Asian Stocks Possibly Priced Below Their Estimated Value In June 2025

As global markets navigate a complex landscape of trade tensions and economic indicators, Asian stock markets present intriguing opportunities for investors seeking value. In this environment, identifying stocks that may be priced below their estimated value can offer potential advantages, especially when considering factors such as market resilience and government stimulus efforts in the region.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2420.00 | ¥4746.14 | 49% |

| Lucky Harvest (SZSE:002965) | CN¥41.69 | CN¥81.92 | 49.1% |

| Kanto Denka Kogyo (TSE:4047) | ¥843.00 | ¥1678.38 | 49.8% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.78 | NZ$1.56 | 49.9% |

| Good Will Instrument (TWSE:2423) | NT$44.20 | NT$87.29 | 49.4% |

| Fuji (TSE:6134) | ¥2247.50 | ¥4448.27 | 49.5% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥26.48 | CN¥52.37 | 49.4% |

| Dive (TSE:151A) | ¥924.00 | ¥1813.20 | 49% |

| cottaLTD (TSE:3359) | ¥436.00 | ¥859.36 | 49.3% |

| BalnibarbiLtd (TSE:3418) | ¥1162.00 | ¥2283.94 | 49.1% |

Here's a peek at a few of the choices from the screener.

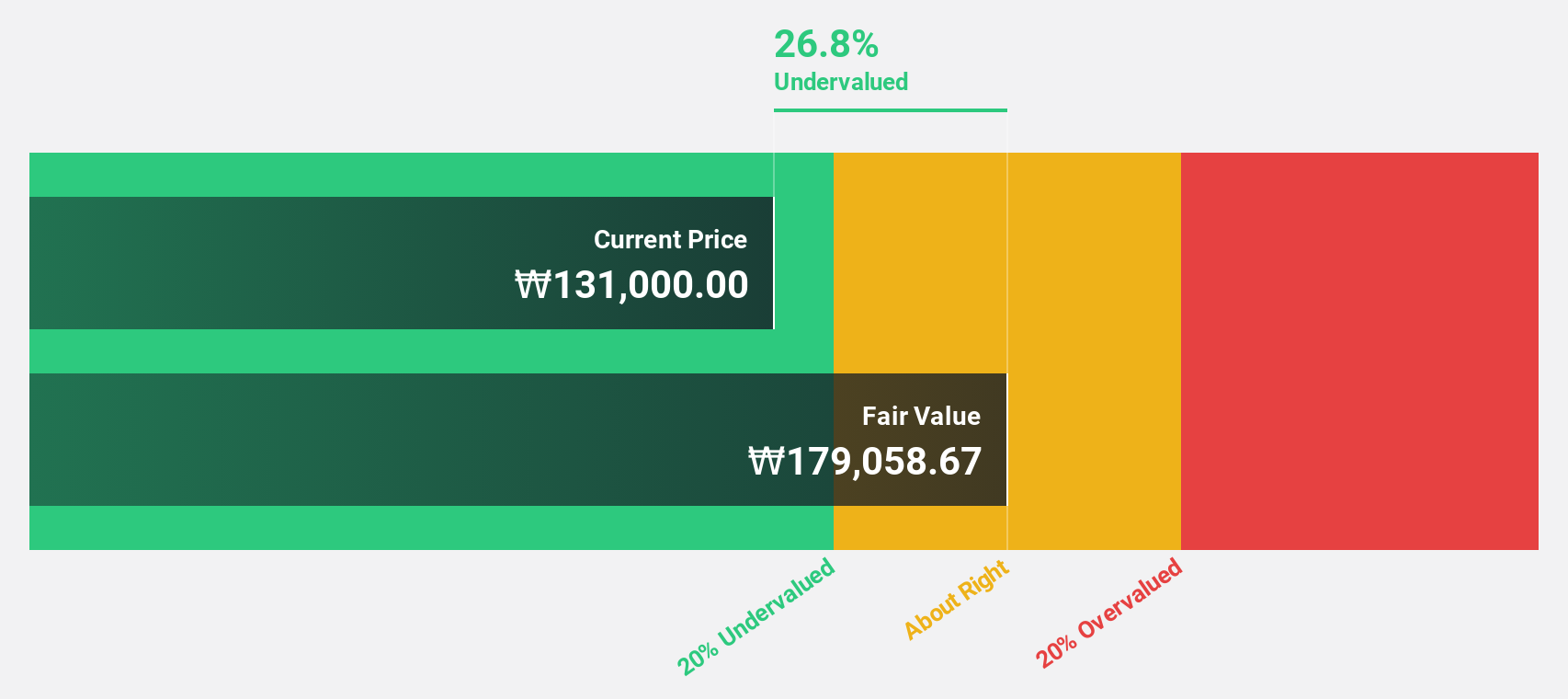

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for both men and women, with a market cap of ₩4.47 billion.

Operations: The company's revenue is primarily derived from the Cosmetics Sector, which generates ₩1.00 billion, followed by the Clothing Fashion Sector with ₩49.44 million.

Estimated Discount To Fair Value: 32.8%

APR Co., Ltd. is trading at ₩120,800, significantly below its estimated fair value of ₩179,828.39, suggesting it may be undervalued based on cash flows. The company has shown robust earnings growth of 56.4% over the past year and is expected to continue growing at a significant rate of 28.6% annually over the next three years, outpacing the KR market's growth rate. However, its share price has been highly volatile recently despite high non-cash earnings quality.

- Upon reviewing our latest growth report, APR's projected financial performance appears quite optimistic.

- Get an in-depth perspective on APR's balance sheet by reading our health report here.

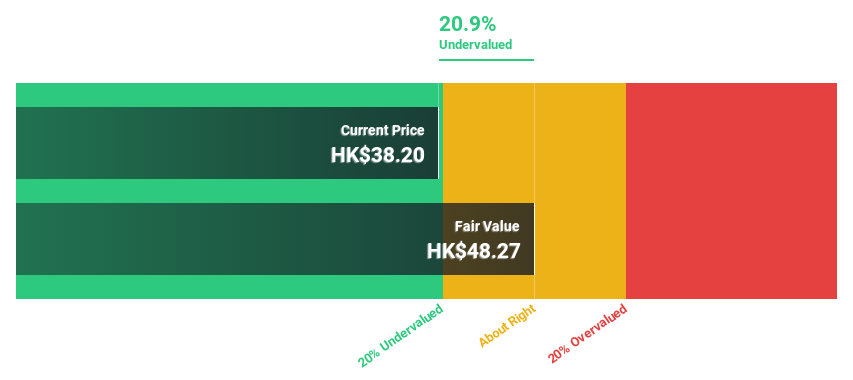

Nongfu Spring (SEHK:9633)

Overview: Nongfu Spring Co., Ltd. is engaged in researching, developing, producing, and marketing packaged drinking water and beverage products primarily in Mainland China, with a market cap of approximately HK$444.80 billion.

Operations: Nongfu Spring generates revenue from several segments, including CN¥15.95 billion from water products, CN¥16.74 billion from ready-to-drink tea products, CN¥4.08 billion from juice beverage products, and CN¥4.93 billion from functional drinks products.

Estimated Discount To Fair Value: 18.9%

Nongfu Spring, trading at HK$39.55, is undervalued relative to its fair value estimate of HK$48.77. Despite slower forecasted revenue growth of 10.7% annually compared to the broader market, its earnings are expected to grow slightly faster than the Hong Kong market at 10.5% per year. Recent board and auditor changes may influence corporate governance positively, while a dividend increase to RMB 0.76 per share reflects financial stability amidst modest profit growth projections.

- Our growth report here indicates Nongfu Spring may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Nongfu Spring.

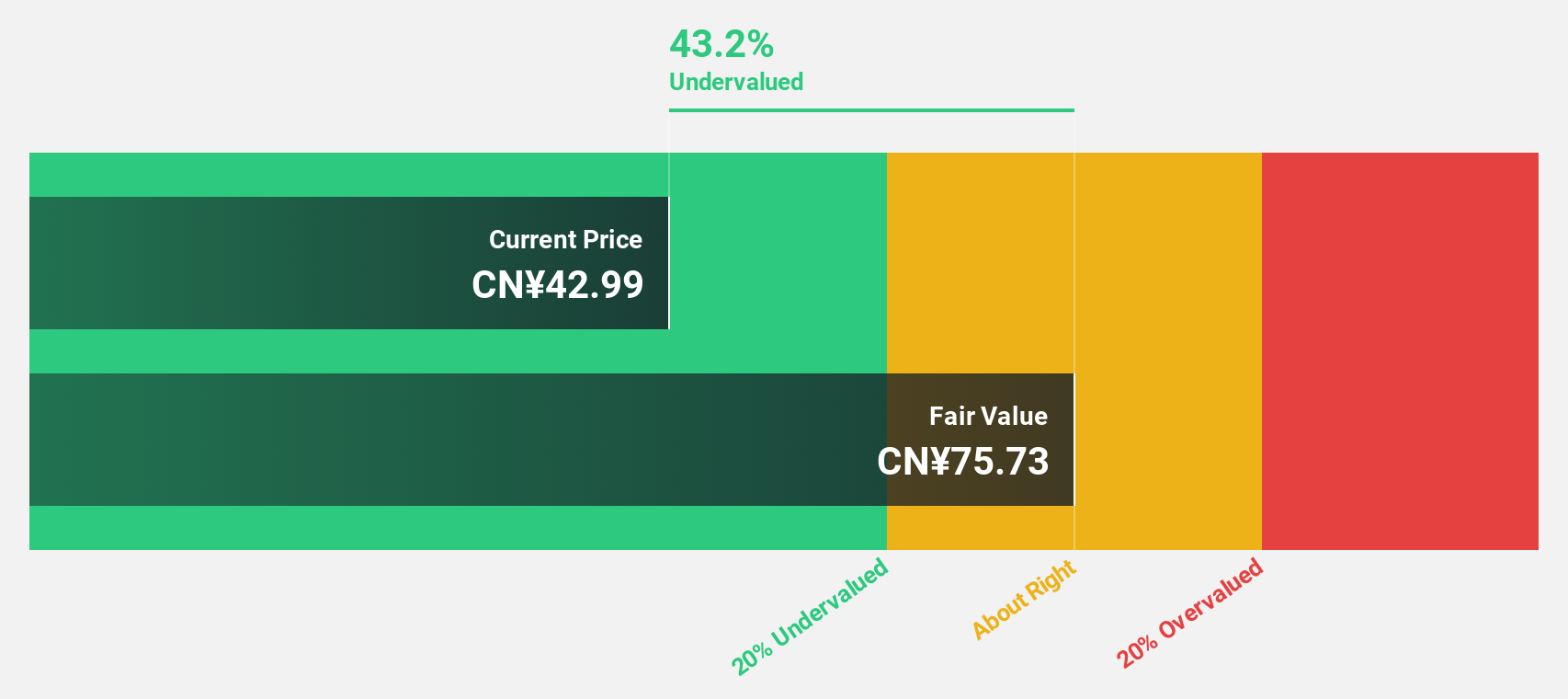

Shengyi Electronics (SHSE:688183)

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of printed circuit boards in China with a market cap of CN¥33.74 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 45.5%

Shengyi Electronics, trading at CN¥41.33, is undervalued with a fair value estimate of CN¥75.81. Earnings are expected to grow significantly at 35.2% per year, surpassing the broader Chinese market's growth rate. Recent financial results show strong performance with first-quarter revenue reaching CN¥1.58 billion and net income rising to CN¥200.18 million from the previous year’s figures. A share repurchase program worth up to CN¥100 million further underscores its robust cash flow position.

- Our comprehensive growth report raises the possibility that Shengyi Electronics is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Shengyi Electronics.

Next Steps

- Access the full spectrum of 300 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal