3 Promising Penny Stocks With Market Caps Over $90M

The market has been flat over the last week, but it has shown a 13% rise over the past year, with earnings projected to grow by 14% annually in the coming years. In this context, identifying promising stocks involves looking for those that combine affordability with solid financials. While penny stocks might seem like an outdated term, they remain relevant as they often represent smaller or newer companies offering potential growth opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Perfect (NYSE:PERF) | $1.80 | $184.35M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.04 | $171.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.51 | $55.27M | ✅ 1 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.98 | $372.6M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.03 | $96.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.91 | $23.78M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.82 | $6.07M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.53 | $70.6M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.9098 | $32.33M | ✅ 4 ⚠️ 5 View Analysis > |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.12 | $34.44M | ✅ 2 ⚠️ 5 View Analysis > |

Click here to see the full list of 724 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cerus (NasdaqGM:CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $252.33 million.

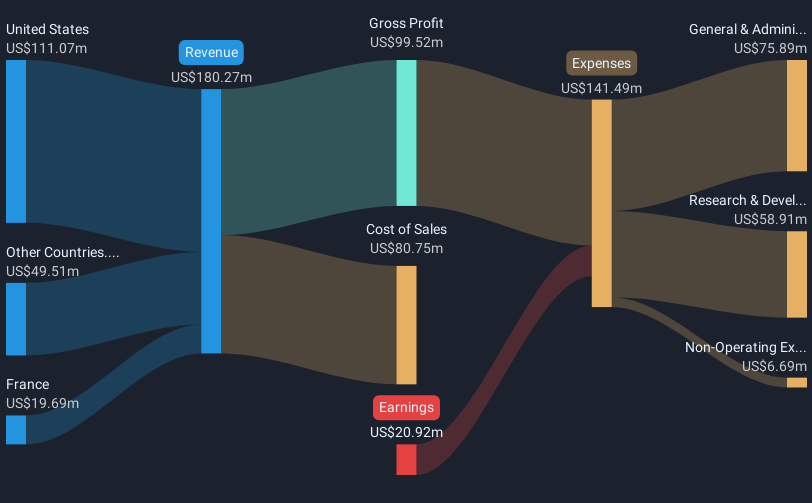

Operations: The company's revenue for Blood Safety is $185.14 million.

Market Cap: $252.33M

Cerus Corporation, with a market cap of US$252.33 million, has recently secured regulatory approvals in France and Switzerland for its INT200 device, enhancing its INTERCEPT Blood System platform. Despite being unprofitable, the company has reduced losses over five years by 20.9% annually and maintains a satisfactory net debt to equity ratio of 7.2%. Revenue is projected to grow by 11.85% per year, supported by increased product revenue guidance for 2025 between US$194 million and US$200 million. Cerus's experienced management team ensures stability as it navigates growth opportunities despite ongoing challenges in achieving profitability.

- Unlock comprehensive insights into our analysis of Cerus stock in this financial health report.

- Examine Cerus' earnings growth report to understand how analysts expect it to perform.

Biomea Fusion (NasdaqGS:BMEA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biomea Fusion, Inc. is a clinical-stage company specializing in the development of covalent small molecule drugs for genetically defined cancers and metabolic diseases such as diabetes and obesity, with a market cap of $93.55 million.

Operations: Biomea Fusion, Inc. has not reported any revenue segments as it is currently in the clinical-stage of developing covalent small molecule drugs for specific cancers and metabolic diseases.

Market Cap: $93.55M

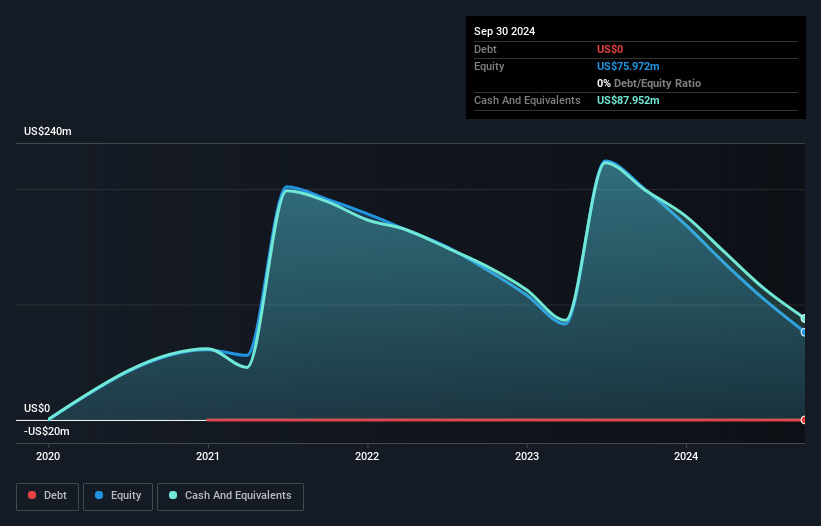

Biomea Fusion, Inc., with a market cap of US$93.55 million, remains pre-revenue as it focuses on developing covalent small molecule drugs for specific cancers and metabolic diseases. Despite its experienced management team and debt-free status, the company faces financial challenges with less than a year of cash runway and ongoing unprofitability. Recent clinical data presentations at major conferences highlight potential breakthroughs in diabetes treatment with icovamenib and leukemia therapy with BMF-500. However, concerns persist as auditors express doubts about its ability to continue as a going concern amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Biomea Fusion.

- Understand Biomea Fusion's earnings outlook by examining our growth report.

Perspective Therapeutics (NYSEAM:CATX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Perspective Therapeutics, Inc., along with its subsidiaries, focuses on developing and commercializing precision targeted alpha therapies to treat cancer in the United States and has a market cap of approximately $176.98 million.

Operations: The company's revenue is primarily derived from its drug operations, totaling $1.47 million.

Market Cap: $176.98M

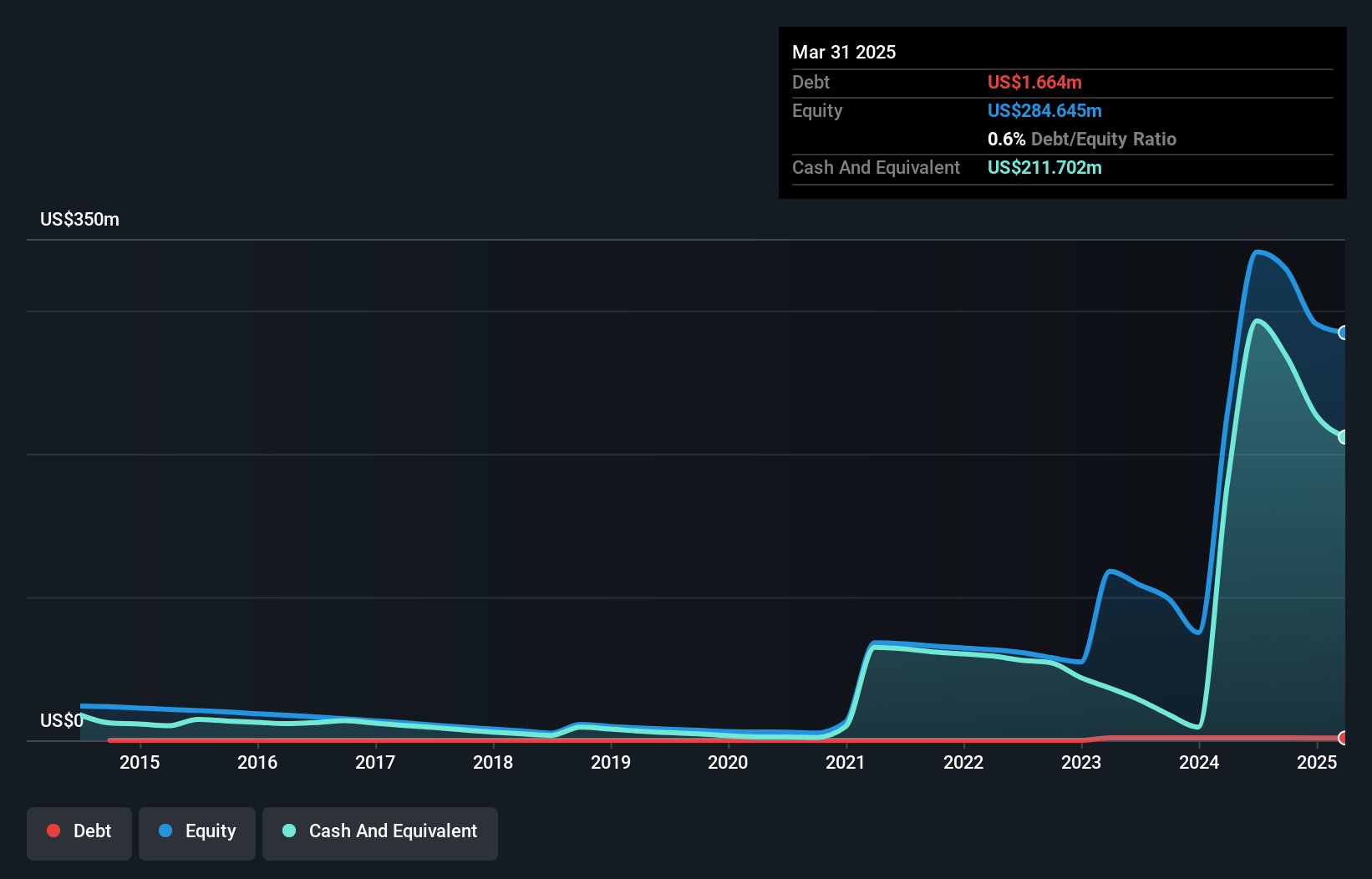

Perspective Therapeutics, Inc., with a market cap of US$176.98 million, is advancing its pipeline with precision-targeted alpha therapies for cancer treatment. Despite generating limited revenue of US$1.47 million, the company has made significant strides in clinical trials, presenting promising interim results for its [212Pb]VMT-a-NET therapy at the ASCO Annual Meeting 2025. The company's financials reveal a net loss increase to US$18.18 million in Q1 2025 compared to last year, but it maintains sufficient cash runway for three years and strong short-term asset coverage over liabilities. However, high share price volatility and an inexperienced management team remain concerns.

- Navigate through the intricacies of Perspective Therapeutics with our comprehensive balance sheet health report here.

- Assess Perspective Therapeutics' future earnings estimates with our detailed growth reports.

Make It Happen

- Click this link to deep-dive into the 724 companies within our US Penny Stocks screener.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal