3 Promising European Penny Stocks With Under €50M Market Cap

As the European markets experience a boost with the pan-European STOXX Europe 600 Index rising by 0.90% amid eased monetary policy and slowing inflation, investors are increasingly looking for opportunities in lesser-known territories. Penny stocks, though a somewhat outdated term, continue to represent smaller or newer companies that can offer unique growth potential when backed by strong financial fundamentals. This article will explore three such stocks that combine balance sheet strength with promising long-term prospects in the evolving European landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.996 | SEK541.22M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.61 | SEK270.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.95 | €62.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.78 | €17.87M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.00 | PLN10.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.62 | SEK220.24M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.20 | €9.32M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.175 | €300.29M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.936 | €31.34M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 447 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Honkarakenne Oyj (HLSE:HONBS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Honkarakenne Oyj designs, manufactures, and sells log and solid-wood house packages in Finland, with a market cap of €17.91 million.

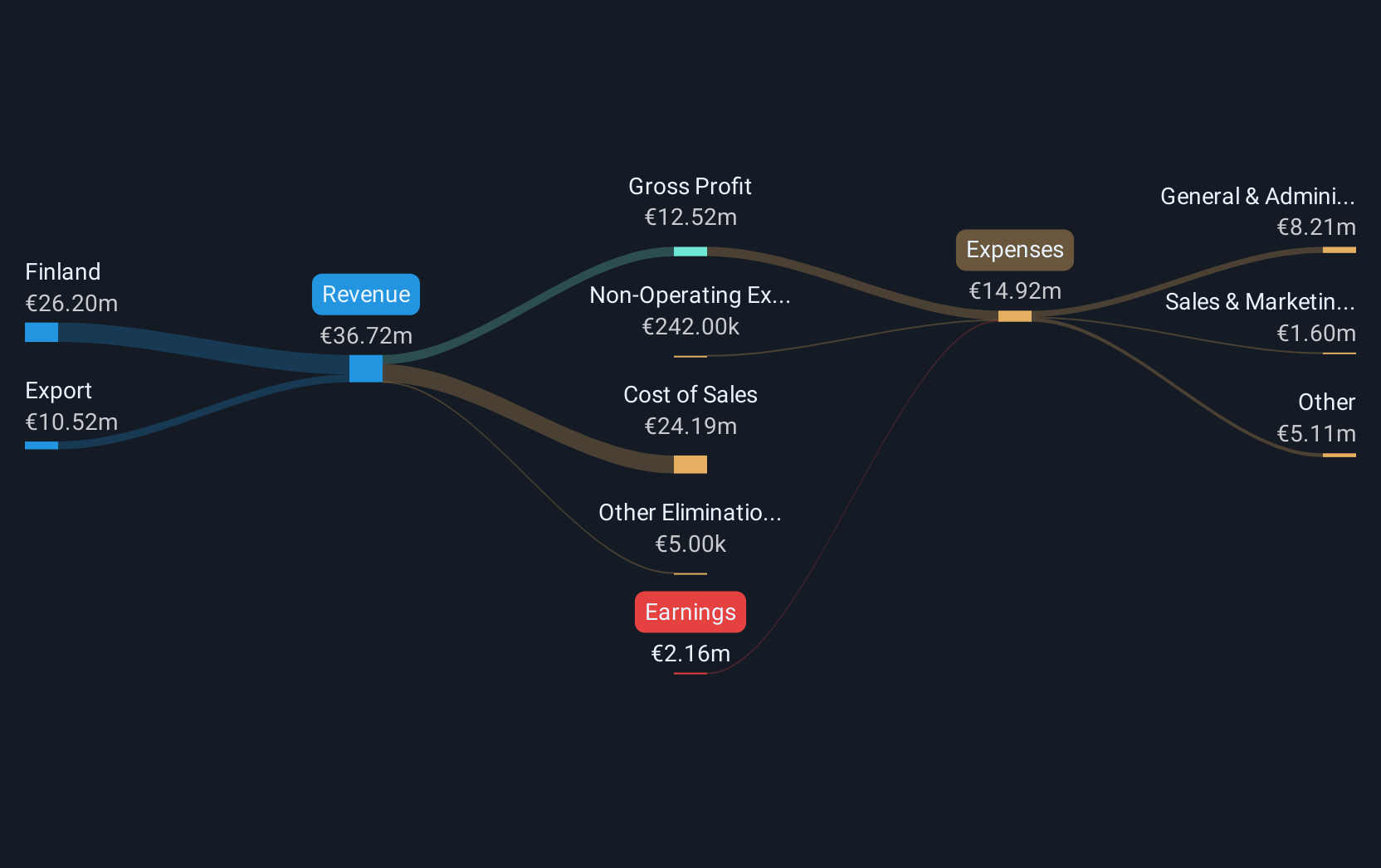

Operations: The company generates revenue of €36.71 million from its Home Builders segment, which includes both residential and commercial projects.

Market Cap: €17.91M

Honkarakenne Oyj, with a market cap of €17.91 million, operates in the log and solid-wood house package sector. Despite being unprofitable, the company has managed to reduce its debt-to-equity ratio from 26.7% to 13.9% over five years and maintains more cash than total debt. Its short-term assets exceed both short-term (€9M) and long-term liabilities (€3.9M), indicating sound liquidity management. However, its share price remains highly volatile, and no dividend was declared for 2024 due to ongoing financial challenges. Earnings are forecasted to grow significantly at 67.59% per year despite recent losses increasing annually by 44.5%.

- Navigate through the intricacies of Honkarakenne Oyj with our comprehensive balance sheet health report here.

- Understand Honkarakenne Oyj's earnings outlook by examining our growth report.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies, with a market cap of NOK561.66 million.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, totaling $8.28 million.

Market Cap: NOK561.66M

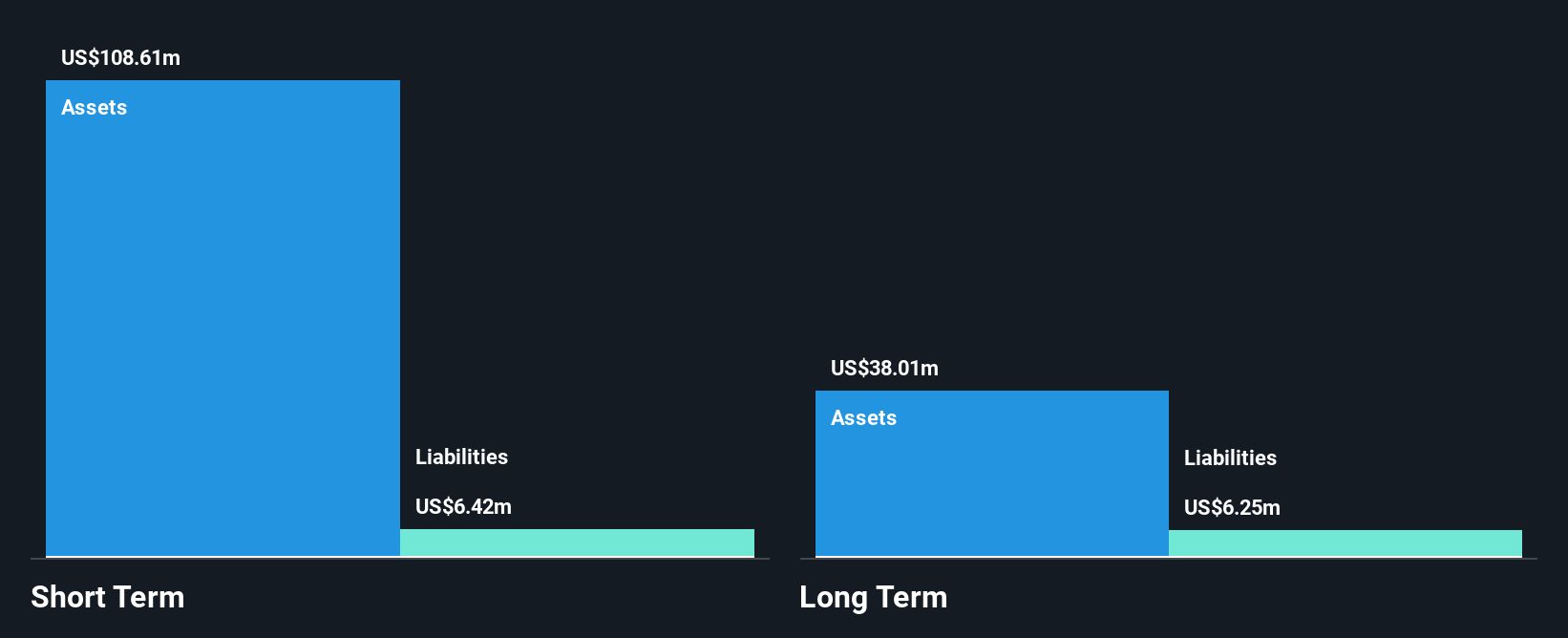

Nykode Therapeutics, with a market cap of NOK561.66 million, is a clinical-stage biopharmaceutical company focused on immunotherapies. Despite reporting revenue of US$0.137 million for Q1 2025, it remains pre-revenue and unprofitable. The company has no debt and maintains robust short-term assets (US$108.6M) against liabilities (US$12.7M). Recent clinical trials presented at ASCO highlight promising results for its cancer immunotherapy candidates VB10.16 and VB10.NEO, indicating potential in heavily pre-treated patients across various tumor types with favorable safety profiles, warranting further exploration despite high share price volatility and recent executive turnover concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Nykode Therapeutics.

- Examine Nykode Therapeutics' earnings growth report to understand how analysts expect it to perform.

4MASS Spólka Akcyjna (WSE:4MS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 4Mass Spólka Akcyjna is involved in the manufacture and distribution of make-up products, with a market cap of PLN103.25 million.

Operations: The company has not reported any revenue segments.

Market Cap: PLN103.25M

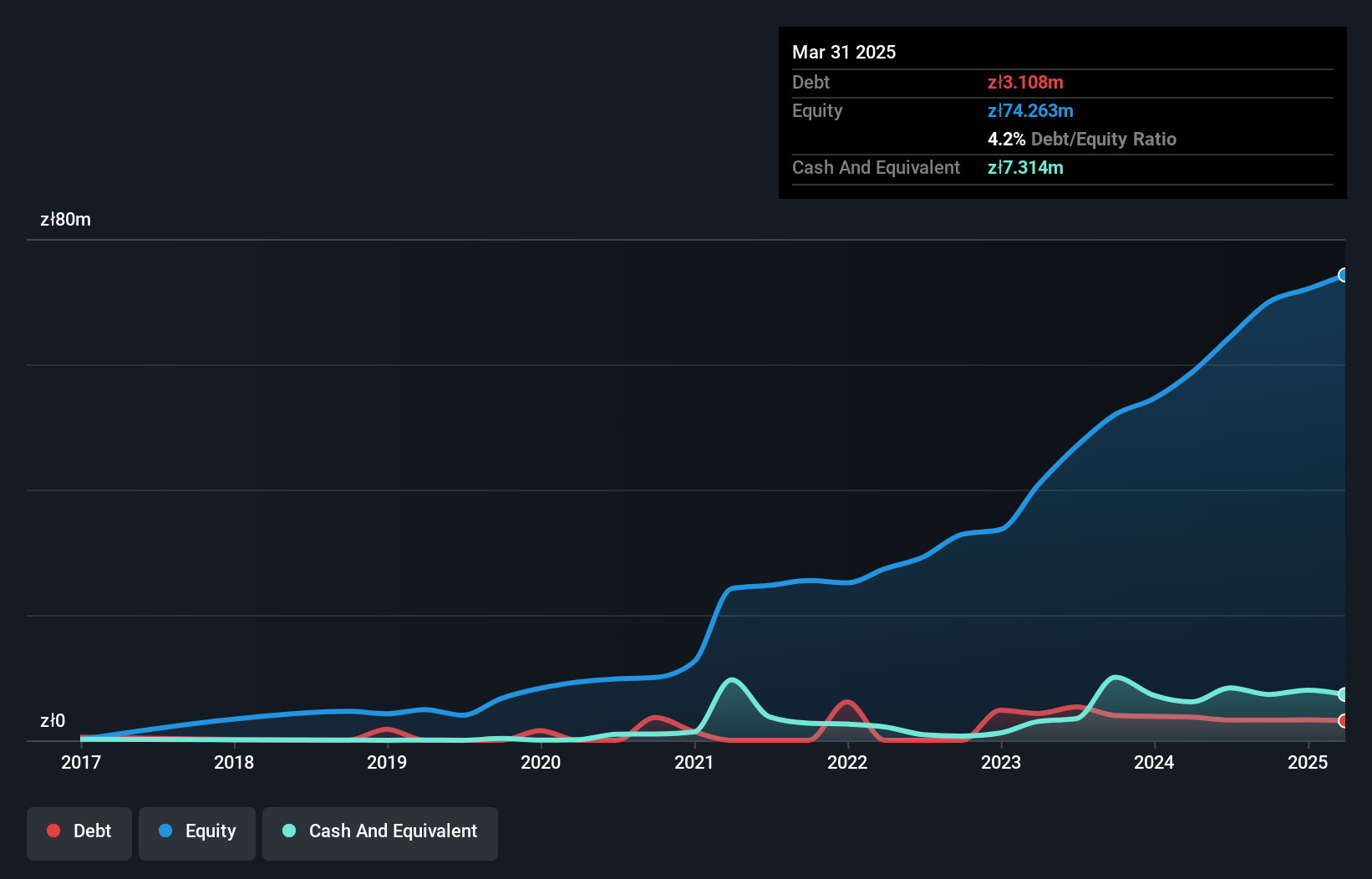

4MASS Spólka Akcyjna, with a market cap of PLN103.25 million, has shown stable revenue growth, reporting PLN 27.87 million for Q1 2025 and PLN 124.02 million for the full year 2024. Despite a decline in net income to PLN 2.3 million from last year's figures, the company maintains strong financial health with short-term assets exceeding both long-term and short-term liabilities significantly and more cash than total debt. Its debt is well covered by operating cash flow (315.8%), while interest payments are comfortably managed by EBIT (29.3x). However, negative earnings growth (-13.1%) over the past year presents challenges despite high-quality past earnings and a favorable price-to-earnings ratio (6.6x) compared to the Polish market average.

- Take a closer look at 4MASS Spólka Akcyjna's potential here in our financial health report.

- Evaluate 4MASS Spólka Akcyjna's historical performance by accessing our past performance report.

Where To Now?

- Unlock our comprehensive list of 447 European Penny Stocks by clicking here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal