NuScale Power (NYSE:SMR) Gains 84% Over Last Quarter

NuScale Power (NYSE:SMR) recently received a significant regulatory approval from the U.S. Nuclear Regulatory Commission for its uprated 250 MWt NuScale Power Modules, enhancing its capacity to deliver carbon-free energy solutions. This milestone complements the company's efforts to expand its educational outreach with new Energy Exploration Centers, aiming to nurture future nuclear professionals. Over the last quarter, the company's share price surged by 84%, a notable move compared to a 12% market rise over the past year. These advancements could have bolstered NuScale's position, aligning with broader market trends.

We've identified 4 possible red flags for NuScale Power that you should be aware of.

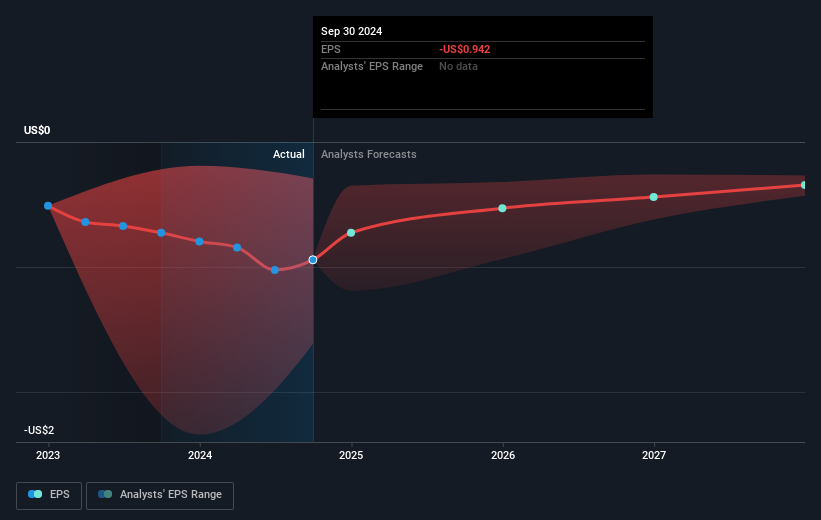

NuScale Power’s recent regulatory approval for its uprated 250 MWt modules could significantly bolster its revenue prospects and earnings forecasts. The company's advanced small modular reactor technology positions it for faster deployment and potential revenue acceleration, enhancing profitability amid the anticipated growth in demand from energy-intensive sectors like AI-driven data centers. Such developments suggest a promising pathway for NuScale to improve financial performance beyond its recent revenue of US$49.04 million and earnings loss of US$134.06 million. However, hurdles such as securing long-term agreements and supply chain constraints need careful management to maintain this upward momentum.

Over the past year, NuScale's total shareholder return, a combination of share price appreciation and dividends, reached over 355%, a very large percentage, significantly outperforming the US electrical industry, which saw an 18.5% rise. This remarkable longer-term gain contrasts with the overall market’s moderate performance of 11.9% during the same period. As of today, the recent share price of US$13.91 represents a nearly 43% discount relative to the consensus analyst price target of US$24.46. This gap may reflect differing views on the company's ability to meet ambitious revenue and earnings projections amidst evolving market dynamics and operational challenges. Investors should consider how these factors might influence future valuations and NuScale's financial trajectory.

Examine NuScale Power's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal