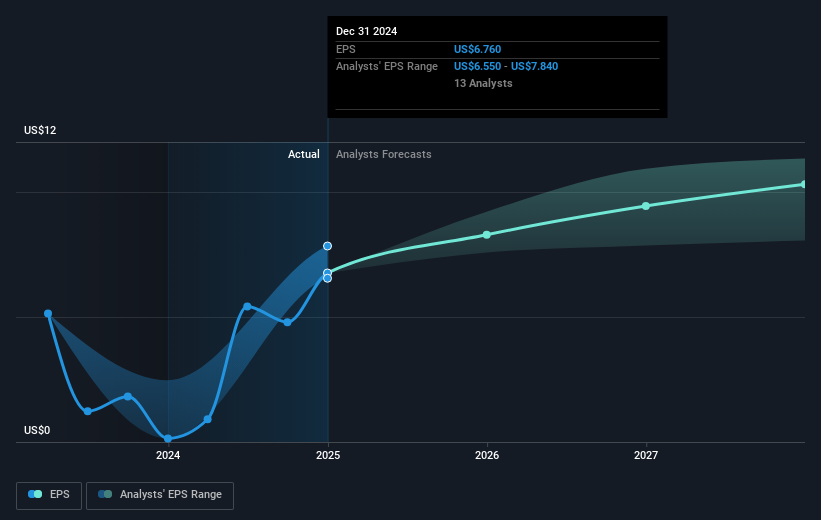

The recent FDA approval of ENFLONSIA and successful trial results for enlicitide decanoate are likely to bolster Merck's revenue projections, enhancing confidence in its strategic investments aimed at expanding its product pipeline. Analysts anticipate these developments might contribute to Merck's robust earnings growth, possibly aligning with expectations of reaching US$24.6 billion by 2028. While these advancements could potentially improve near-term revenue streams, ongoing challenges like the decline in GARDASIL sales and potential tariffs remain key considerations for analysts evaluating long-term sustainability.

Over the past five years, Merck's total shareholder return, including dividends, was 30.01%, offering a modest perspective against a backdrop of broader market performance. This contrasts with its recent 1-year period underperformance relative to the US Pharmaceuticals industry, which saw a 10.1% decline. Despite shorter-term price movements influenced by product news, Merck's performance highlights the importance of weighing its market positioning with historical progression.

With the current price of US$79.04 and a consensus price target of US$105.02, a significant 28.3% potential upside is anticipated. The product-related announcements support the current valuation metrics, yet stakeholders are advised to keep market and industry challenges in mind. Merck's positioning remains a subject of analyst consensus, highlighting the optimism surrounding future revenue and earnings trajectories.

Learn about Merck's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal