Marriott International (NasdaqGS:MAR) Launches Luxury Dining Series Across Asia Pacific

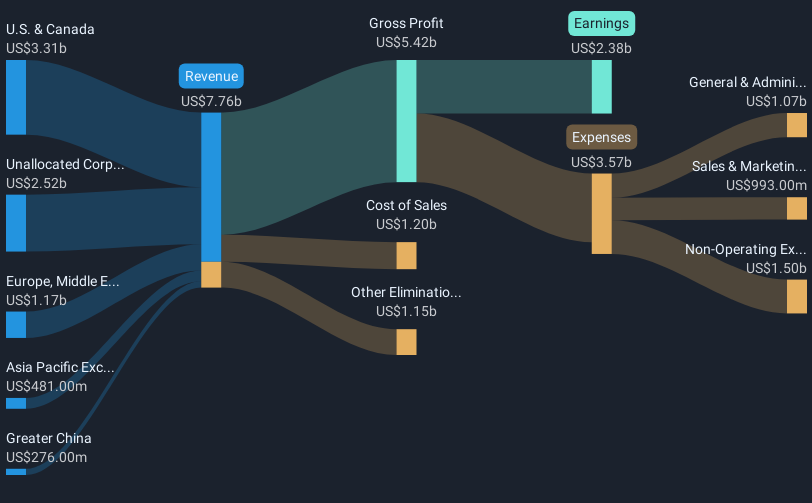

Marriott International (NasdaqGS:MAR) recently announced the return of its Luxury Dining Series across Asia Pacific, a move that aligns with its focus on enhancing customer experiences through its awarded Marriott Bonvoy program. Over the last quarter, Marriott's stock price saw a 8% rise, reflecting broader market trends, as the S&P 500 and Nasdaq Composite reached new highs this year on robust corporate earnings. The company's expansion in the Asia Pacific region and solid Q1 earnings report, featuring increased sales and net income, may have added weight to this positive trend, despite no apparent direct connection to the overall market rise.

The return of Marriott's Luxury Dining Series across Asia Pacific aligns with their strategy to enhance customer experiences and leverage their well-regarded Marriott Bonvoy program. This initiative could further bolster customer loyalty and market penetration in the region, potentially impacting future revenue forecasts positively. However, recent macroeconomic uncertainties, particularly in the U.S. and China, may overshadow these efforts, posing challenges to Marriott's broader revenue and earnings expectations. Analysts continue to anticipate significant revenue growth, but these external factors could lead to adjustments in future forecasts.

Over a five-year period, Marriott International's total shareholder return, encompassing both share price appreciation and dividends, was 202.23%. This is significantly above the 1-year return for the US market, which stood at 12.4%, showcasing the company's long-term performance strength despite recent quarterly changes. However, over the past year, Marriott underperformed the broader US Hospitality industry, which achieved a 17.6% return. This suggests that while Marriott has experienced considerable long-term gains, recent performance has been less robust relative to industry peers.

With the company's shares recently priced at US$251.96, they remain slightly below the consensus analyst price target of US$271.87. The present valuation reflects a potential upside of 7.3%, indicating analysts believe the current price may present a reasonable opportunity for appreciation, assuming earnings and revenue growth forecasts align with expectations. However, investors should weigh this price movement in the context of the discussed macroeconomic challenges and consider monitoring any developments that may affect future performance relative to industry trends.

Take a closer look at Marriott International's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal