TSX Stocks With Estimated Value Opportunities Featuring Savaria And Two Others

As the Canadian market continues to navigate tariff uncertainties and economic adjustments, recent trends have shown resilience with a notable rise in the TSX index. In this environment, identifying undervalued stocks can be particularly rewarding for investors seeking opportunities amidst market fluctuations; this article will explore such prospects by highlighting Savaria and two other promising companies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VersaBank (TSX:VBNK) | CA$14.78 | CA$27.90 | 47% |

| Timbercreek Financial (TSX:TF) | CA$7.34 | CA$11.01 | 33.4% |

| TerraVest Industries (TSX:TVK) | CA$169.47 | CA$301.65 | 43.8% |

| OceanaGold (TSX:OGC) | CA$6.46 | CA$10.48 | 38.4% |

| Magna Mining (TSXV:NICU) | CA$1.58 | CA$3.08 | 48.7% |

| Lithium Royalty (TSX:LIRC) | CA$5.20 | CA$8.53 | 39% |

| Journey Energy (TSX:JOY) | CA$1.80 | CA$2.89 | 37.8% |

| Groupe Dynamite (TSX:GRGD) | CA$16.24 | CA$28.84 | 43.7% |

| Docebo (TSX:DCBO) | CA$37.07 | CA$57.11 | 35.1% |

| Alphamin Resources (TSXV:AFM) | CA$0.86 | CA$1.34 | 36% |

Let's take a closer look at a couple of our picks from the screened companies.

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.37 billion.

Operations: The company generates revenue from its Patient Care segment, amounting to CA$194.92 million.

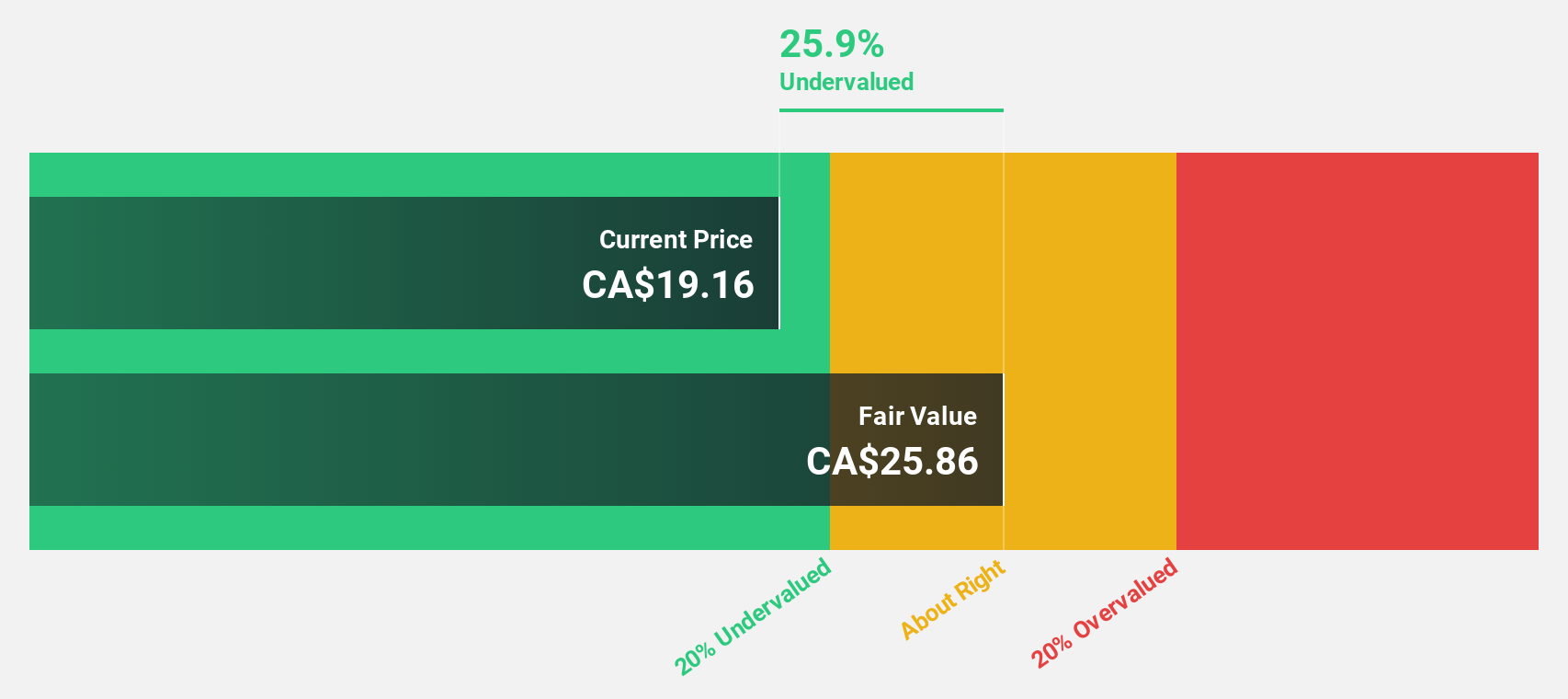

Estimated Discount To Fair Value: 25.9%

Savaria Corporation's stock appears undervalued, trading at CA$19.2, below its estimated fair value of CA$25.9, with analysts predicting a 26.5% price rise. The company reported a first-quarter net income increase to CA$12.48 million and forecasts 2025 revenue growth of 5-8%, supported by new products and favorable exchange rates. Earnings are expected to grow significantly at 28.9% annually, outpacing the Canadian market's average growth rate of 12.3%.

- The growth report we've compiled suggests that Savaria's future prospects could be on the up.

- Dive into the specifics of Savaria here with our thorough financial health report.

Alphamin Resources (TSXV:AFM)

Overview: Alphamin Resources Corp. is involved in the production and sale of tin concentrate, with a market cap of CA$1.16 billion.

Operations: The company's revenue is primarily derived from the production and sale of tin concentrate from its Bisie Tin Mine, amounting to $539.16 million.

Estimated Discount To Fair Value: 36%

Alphamin Resources, trading at CA$0.86, is undervalued compared to its fair value estimate of CA$1.34, offering a 36% discount. Despite recent operational disruptions due to security issues in the DRC, first-quarter earnings rose to US$23.64 million from US$20.71 million a year ago. While revenue growth is expected at 7.1% annually—slower than profit growth—earnings are forecasted to grow significantly by 26% per year, surpassing the Canadian market average of 12.3%.

- Our comprehensive growth report raises the possibility that Alphamin Resources is poised for substantial financial growth.

- Click here to discover the nuances of Alphamin Resources with our detailed financial health report.

Kraken Robotics (TSXV:PNG)

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$635.97 million.

Operations: The company's revenue comes from two main segments: Products, which generated CA$59.67 million, and Services, contributing CA$26.88 million.

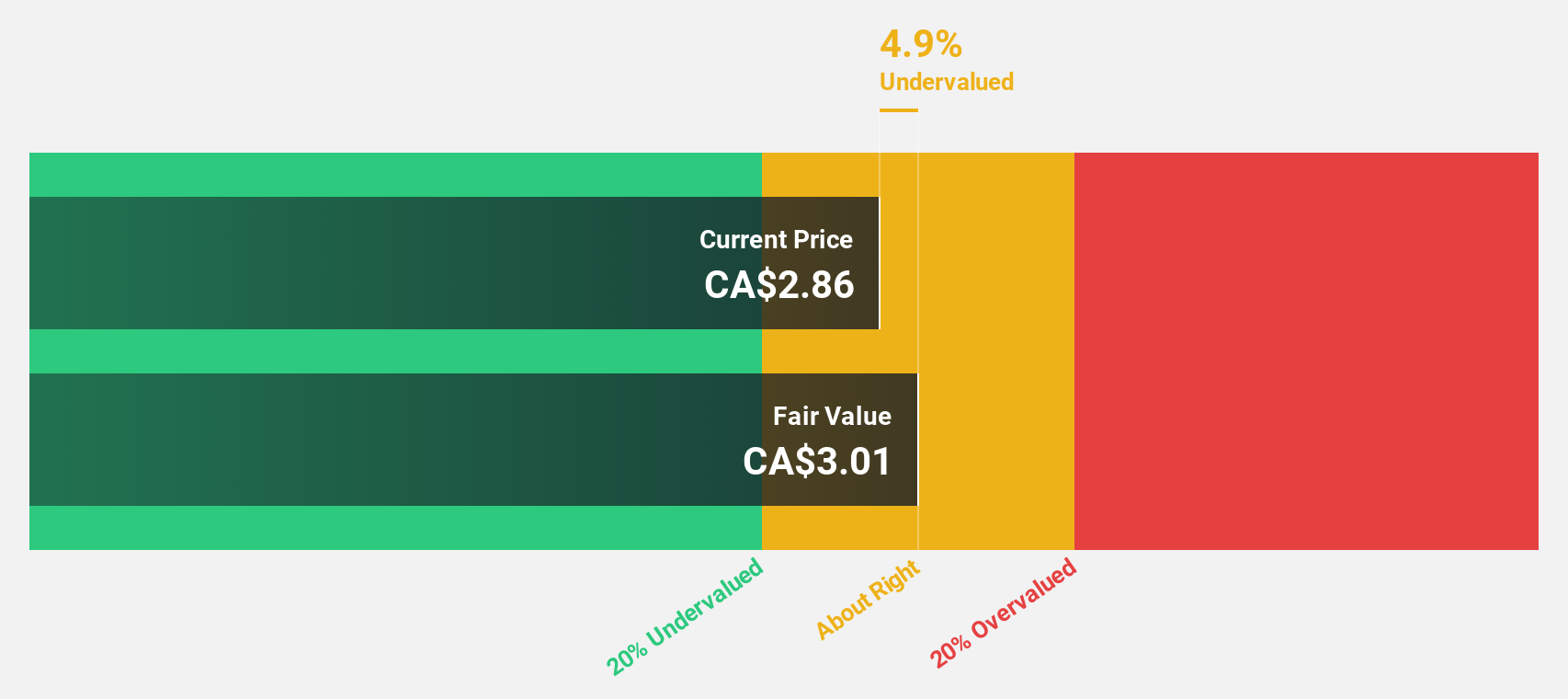

Estimated Discount To Fair Value: 17%

Kraken Robotics, trading at CA$2.49, is undervalued compared to its fair value estimate of CA$3. Despite a recent decline in quarterly revenue to CA$16.13 million from CA$20.88 million, earnings have grown significantly over the past year and are forecasted to grow 28.22% annually—outpacing the Canadian market average. The company anticipates substantial revenue growth between $120 million and $135 million for 2025, driven by new orders and strategic expansions in defense markets.

- According our earnings growth report, there's an indication that Kraken Robotics might be ready to expand.

- Get an in-depth perspective on Kraken Robotics' balance sheet by reading our health report here.

Key Takeaways

- Unlock our comprehensive list of 22 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal