What 5 Analyst Ratings Have To Say About Marex Group

Marex Group (NASDAQ:MRX) underwent analysis by 5 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

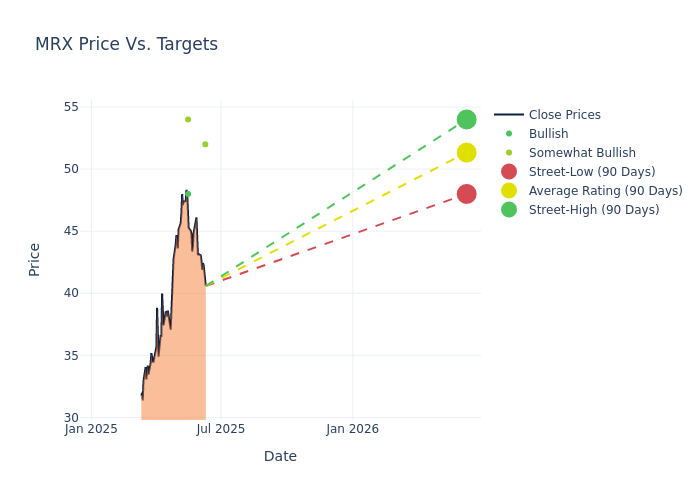

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $48.4, along with a high estimate of $54.00 and a low estimate of $44.00. This current average has increased by 6.61% from the previous average price target of $45.40.

Interpreting Analyst Ratings: A Closer Look

The standing of Marex Group among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Benjamin Budish | Barclays | Lowers | Overweight | $52.00 | $57.00 |

| Alexander Blostein | Goldman Sachs | Raises | Buy | $48.00 | $42.00 |

| Kyle Voigt | Keefe, Bruyette & Woods | Raises | Outperform | $54.00 | $45.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $44.00 | $43.00 |

| Alexander Blostein | Goldman Sachs | Raises | Buy | $44.00 | $40.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Marex Group. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Marex Group compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Marex Group's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Marex Group's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Marex Group analyst ratings.

Unveiling the Story Behind Marex Group

Marex Group PLC offers a diversified financial services platform providing essential liquidity, market access, and infrastructure services to clients across energy, commodities, and financial markets. It provides critical services to the clients by connecting them to exchanges and providing various execution and hedging services across its assets and products. The group operates in a large and fragmented market with infrastructure requirements and regulatory and technological complexity. It has five segments Clearing, Agency and Execution, Market Making, Hedging and Investment Solutions, and The Corporate. The group generates revenue from Agency and Execution that matches buyers and sellers by facilitating price discovery across the energy and financial securities markets.

Key Indicators: Marex Group's Financial Health

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining Marex Group's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 28.23% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Marex Group's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 8.37%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Marex Group's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 7.17%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Marex Group's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.3%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Marex Group's debt-to-equity ratio is notably higher than the industry average. With a ratio of 6.51, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal