UK Stocks That May Be Undervalued In June 2025

As the UK market grapples with the impact of weak trade data from China, reflected in recent declines in both the FTSE 100 and FTSE 250 indices, investors are keenly observing potential opportunities amid these challenges. In such an environment, identifying stocks that may be undervalued could offer strategic advantages for those looking to navigate through economic uncertainties and capitalize on long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £5.978 | £11.75 | 49.1% |

| Victrex (LSE:VCT) | £7.88 | £15.59 | 49.4% |

| Van Elle Holdings (AIM:VANL) | £0.38 | £0.69 | 44.8% |

| LSL Property Services (LSE:LSL) | £2.90 | £5.78 | 49.9% |

| Just Group (LSE:JUST) | £1.522 | £2.95 | 48.4% |

| Informa (LSE:INF) | £7.974 | £14.49 | 45% |

| Huddled Group (AIM:HUD) | £0.0325 | £0.06 | 45.6% |

| Gooch & Housego (AIM:GHH) | £5.94 | £11.06 | 46.3% |

| Entain (LSE:ENT) | £7.498 | £13.63 | 45% |

| Duke Capital (AIM:DUKE) | £0.294 | £0.53 | 45% |

Let's explore several standout options from the results in the screener.

Entain (LSE:ENT)

Overview: Entain Plc is a sports-betting and gaming company with operations in the United Kingdom, Ireland, Italy, other parts of Europe, Australia, New Zealand, and internationally; it has a market cap of £4.80 billion.

Operations: The company generates revenue from various segments, including £488 million from CEE, £2.05 billion from the UK & Ireland, and £2.57 billion internationally.

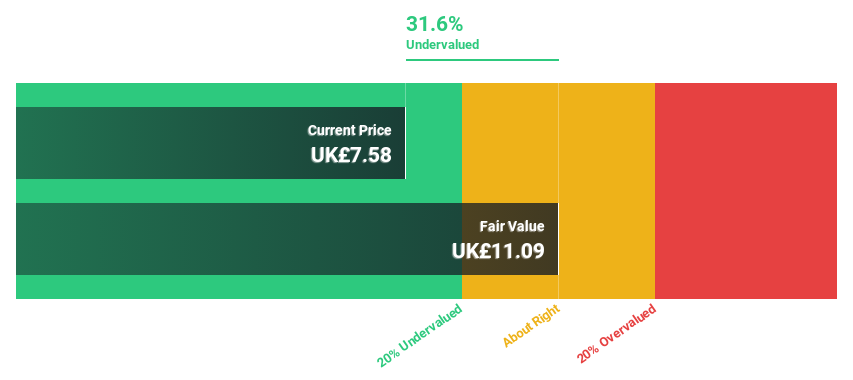

Estimated Discount To Fair Value: 45%

Entain is trading at approximately 45% below its estimated fair value of £13.63, presenting an undervaluation based on discounted cash flow analysis. The company expects revenue growth of 4.3% annually, slightly above the UK market average, and aims to achieve profitability within three years with strong earnings growth forecasts. However, its dividend yield of 2.48% is not well covered by earnings. Recent leadership changes include Stella David's appointment as CEO in April 2025.

- Our growth report here indicates Entain may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Entain's balance sheet health report.

Informa (LSE:INF)

Overview: Informa plc is an international company specializing in events, digital services, and academic research across the United Kingdom, Continental Europe, North America, China, and other global markets with a market cap of approximately £10.39 billion.

Operations: The company's revenue is derived from several segments: Informa Tech (£423.90 million), Informa Connect (£631 million), Informa Markets (£1.72 billion), and Taylor & Francis (£698.20 million).

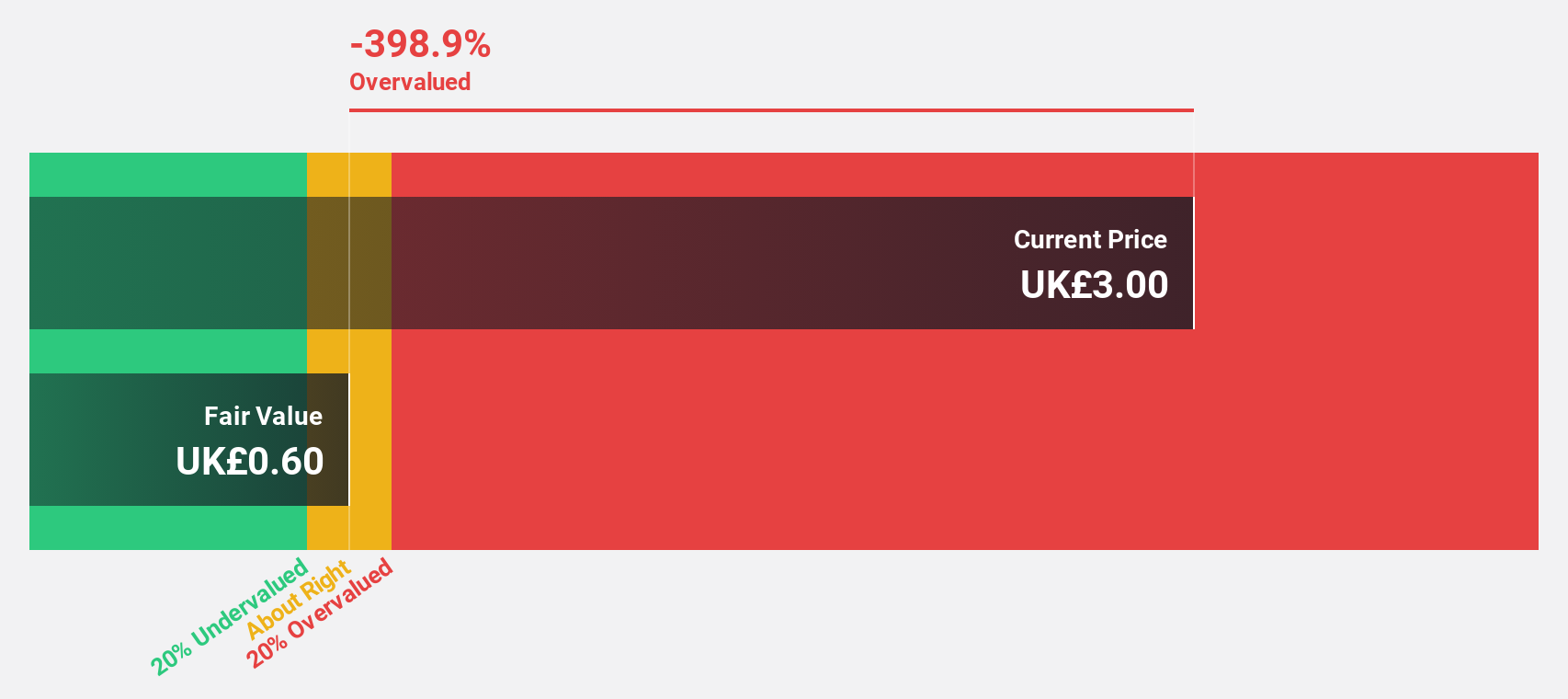

Estimated Discount To Fair Value: 45%

Informa is trading 45% below its estimated fair value of £14.49, highlighting an undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 13.1% to 8.4%, earnings are projected to grow significantly at 20.3% per year, outpacing the UK market's growth rate of 14.5%. The company re-affirmed a revenue target of approximately £4.1 billion for 2025, supporting expectations for robust financial performance amidst ongoing conference activities globally.

- Our comprehensive growth report raises the possibility that Informa is poised for substantial financial growth.

- Take a closer look at Informa's balance sheet health here in our report.

LSL Property Services (LSE:LSL)

Overview: LSL Property Services plc, with a market cap of £299.56 million, operates in the United Kingdom providing business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders.

Operations: The company's revenue is derived from three main segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency excluding Financial Services (£26.96 million).

Estimated Discount To Fair Value: 49.9%

LSL Property Services is trading significantly below its estimated fair value of £5.78, with a current price of £2.9, suggesting an undervaluation based on cash flows. The company's earnings grew by over 100% last year and are forecast to grow at 16.46% annually, surpassing the UK market average. Despite a stable dividend payout policy tied to operating profit, the track record remains unstable. Recent buyback completions may support shareholder value enhancement efforts amidst moderate revenue growth expectations.

- In light of our recent growth report, it seems possible that LSL Property Services' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of LSL Property Services.

Make It Happen

- Click through to start exploring the rest of the 52 Undervalued UK Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal