3 European Growth Stocks With Significant Insider Ownership

As the European markets navigate through a period of easing inflation and potential interest rate cuts by the European Central Bank, investors are keenly observing growth opportunities within this evolving landscape. In such an environment, companies with significant insider ownership often stand out as they may signal strong internal confidence in their future prospects and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

| Lokotech Group (OB:LOKO) | 4.4% | 58.1% |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| Elliptic Laboratories (OB:ELABS) | 22.9% | 79% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 85.7% |

Let's review some notable picks from our screened stocks.

Hoist Finance (OM:HOFI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company that focuses on loan acquisition and management operations across Europe, with a market cap of SEK8.27 billion.

Operations: Hoist Finance generates revenue through its operations in Europe, with SEK1.16 billion from secured loans and SEK2.99 billion from unsecured loans.

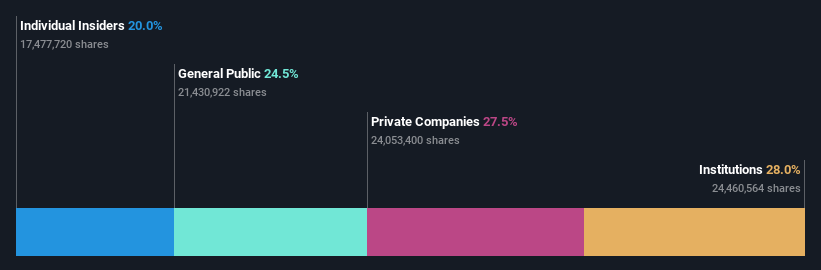

Insider Ownership: 20%

Hoist Finance demonstrates promising growth potential with earnings forecasted to grow significantly at 20.62% annually, outpacing the Swedish market's 15.9%. Insider confidence is evident, with substantial insider buying and no significant selling in recent months. The company trades at a discount to its estimated fair value, suggesting potential upside. However, despite strong earnings growth of 34.6% last year and a completed share buyback program worth SEK 99.93 million, it faces challenges like an unstable dividend track record and high debt levels.

- Click here to discover the nuances of Hoist Finance with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Hoist Finance's share price might be too pessimistic.

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

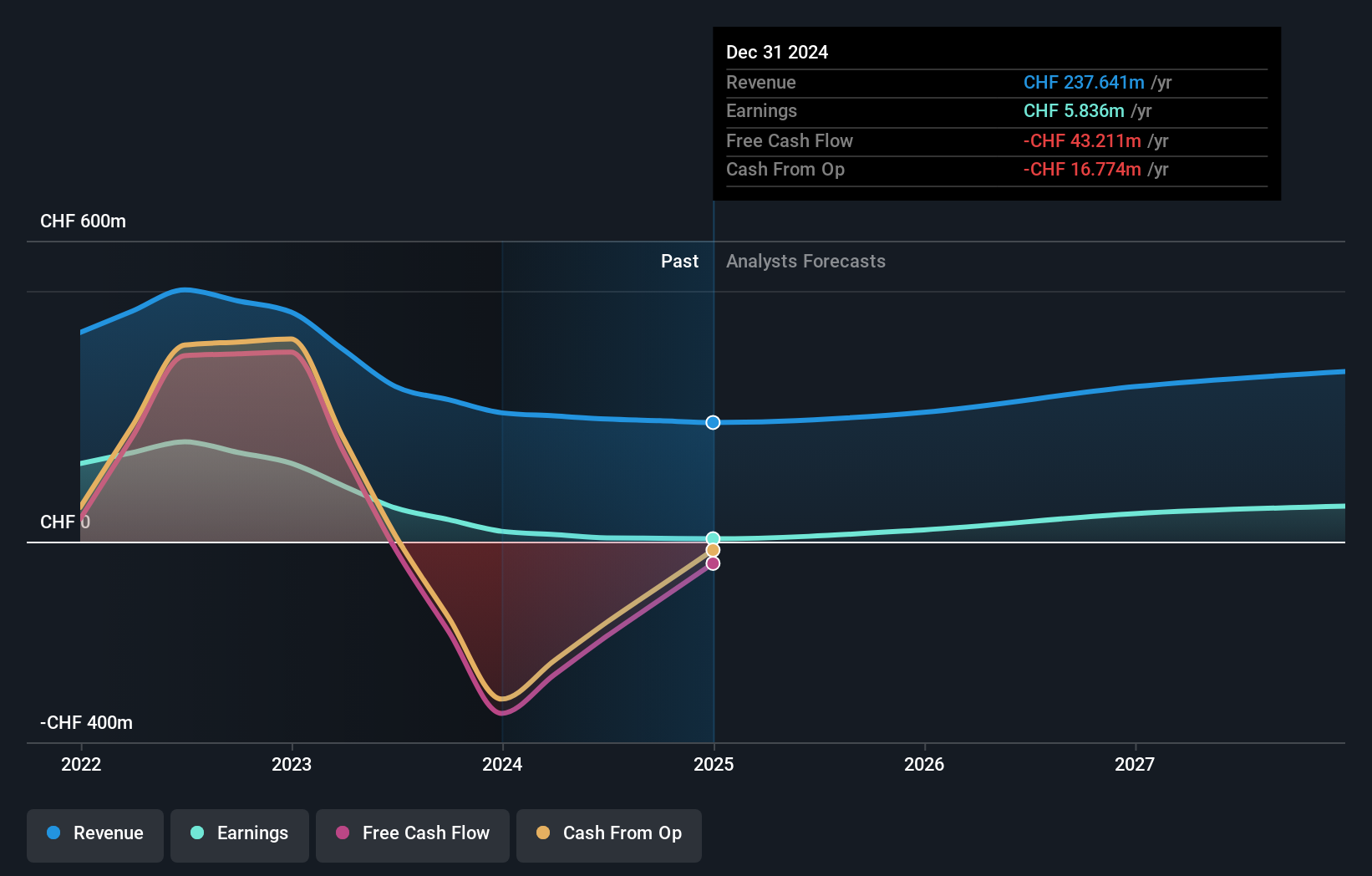

Overview: Leonteq AG is a company that offers derivative investment products and services across Switzerland, Europe, Asia, and internationally, with a market cap of CHF307.16 million.

Operations: Leonteq AG generates revenue primarily through its brokerage segment, which accounted for CHF237.64 million.

Insider Ownership: 17.9%

Leonteq is expanding its leverage product offerings, marking a strategic milestone in the Swiss market. Despite forecasted earnings growth of 35.2% per year, which outpaces the Swiss market, challenges include low return on equity and declining profit margins. The company's stock trades at a significant discount to its estimated fair value but has experienced high volatility recently. Insider ownership remains stable with no substantial buying or selling reported in recent months amidst management changes.

- Click here and access our complete growth analysis report to understand the dynamics of Leonteq.

- Our expertly prepared valuation report Leonteq implies its share price may be too high.

Shoper (WSE:SHO)

Simply Wall St Growth Rating: ★★★★☆☆

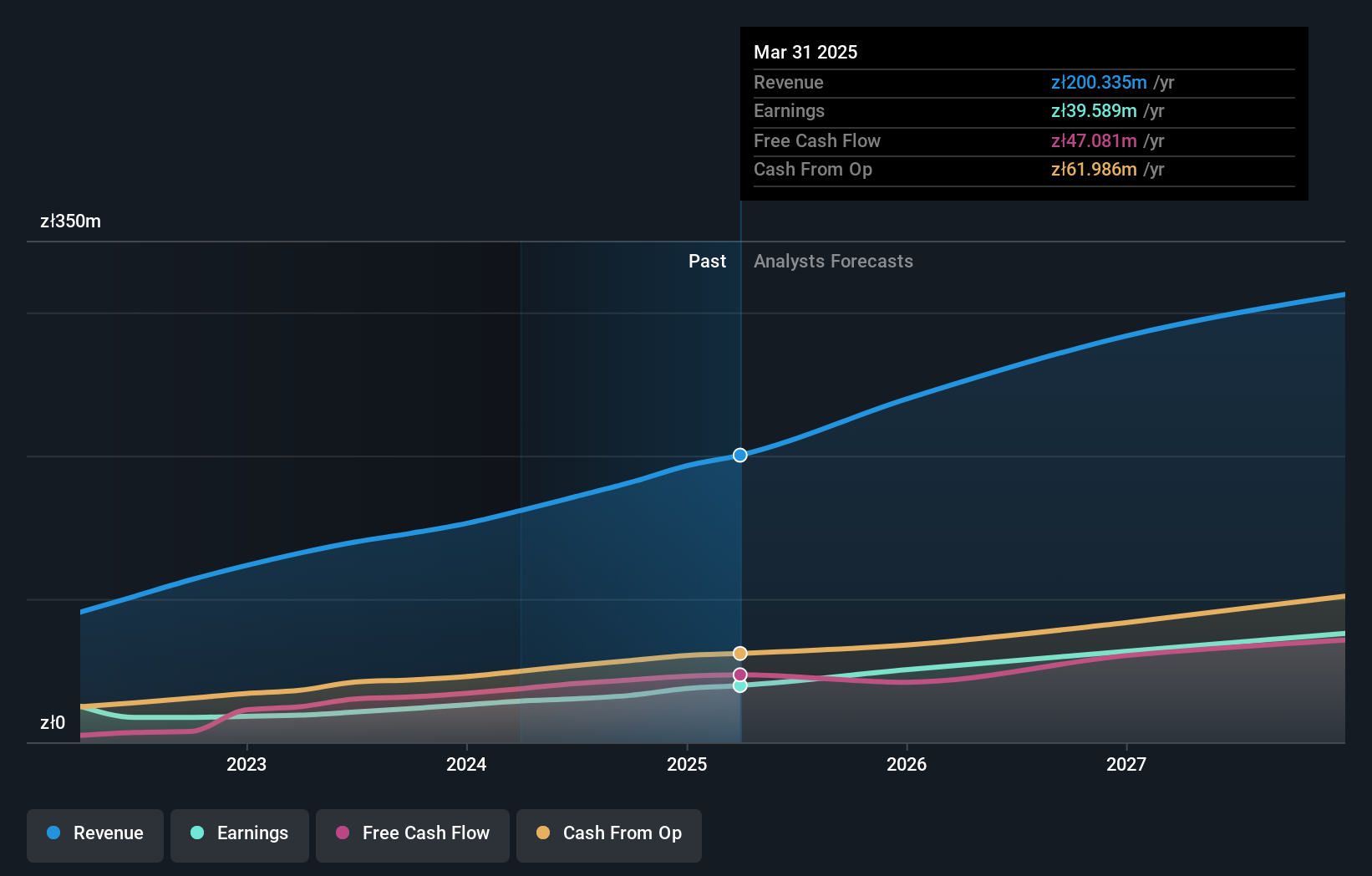

Overview: Shoper SA offers Software as a Service solutions for e-commerce in Poland, with a market cap of PLN1.40 billion.

Operations: The company generates revenue through its Solutions segment, which accounts for PLN157.26 million, and its Subscriptions segment, contributing PLN43.08 million.

Insider Ownership: 23.6%

Shoper's earnings are forecast to grow significantly at 23.2% annually, outpacing the Polish market. Despite slower revenue growth of 13.9% per year, it remains above the market average. Recent earnings show improvement with Q1 2025 revenue at PLN 51.73 million and net income rising to PLN 9.84 million from a year ago. Insider ownership is high, with no substantial insider trading activity recently reported, supporting confidence in its growth trajectory amidst stable governance structures.

- Unlock comprehensive insights into our analysis of Shoper stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shoper shares in the market.

Where To Now?

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 213 companies by clicking here.

- Want To Explore Some Alternatives? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal