European Penny Stocks Spotlight: Sinteza And Two Promising Picks

As the European markets continue to show resilience, with major stock indexes rising and inflation easing, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, often overlooked due to their smaller market presence, can offer unique investment prospects when supported by solid financials. This article will explore three such stocks in Europe that stand out for their potential to deliver value and growth amid evolving economic conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.86 | SEK504.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.67 | SEK275.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.97 | €62.64M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.68 | €17.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN10.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.41 | SEK2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.54 | SEK215.37M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.195 | €303.05M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.952 | €31.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 447 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Sinteza (BVB:STZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

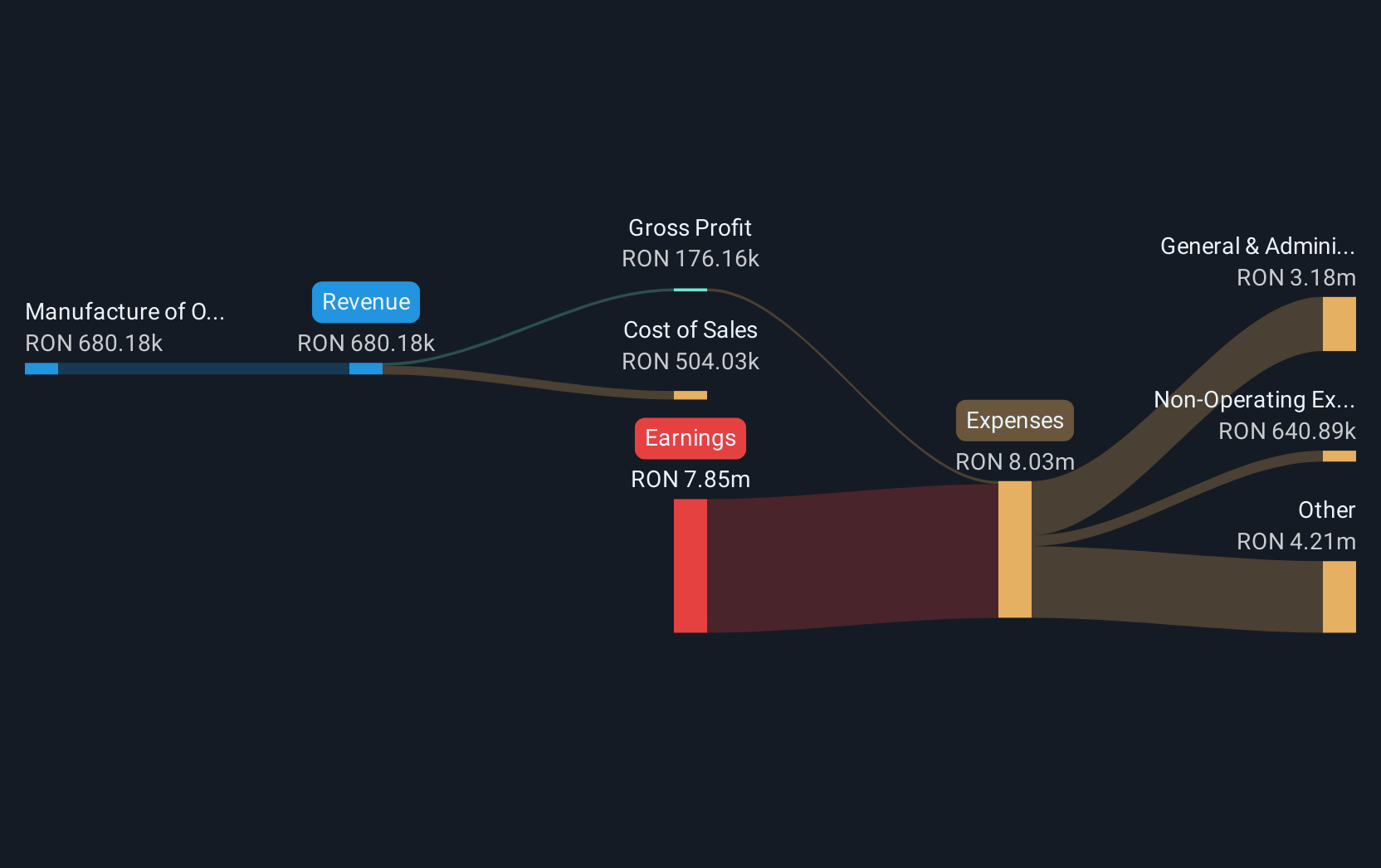

Overview: Sinteza S.A. is a Romanian company involved in the production and marketing of basic organic chemical products, with a market cap of RON47.60 million.

Operations: The company's revenue is primarily derived from the manufacture of other organic basic chemicals, amounting to RON0.68 million.

Market Cap: RON47.6M

Sinteza S.A., a Romanian chemical producer, remains pre-revenue with sales of RON0.10 million in Q1 2025, down from RON2.18 million the previous year. Despite its unprofitability and negative return on equity of -34.02%, the company has a satisfactory net debt to equity ratio of 14.7% and a cash runway exceeding three years due to positive free cash flow growth. However, Sinteza faces challenges with short-term assets not covering liabilities and increased losses over five years at 26.3% annually, alongside high share price volatility compared to other Romanian stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Sinteza.

- Learn about Sinteza's historical performance here.

Broadpeak Société anonyme (ENXTPA:ALBPK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Broadpeak Société anonyme designs and manufactures video delivery components for content and network service providers deploying video streaming services over various broadband networks worldwide, with a market cap of €19.35 million.

Operations: Broadpeak Société anonyme generates revenue through three primary segments: Equipment (€3.55 million), Licenses and Services (€20.26 million), and Maintenance and Service as a Software (SaaS) (€15.57 million).

Market Cap: €19.35M

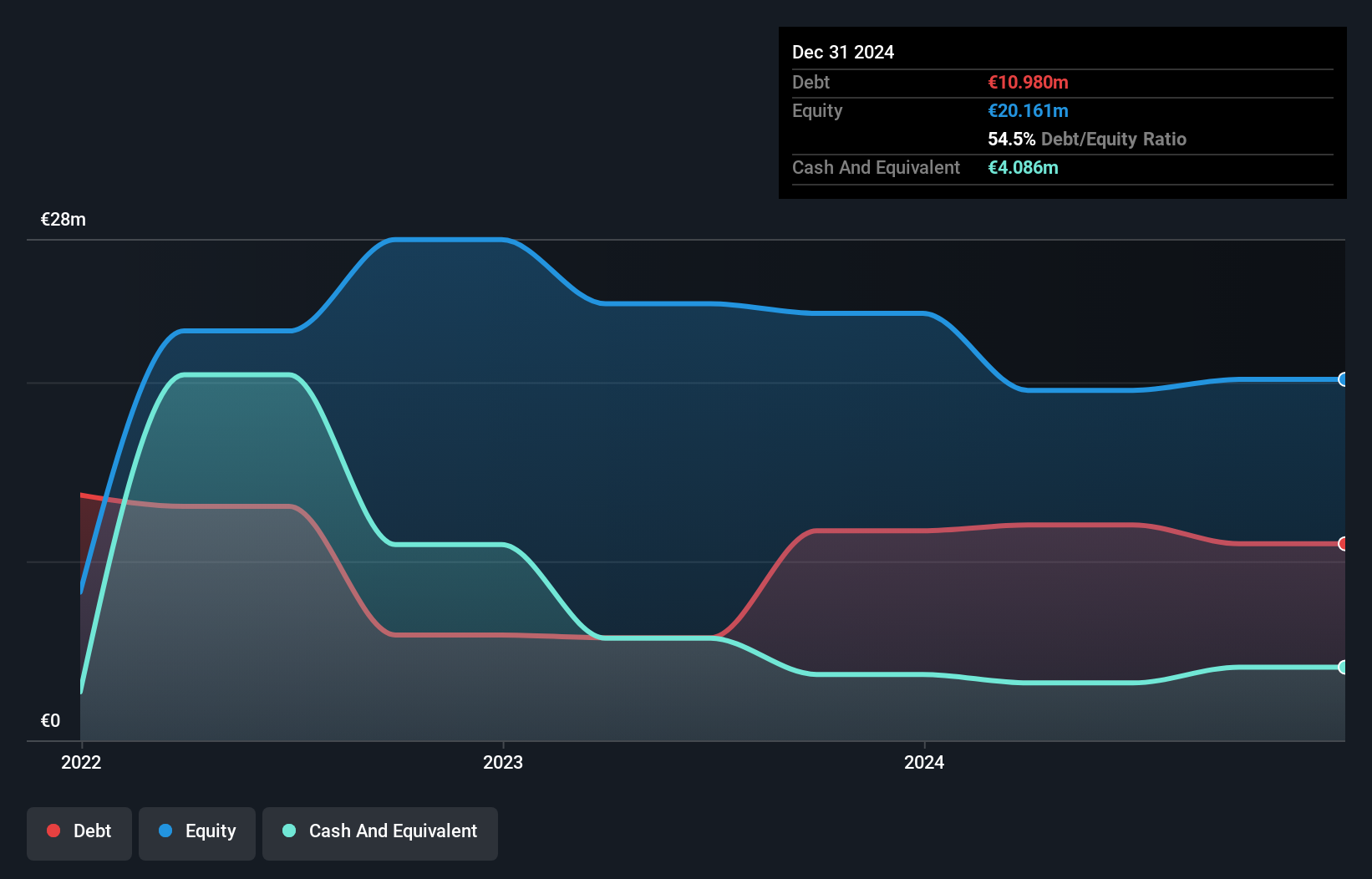

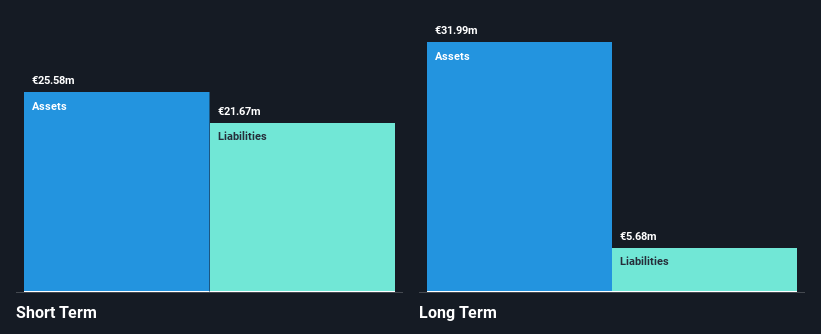

Broadpeak Société anonyme, with a market cap of €19.35 million, reported 2024 revenues of €39.38 million, showing slight growth from the previous year. Despite being unprofitable and having a negative return on equity of -19.96%, the company maintains sufficient cash runway for over three years due to positive free cash flow and short-term assets exceeding liabilities (€28.1M vs €21.8M). The firm trades at a significant discount to its estimated fair value and has not experienced meaningful shareholder dilution recently, although it remains highly volatile compared to French stocks with stable weekly volatility at 14%.

- Dive into the specifics of Broadpeak Société anonyme here with our thorough balance sheet health report.

- Evaluate Broadpeak Société anonyme's prospects by accessing our earnings growth report.

Nextedia (ENXTPA:ALNXT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextedia S.A. operates in France offering cybersecurity, cloud and digital workspace, and customer experience solutions, with a market cap of €23.17 million.

Operations: The company generates revenue from its Direct Marketing segment, totaling €64.62 million.

Market Cap: €23.17M

Nextedia S.A., with a market cap of €23.17 million, demonstrates strong financial health in the penny stock arena. The company reported 2024 revenues of €64.62 million, reflecting growth from the previous year alongside a net income increase to €1.9 million from €0.7 million. Its debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT, indicating robust financial management. Trading at a significant discount to its estimated fair value, Nextedia also benefits from seasoned board leadership and high-quality earnings growth outpacing industry averages, though its return on equity remains low at 6.1%.

- Jump into the full analysis health report here for a deeper understanding of Nextedia.

- Understand Nextedia's earnings outlook by examining our growth report.

Seize The Opportunity

- Click through to start exploring the rest of the 444 European Penny Stocks now.

- Contemplating Other Strategies? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal