Three Prominent Dividend Stocks To Consider

In the last week, the United States market has been flat, yet it has experienced an 11% increase over the past year with earnings forecasted to grow by 14% annually. In this environment, dividend stocks that offer consistent income and potential for growth can be appealing options for investors seeking stability and returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 5.09% | ★★★★★☆ |

| Universal (UVV) | 5.42% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.17% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.91% | ★★★★★★ |

| Ennis (EBF) | 5.40% | ★★★★★★ |

| Dillard's (DDS) | 6.59% | ★★★★★★ |

| Credicorp (BAP) | 5.14% | ★★★★★☆ |

| CompX International (CIX) | 5.04% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.26% | ★★★★★★ |

| Chevron (CVX) | 5.00% | ★★★★★★ |

Click here to see the full list of 149 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

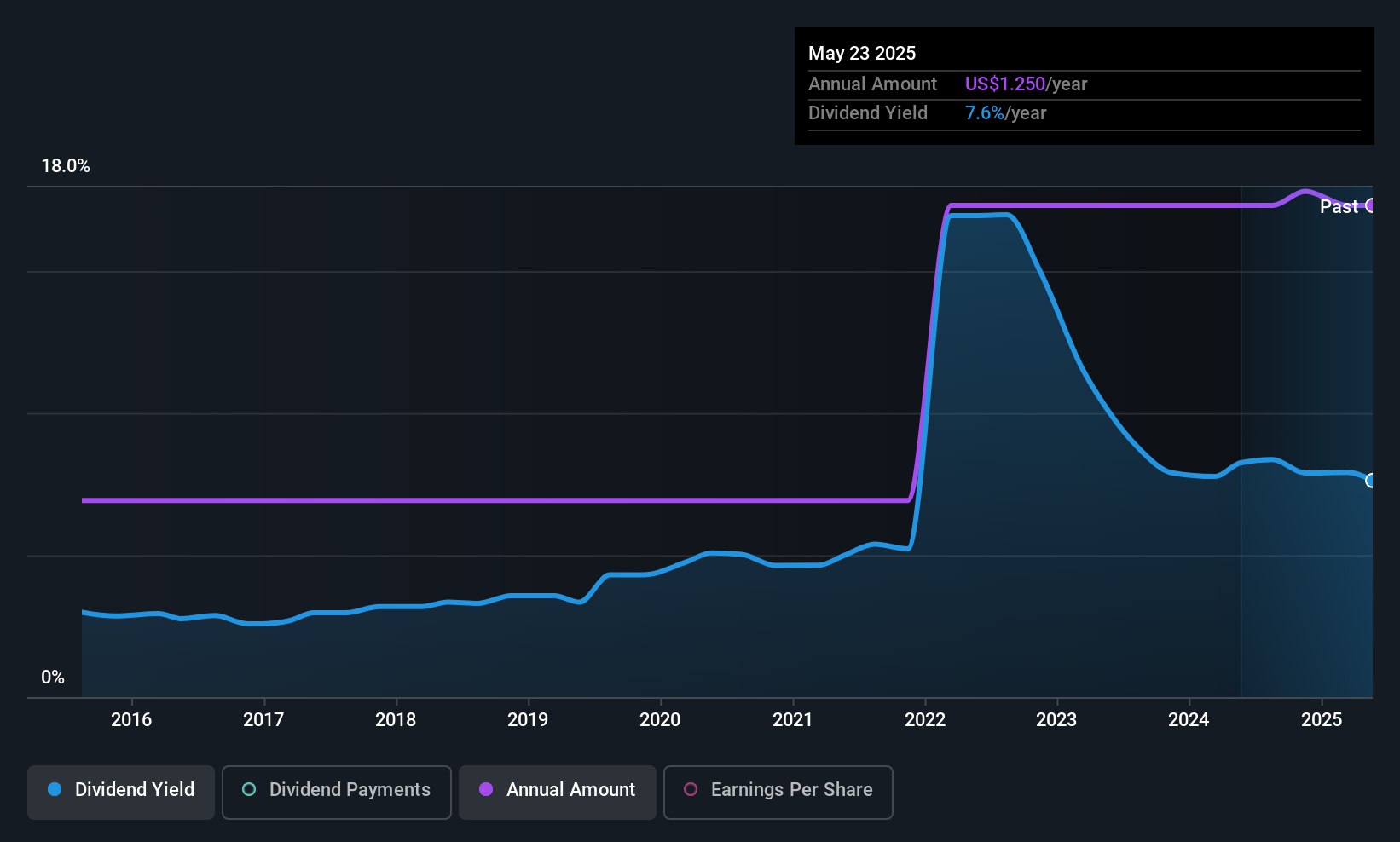

Spok Holdings (SPOK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spok Holdings, Inc., through its subsidiary Spok, Inc., offers healthcare communication solutions across various regions including the United States, Europe, Canada, Australia, Asia, and the Middle East with a market cap of $329.98 million.

Operations: Spok Holdings generates revenue primarily through its Clinical Communication and Collaboration Business, which accounted for $139.04 million.

Dividend Yield: 7.6%

Spok Holdings has consistently paid dividends over the past decade, with recent affirmations of a US$0.3125 quarterly dividend. However, its high payout ratio of 159.4% and cash payout ratio of 98.5% suggest dividends are not well covered by earnings or cash flows, raising sustainability concerns despite its top-tier yield of 7.65%. Recent Q1 results show improved revenue and net income, yet the lack of share buybacks may impact future capital allocation strategies.

- Delve into the full analysis dividend report here for a deeper understanding of Spok Holdings.

- In light of our recent valuation report, it seems possible that Spok Holdings is trading beyond its estimated value.

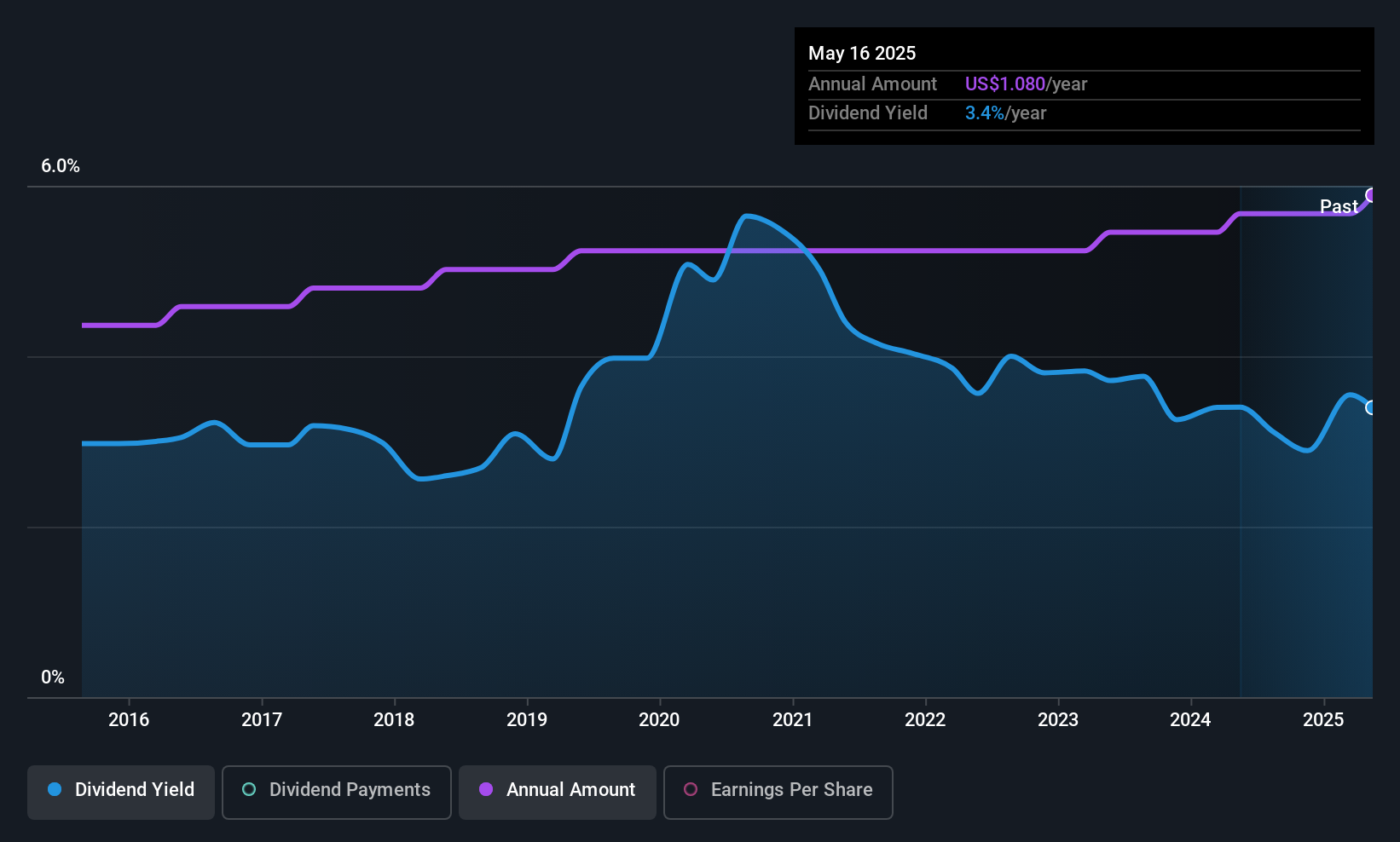

Weyco Group (WEYS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Weyco Group, Inc. designs, markets, and distributes footwear for men, women, and children across the United States, Canada, Australia, Asia, and South Africa with a market cap of $300.70 million.

Operations: Weyco Group's revenue is primarily generated through its Wholesale segment at $225.96 million and its Retail segment at $37.55 million.

Dividend Yield: 3.4%

Weyco Group offers a stable dividend yield of 3.41%, with recent increases indicating growth potential. The dividend is well-covered by both earnings and cash flows, with payout ratios at 34.1% and 39.6%, respectively, suggesting sustainability. Despite a lower-than-top-tier yield compared to peers, the company maintains reliable dividends over the past decade. However, recent delisting concerns due to board composition may impact investor confidence until resolved within Nasdaq's specified timeframe.

- Click here to discover the nuances of Weyco Group with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Weyco Group's share price might be too optimistic.

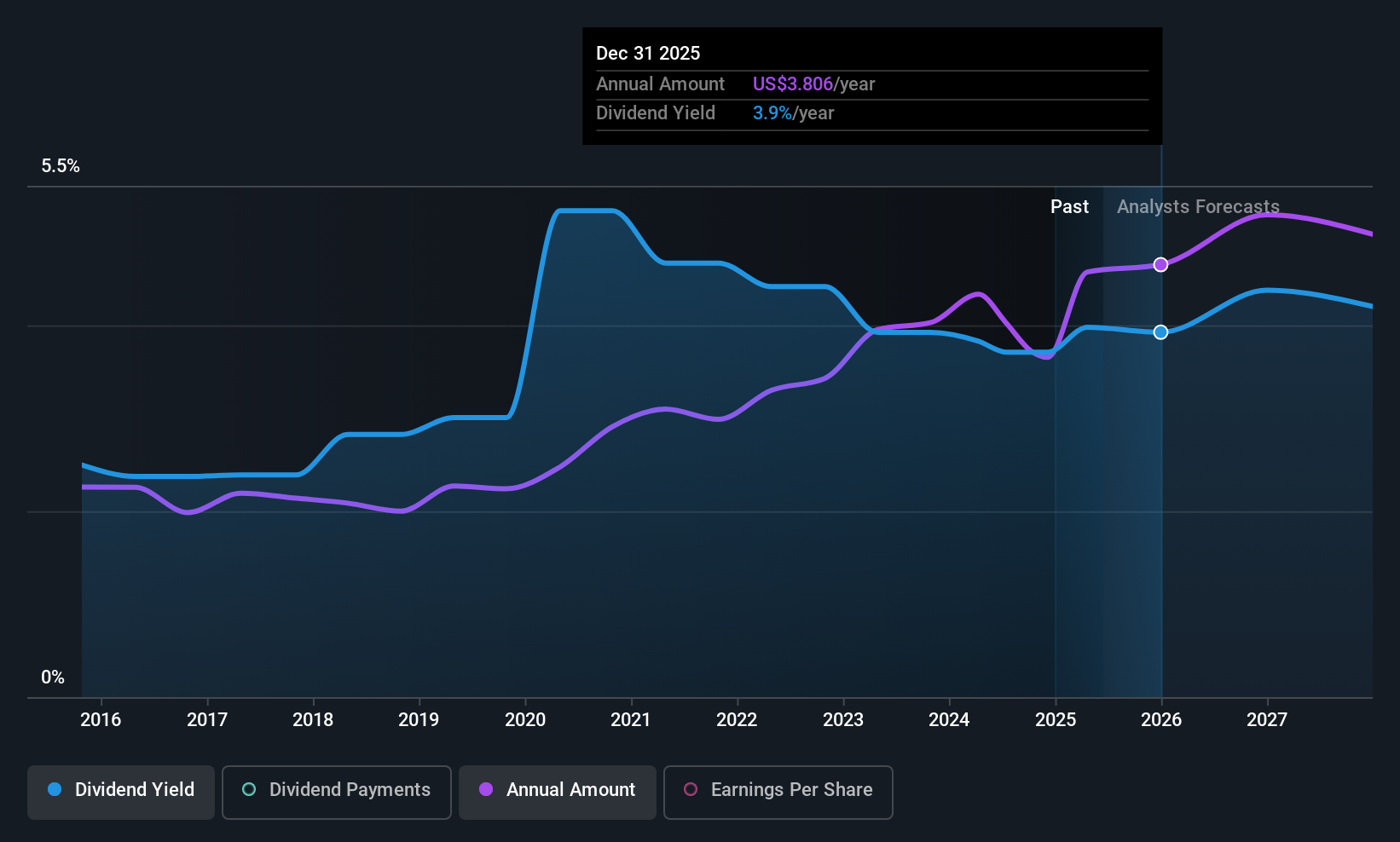

Coca-Cola FEMSA. de (KOF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coca-Cola FEMSA, S.A.B. de C.V. is a franchise bottler that produces, markets, sells, and distributes Coca-Cola trademark beverages across several Latin American countries including Mexico and Brazil, with a market cap of approximately $20.25 billion.

Operations: Coca-Cola FEMSA's revenue primarily comes from its Non-Alcoholic Beverages segment, which generated MX$286.15 billion.

Dividend Yield: 4%

Coca-Cola FEMSA's dividend yield of 3.97% is lower than the top US market payers, yet it has shown stability and growth over the past decade. Despite being well-covered by earnings with a payout ratio of 64.8%, its high cash payout ratio (171.6%) indicates dividends are not well-supported by free cash flows. Recent earnings growth and trading at a significant discount to fair value highlight potential for value investors, but sustainability concerns remain due to cash flow coverage issues.

- Unlock comprehensive insights into our analysis of Coca-Cola FEMSA. de stock in this dividend report.

- In light of our recent valuation report, it seems possible that Coca-Cola FEMSA. de is trading behind its estimated value.

Summing It All Up

- Navigate through the entire inventory of 149 Top US Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal