3 Growth Companies With Insider Stakes As High As 20%

The market has been flat over the last week but is up 13% over the past year, with earnings forecast to grow by 14% annually. In this environment, stocks with significant insider ownership can be appealing as they often indicate confidence from those closest to the company's operations and potential for growth.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 22.7% | 24.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 16.2% | 39.1% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| FTC Solar (NasdaqCM:FTCI) | 27.9% | 62.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 45% |

| Astera Labs (NasdaqGS:ALAB) | 15.1% | 44.4% |

| Prairie Operating (NasdaqCM:PROP) | 34.2% | 71.1% |

| Enovix (NasdaqGS:ENVX) | 12.1% | 58.4% |

| Hesai Group (NasdaqGS:HSAI) | 21.3% | 45.5% |

| ARS Pharmaceuticals (NasdaqGM:SPRY) | 14.3% | 60.6% |

Here's a peek at a few of the choices from the screener.

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viemed Healthcare, Inc. operates in the United States, offering home medical equipment and post-acute respiratory healthcare services, with a market cap of $259.28 million.

Operations: The company generates revenue of $232.79 million from its Sleep and Respiratory Disorders Sector.

Insider Ownership: 12.8%

Viemed Healthcare exhibits strong growth potential with earnings forecasted to grow 26.2% annually, outpacing the US market. Recent earnings reports show increased sales and net income, with Q1 2025 sales at US$59.13 million and net income at US$2.63 million, reflecting solid performance year-over-year. Despite significant insider selling in the past quarter, insider buying has outweighed it recently, indicating confidence in future prospects amidst raised revenue guidance for 2025 up to US$265 million.

- Click to explore a detailed breakdown of our findings in Viemed Healthcare's earnings growth report.

- In light of our recent valuation report, it seems possible that Viemed Healthcare is trading behind its estimated value.

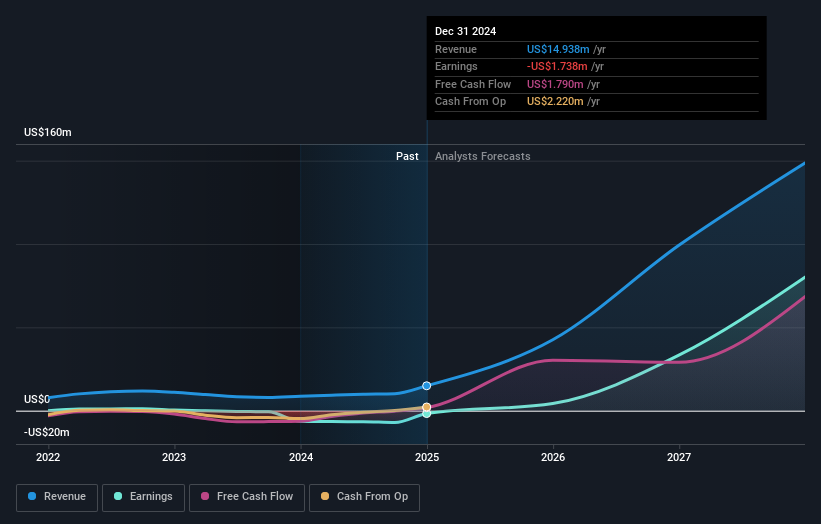

United States Antimony (NYSEAM:UAMY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: United States Antimony Corporation is involved in the production and sale of antimony, zeolite, and precious metals in the United States and Canada, with a market cap of $298.35 million.

Operations: The company generates revenue from its antimony segment at $15.43 million and its zeolite segment at $3.43 million.

Insider Ownership: 17.6%

United States Antimony is positioned for substantial growth, with revenue expected to increase by 50.8% annually, surpassing the US market's average. The company recently reported a significant rise in Q1 sales to US$7 million and turned profitable with a net income of US$0.55 million compared to last year's loss. Despite recent share price volatility and no significant insider trading activity, analysts anticipate an 85.6% stock price increase, reflecting optimism about future profitability within three years.

- Click here and access our complete growth analysis report to understand the dynamics of United States Antimony.

- Insights from our recent valuation report point to the potential overvaluation of United States Antimony shares in the market.

Youdao (NYSE:DAO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce in China with a market cap of approximately $1.07 billion.

Operations: The company's revenue is primarily derived from Learning Services (CN¥2.63 billion), Online Marketing Services (CN¥1.99 billion), and Smart Devices (CN¥912.97 million).

Insider Ownership: 20.4%

Youdao's earnings are forecast to grow at 35.7% annually, outpacing the US market average of 14.4%, while revenue growth is expected at 11.3% per year, slightly above the market rate. Despite becoming profitable this year, debt coverage by operating cash flow remains inadequate. No insider trading activity was noted recently, but a share buyback of 6.19% for US$33.8 million has been completed since November 2022, indicating confidence in long-term growth prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Youdao.

- Our valuation report unveils the possibility Youdao's shares may be trading at a premium.

Summing It All Up

- Get an in-depth perspective on all 190 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal