Australian Ethical Investment Leads These 3 Promising Small Caps with Strong Potential

In the current Australian market landscape, the ASX200 experienced a volatile day with notable fluctuations influenced by global uncertainty and profit-taking activities. As investors navigate these choppy waters, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager focused on ethical and sustainable investing, with a market cap of A$691.86 million.

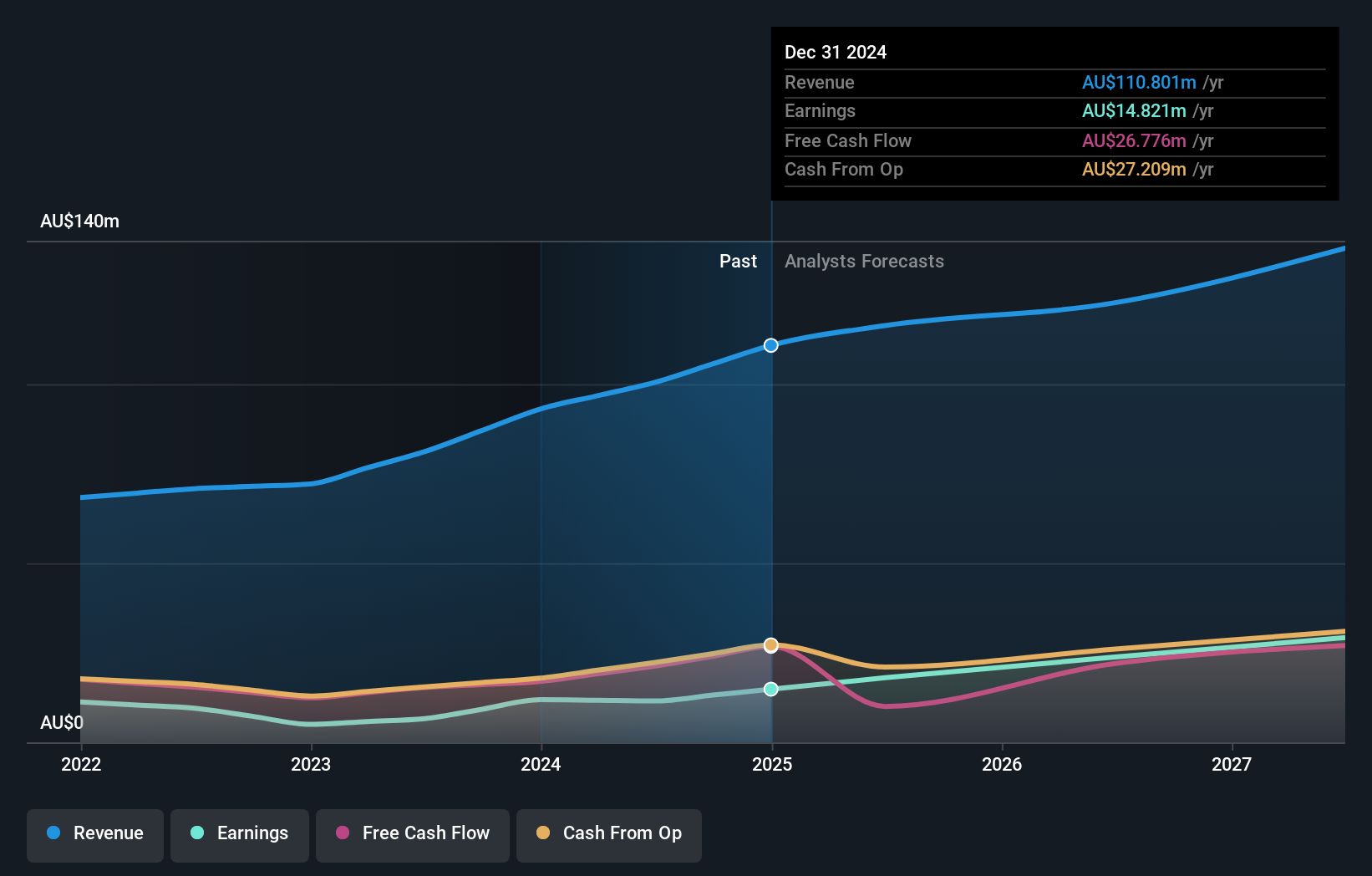

Operations: Australian Ethical Investment Ltd generates revenue primarily through its funds management segment, amounting to A$110.80 million.

Australian Ethical Investment has made notable strides with the integration of Altius Asset Management, adding A$1.93 billion to its funds under management. This move is likely to enhance revenue and operational efficiency, especially with platform initiatives like transitioning super administration to GROW and custody transfer to State Street. Despite a large one-off loss of A$8.4 million impacting recent financial results, the company remains debt-free and forecasts earnings growth of 23.98% annually. However, potential challenges include integration issues that could pressure margins and increased operating expenses potentially outpacing revenue growth.

Qualitas (ASX:QAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qualitas is a real estate investment firm specializing in direct investments across various property classes and locations, distressed debt acquisitions and restructuring, third-party capital raising, and consulting services, with a market cap of A$848.09 million.

Operations: Revenue streams for Qualitas include direct lending, contributing A$23.03 million, and funds management, generating A$21.46 million.

Qualitas, a nimble player in the real estate investment space, is capitalizing on Australia's residential development upswing. With fee-earning funds under management surging by 41%, revenue from base management fees is set to climb. The firm's debt-to-equity ratio impressively shrank from 1014.3% to 10.7% over five years, highlighting financial prudence. While earnings grew at an annual rate of 21.6% over the past five years, free cash flow remains negative, posing a challenge amidst rising costs and stiff competition in the residential sector which makes up 85% of deployment. Analysts peg its future price at A$3.6 amid varied opinions on valuation prospects.

Tuas (ASX:TUA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tuas Limited owns and operates a mobile network in Singapore, with a market capitalization of A$2.79 billion.

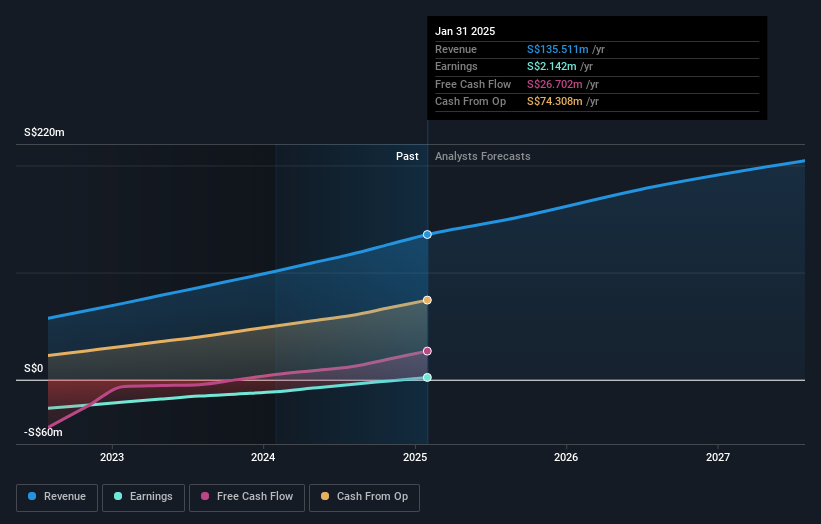

Operations: The company's primary revenue stream is from its mobile operations, generating SGD 135.51 million.

Tuas, a nimble player in the telecom sector, has shown impressive strides by turning profitable this year with net income of SGD 3.02 million for H1 2025, compared to a SGD 3.5 million loss last year. The company's revenue climbed to SGD 73.16 million from SGD 54.72 million over the same period, highlighting robust growth potential as it outpaces industry averages with a forecasted annual revenue growth of nearly 17%. Free cash flow turned positive at A$26.7 million as of January 2025, indicating improved financial health and operational efficiency without any debt burden weighing it down.

- Unlock comprehensive insights into our analysis of Tuas stock in this health report.

Evaluate Tuas' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 44 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal