Old Dominion Freight Line (NasdaqGS:ODFL) Reports 5.8% Revenue Dip in May 2025

Old Dominion Freight Line (NasdaqGS:ODFL) recently reported a decline in revenue performance for May 2025, with revenue per day dropping 6% compared to the previous year, influenced by an 8% decline in LTL tons per day. Despite these challenges, the company’s pricing strategy showed resilience, as LTL revenue per hundredweight increased 3%. Additionally, a 7.7% increase in the quarterly cash dividend was announced. This, along with stable broader market conditions, likely influenced the company's 3% share price rise over the past month, reflecting investor confidence in its operational adjustments and financial policies amidst slightly declining shipment volumes.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The recent news highlights Old Dominion Freight Line's ability to maintain investor confidence despite challenges, as evidenced by its 3% share price rise in the past month. This upswing reflects the market's trust in the company's operational adjustments, even amid a 6% revenue per day decline in May 2025, and could support its strategy of enhancing margins and capturing market share. The resilience in less-than-truckload (LTL) revenue per hundredweight, which increased by 3%, paired with a 7.7% hike in the quarterly cash dividend, suggests solid pricing strategies and investor appeal.

Over a five-year period, Old Dominion's shares have delivered a total return of 103.28%, providing significant value to shareholders. However, it underperformed the US market's 12.6% return over the past year, indicating some recent sluggishness relative to broader market trends. Compared to the US Transportation industry, which returned 6.5% over the last year, Old Dominion also lagged behind, potentially due to economic uncertainties affecting freight volumes.

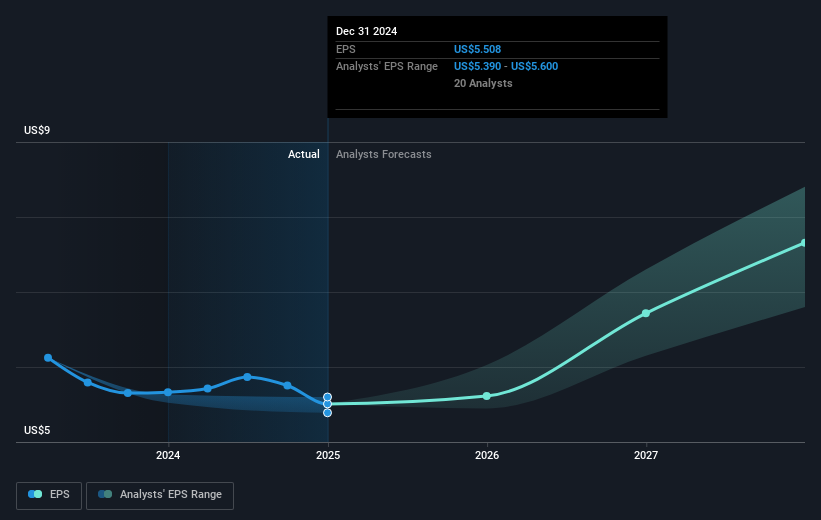

The current news may influence future revenue and earnings forecasts, as ongoing economic uncertainty and a reported 5.8% decline in first-quarter revenue underscore potential headwinds. Analysts anticipate revenue growth of 5.9% annually over the next three years, driven by long-term operational strategies and capital investment. With a consensus price target of US$167.01, 8.2% higher than the current share price of US$153.35, the market seems to view the stock as fairly valued, reflecting confidence in the company's future performance. Investors should continue to monitor how Old Dominion navigates macroeconomic factors and internal efficiency improvements to sustain its growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal