Amazon.com (NasdaqGS:AMZN) To Invest US$10 Billion In North Carolina Data Center Expansion

Amazon.com (NasdaqGS:AMZN) experienced an 11% price increase over the past month, a significant move likely buoyed by its substantial $10 billion investment in North Carolina to enhance data center infrastructure for AI and cloud computing technologies. This business expansion complements broader market trends, which have shown modest overall increases with the tech-heavy Nasdaq Composite gaining 0.3%. Additionally, Amazon's renewable energy projects signal alignment with the escalating market focus on sustainability. Despite other developments and shareholder proposals during this period, the investment highlights the company's drive to strengthen its technology foothold, adding weight to its stock performance.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent 11% rise in Amazon's share price reflects investor optimism around its $10 billion investment in North Carolina to bolster data center infrastructure. This aligns with Amazon's expansion strategy in AI and cloud computing, suggesting potential enhancements to operational efficiency and future earnings as AI integration within Amazon Web Services (AWS) matures. Such moves could positively influence revenue and margins, particularly as Amazon leverages AI technology for advertising and fulfillment network improvements.

Over a three-year period, Amazon's total return, encompassing share price and dividends, stands at 71%, indicating strong long-term performance. Recent one-year comparisons show Amazon met the returns of the US Multiline Retail industry, which posted a 14.8% gain, demonstrating Amazon's ability to keep pace with sector trends despite broader market fluctuations.

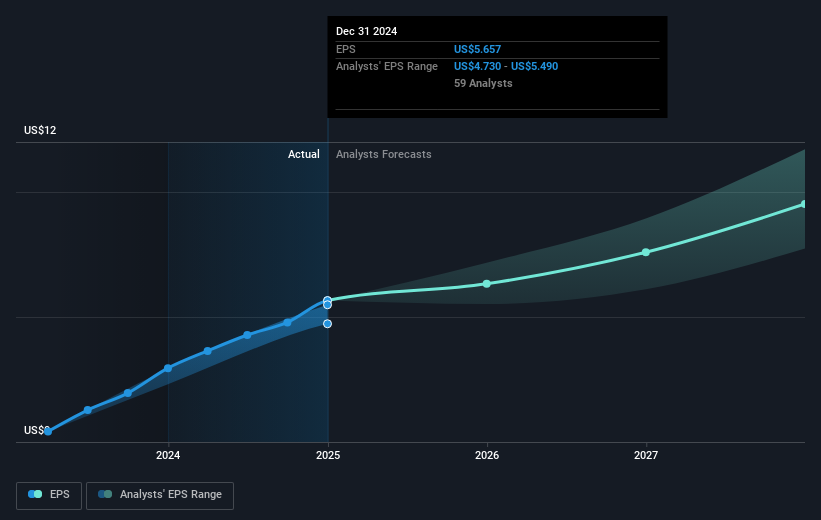

While analysts have set a consensus price target of US$239.33, this presents approximately a 22.7% upside from the current share price of US$185.01. The investment in North Carolina could drive future revenue growth and improve profit margins. However, realizing the full potential of this target will depend on achieving the expected earnings growth and managing risks like tariffs and competition. As such, investor sentiment and analyst confidence in Amazon's growth trajectory could continue to influence share price movements in relation to this target.

Understand Amazon.com's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal