ASX Value Picks: Meeka Metals And 2 Other Stocks Estimated To Trade Below Fair Value

As the Australian market flirts with record highs, recent volatility in sectors like tech and healthcare highlights the importance of careful stock selection amidst fluctuating investor sentiment. In such an environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between current prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$2.86 | A$4.92 | 41.9% |

| Praemium (ASX:PPS) | A$0.705 | A$1.16 | 39% |

| Polymetals Resources (ASX:POL) | A$0.875 | A$1.55 | 43.6% |

| PointsBet Holdings (ASX:PBH) | A$1.195 | A$2.05 | 41.8% |

| Nuix (ASX:NXL) | A$2.45 | A$4.03 | 39.3% |

| Nanosonics (ASX:NAN) | A$4.35 | A$6.88 | 36.8% |

| Flight Centre Travel Group (ASX:FLT) | A$13.13 | A$20.96 | 37.4% |

| Fenix Resources (ASX:FEX) | A$0.285 | A$0.47 | 39.4% |

| Charter Hall Group (ASX:CHC) | A$19.24 | A$33.88 | 43.2% |

| Catalyst Metals (ASX:CYL) | A$6.84 | A$13.18 | 48.1% |

Let's explore several standout options from the results in the screener.

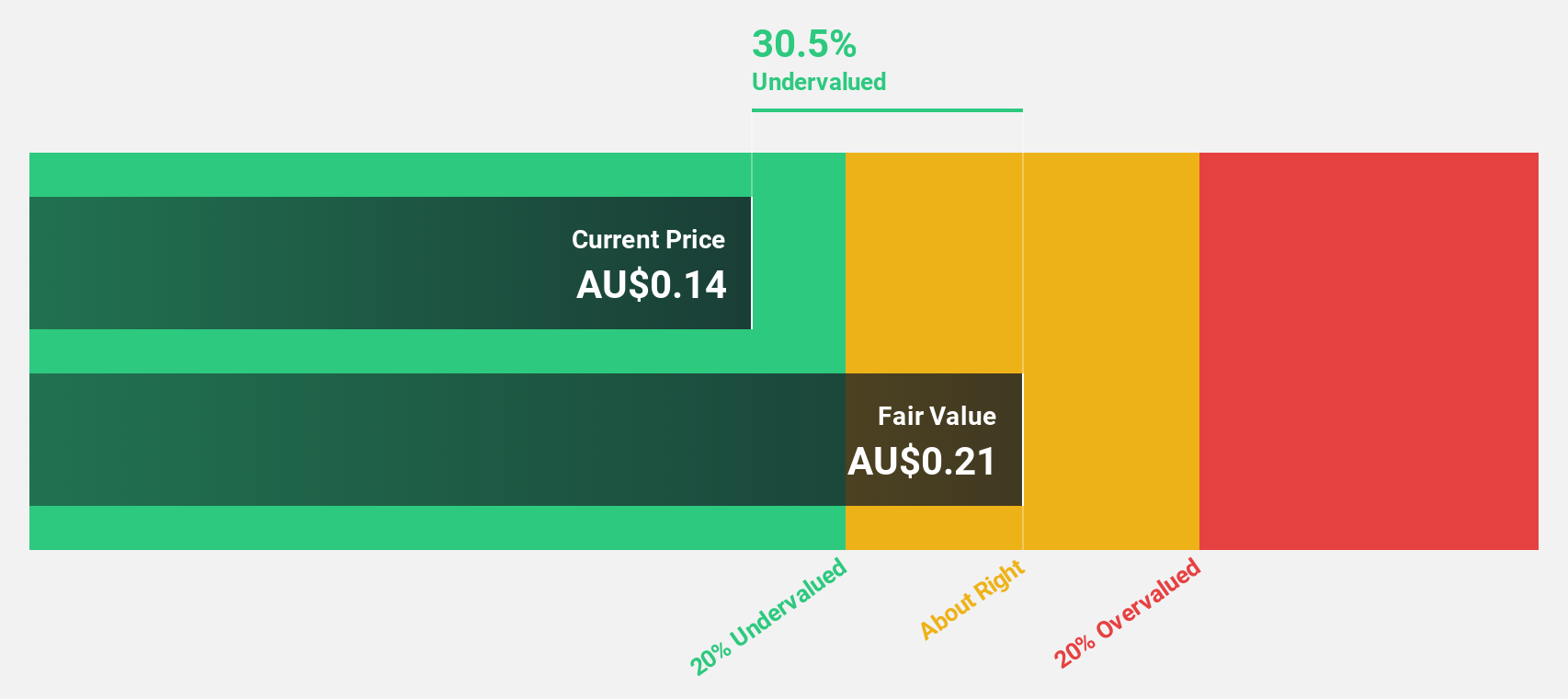

Meeka Metals (ASX:MEK)

Overview: Meeka Metals Limited is involved in the exploration and development of gold properties in Western Australia, with a market cap of A$389.93 million.

Operations: The company focuses on exploring and developing gold properties in Western Australia.

Estimated Discount To Fair Value: 25.2%

Meeka Metals is trading at A$0.16, below its estimated fair value of A$0.21, suggesting potential undervaluation based on cash flows. Despite a recent net loss of A$2.37 million for the half-year ending December 2024, earnings are forecast to grow significantly at 54.14% annually, with expected profitability within three years and revenue growth outpacing the market at 56.1% per year. Recent drilling results indicate promising gold intersections enhancing future prospects.

- Our earnings growth report unveils the potential for significant increases in Meeka Metals' future results.

- Click here to discover the nuances of Meeka Metals with our detailed financial health report.

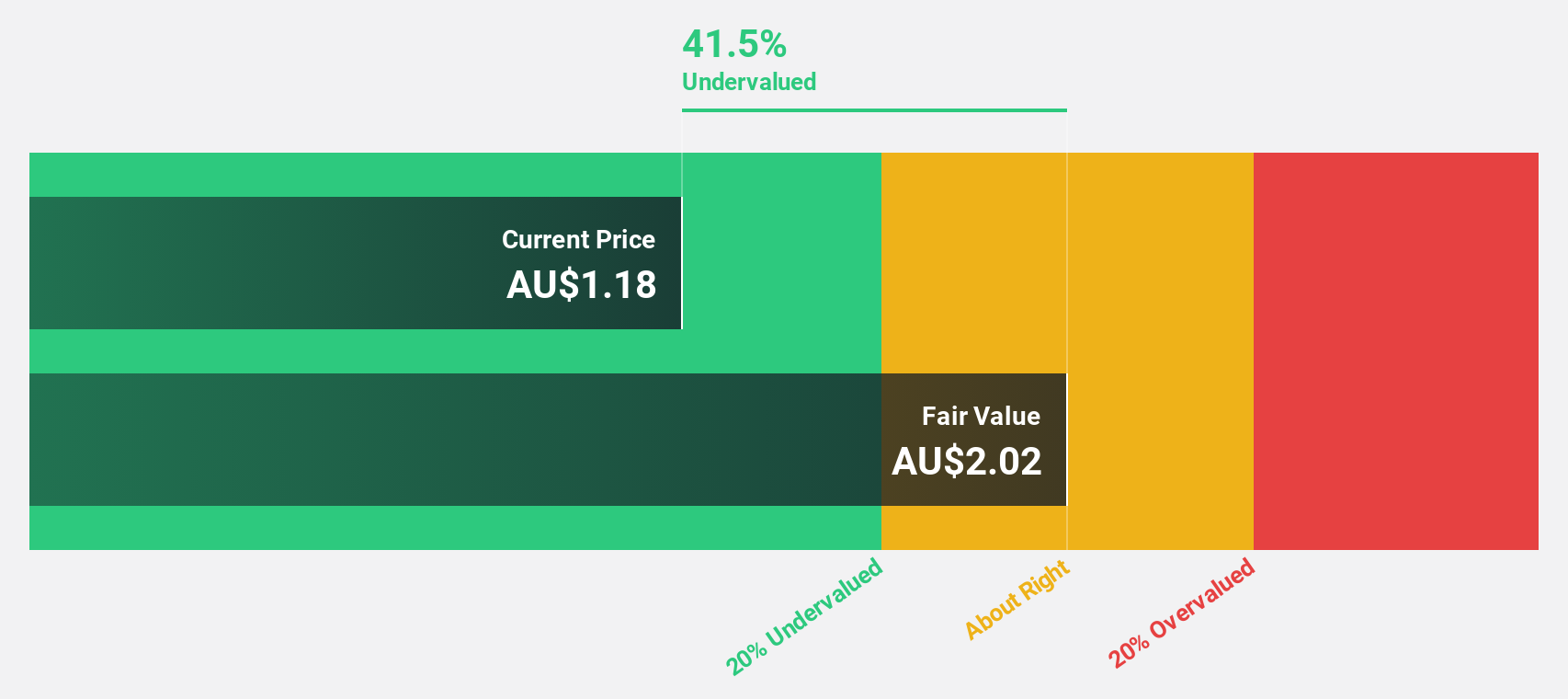

PointsBet Holdings (ASX:PBH)

Overview: PointsBet Holdings Limited offers sports, racing, and iGaming betting services through its cloud-based technology platform in Australia, with a market cap of A$396.41 million.

Operations: The company's revenue segments include Canadian Trading at A$36.24 million and Australian Trading at A$216.01 million.

Estimated Discount To Fair Value: 41.8%

PointsBet Holdings is trading at A$1.2, significantly below its estimated fair value of A$2.05, highlighting potential undervaluation based on cash flows. Revenue is projected to grow at 10.5% annually, surpassing the broader Australian market's growth rate of 5.6%. The company is expected to achieve profitability within three years with earnings anticipated to rise substantially by 116.2% per year, and its return on equity forecasted to be very high in the same period.

- Our comprehensive growth report raises the possibility that PointsBet Holdings is poised for substantial financial growth.

- Take a closer look at PointsBet Holdings' balance sheet health here in our report.

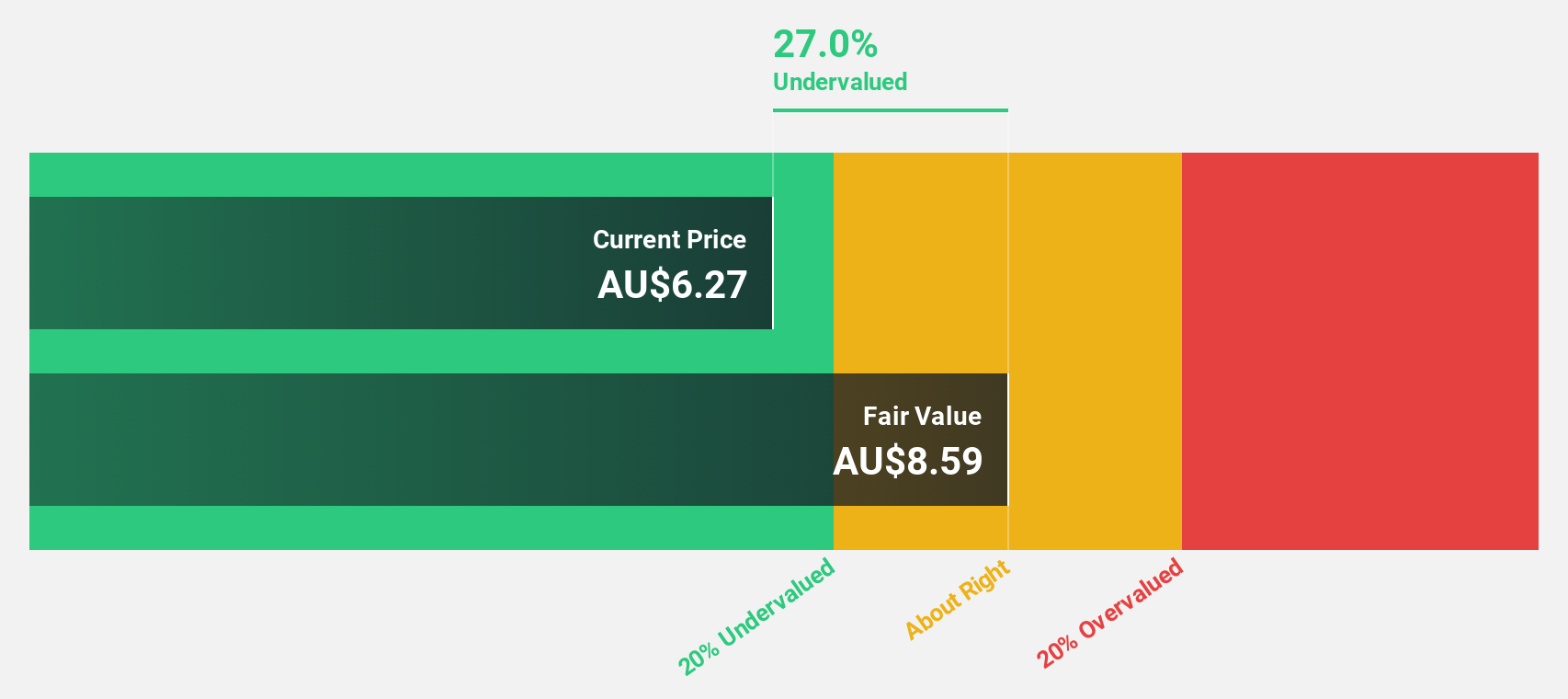

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in the design, production, and sale of cooling products and solutions across various international markets, with a market capitalization of A$710.99 million.

Operations: The company's revenue segments consist of A$46.48 million from PWR C&R and A$109.04 million from PWR Performance Products.

Estimated Discount To Fair Value: 19%

PWR Holdings, trading at A$7.07, is undervalued by 19% compared to its estimated fair value of A$8.72. The company's earnings are projected to grow significantly at 24.66% annually, outpacing the Australian market's growth rate of 11.7%. While revenue growth is expected to be moderate at 13.5% per year, it still exceeds the broader market's pace of 5.6%. Return on equity is forecasted to be high in three years at 26.5%.

- Insights from our recent growth report point to a promising forecast for PWR Holdings' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of PWR Holdings.

Next Steps

- Click here to access our complete index of 33 Undervalued ASX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal