Capital One Financial (NYSE:COF) Expands Board Following Discover Acquisition Completion

Capital One Financial (NYSE:COF) recently completed its acquisition of Discover Financial Services, expanding its board to include new directors like Thomas G. Maheras, Michael Shepherd, and Jennifer L. Wong, highlighting a focus on governance. Over the last quarter, Capital One's share price increased by 11%, reflecting the company's significant corporate developments. The broader market also experienced gains, with major indexes climbing, supported by strong corporate earnings and a robust labor market. Capital One’s price movement aligns with these broader market trends and its internal strategic adjustments likely bolstered investor confidence.

With Capital One Financial's acquisition of Discover Financial Services, the combined entity aims to become a leading platform in consumer banking and payments. This strategic move is expected to positively impact revenue and earnings forecasts, with synergies enhancing corporate growth. In the last five years, the company's total shareholder returns amounted to 216.49%, a substantial increase that reflects a strong longer-term performance. Although the broader market and industry have seen gains, Capital One's yearly performance has notably exceeded the US Consumer Finance industry's 26.7% return over the past year, indicating relative strength.

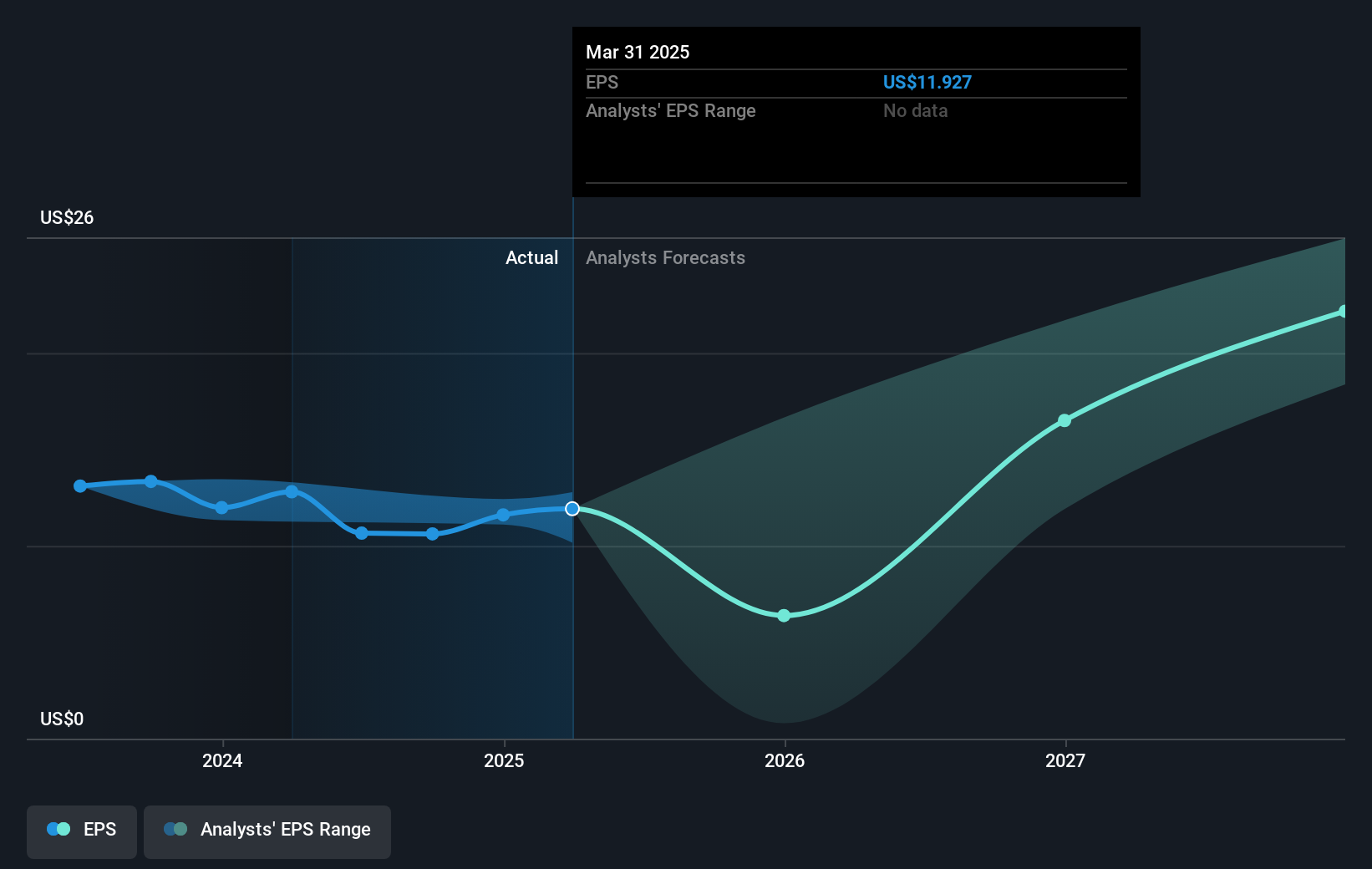

The share price increase of 11% in the last quarter aligns well with future growth projections, bolstered by the acquisition. This surge brings the current share price to US$185.71, positioning it at an 11.9% discount to the analysts’ consensus price target of US$211.20. If forecasted revenue growth of 21.3% annually and an earnings increase to US$9.5 billion by 2028 are realized, the market could potentially reassess its valuation. However, challenges remain, such as rising operational costs and economic uncertainties, which could impact Capital One's ability to meet its improved financial forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal