Coupang (NYSE:CPNG) Enters New US$1.5 Billion Credit Agreement With JPMorgan

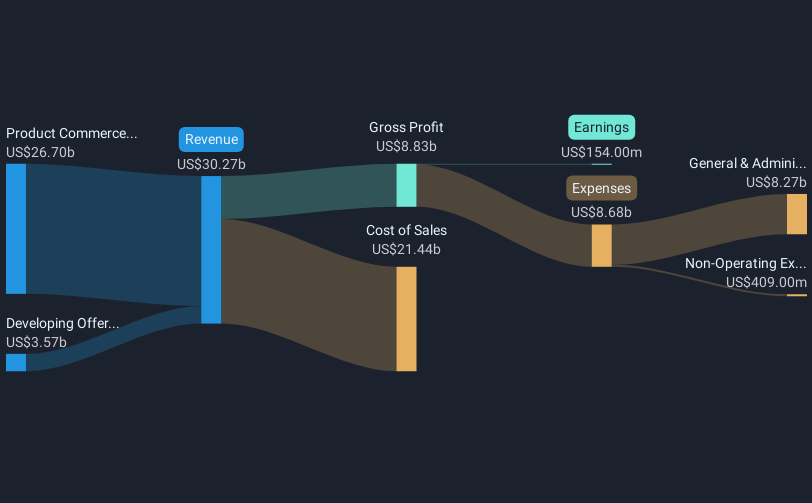

Coupang's (NYSE:CPNG) recent financial maneuvers, particularly its $1.5 billion revolving credit agreement with JPMorgan Chase, coincide with a notable share price increase of 25.45% last quarter. This agreement, offering flexibility in working capital, complements the company's robust Q1 earnings, reporting a revenue rise to $7.9 billion and a substantial jump in net income. Coupled with its share repurchase program, these moves possibly bolstered investor confidence. While the broader market demonstrated resilience with strong corporate earnings, Coupang's strategic initiatives, including its expansion efforts and buyback announcements, aligned and likely added weight to these trends.

Coupang has 2 weaknesses we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent financial moves by Coupang, including the $1.5 billion revolving credit agreement and share buybacks, align with the ongoing narrative of expansion and improved service excellence through initiatives like Rocket Delivery and the Taiwan market entry. These actions could enhance operational efficiency and profitability, potentially supporting revenue growth and bolstering investor confidence. Despite these improvements, the current share price remains at a discount to the consensus analyst price target of US$29.98, implying upside potential if the projected growth materializes.

Over the past three years, Coupang's total shareholder return, including share price appreciation and dividends, was very large at 131.66%. This performance showcases the company's growth trajectory over the longer term, contrasting with recent short-term gains influenced by operational and financial strategies. Over the last year, Coupang's share price increase exceeded the US Multiline Retail industry's performance, providing a comparative advantage amidst sector dynamics.

The recent news could impact revenue and earnings forecasts positively by reinforcing growth initiatives, although risks such as currency volatility and rising operational expenses continue to pose challenges. Analysts anticipate revenue to reach $44.1 billion by 2028, requiring the company to achieve substantial growth. While the share price is trading below fair value estimates, the unfolding of Coupang’s strategic expansions remains pivotal to meeting analyst expectations and realizing the price target.

Navigate through the intricacies of Coupang with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal