IDEXX Laboratories (NasdaqGS:IDXX) Launches Catalyst Cortisol Test for Canine Health

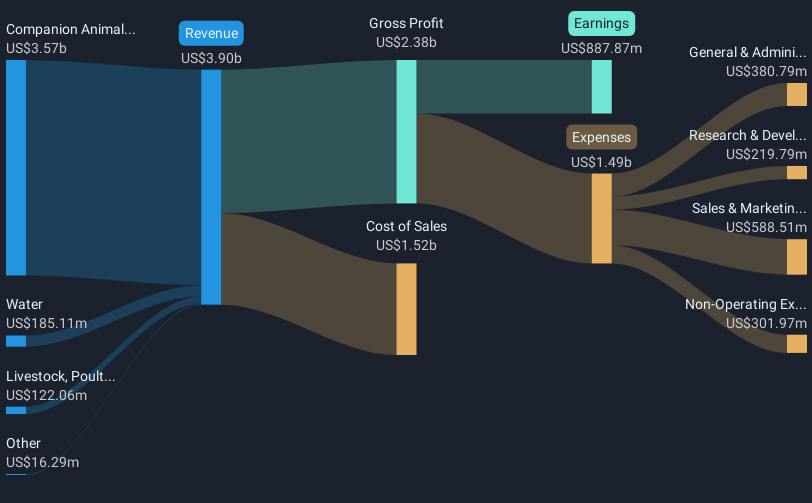

IDEXX Laboratories (NasdaqGS:IDXX) recently introduced its Catalyst® Cortisol Test, an advance in veterinary diagnostics, and reported an earnings growth with a raised revenue guidance for 2025. Furthermore, the company repurchased 930,800 shares, indicating strong financial health. These developments likely supported IDEXX's 22% share price increase over the last quarter. Meanwhile, broader market movements were relatively modest, with indices experiencing slight gains amid optimistic trade discussions between the U.S. and China and positive economic data. IDEXX's performance was possibly bolstered by its innovative launches and solid financials, in line with buoyant market sentiments.

We've spotted 1 risk for IDEXX Laboratories you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The introduction of the Catalyst® Cortisol Test and share repurchase strengthens IDEXX Laboratories' position in veterinary diagnostics, potentially boosting revenue and earnings forecasts through increased diagnostic usage and market expansion. Over the past five years, IDEXX's total shareholder returns increased by 63.06%, including price movements and dividends, reflecting consistent long-term growth despite some market volatilities.

In contrast, IDEXX underperformed the US Medical Equipment industry over the past year, which returned 9%. Though the current share price increase in the last quarter aligns with recent innovations and improved guidance, it trades close to the consensus price target of US$496.54. This suggests analysts view the company as nearing fair value. However, continued product innovations and strategic international expansions might influence future market valuations as IDEXX strives to enhance revenue and earnings growth amid potential challenges such as trade tensions and changing clinical visits.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal