Riot Platforms (NasdaqCM:RIOT) Expands Bitcoin Production & Appoints Key Data Center Leader

Riot Platforms (NasdaqCM:RIOT) has been active recently, announcing increased Bitcoin production and appointing Jonathan Gibbs as Chief Data Center Officer. The company's output reached 514 Bitcoin in May 2025, marking significant growth from the previous year. Despite these updates and securing a larger credit facility, Riot's stock price movement of 1.07% last month didn't standout against a market that rose 2% over the past week. These developments likely reinforced the company's market position but didn't diverge from the broader market trend. The added financial flexibility and leadership strength position Riot well for future initiatives.

Every company has risks, and we've spotted 5 warning signs for Riot Platforms you should know about.

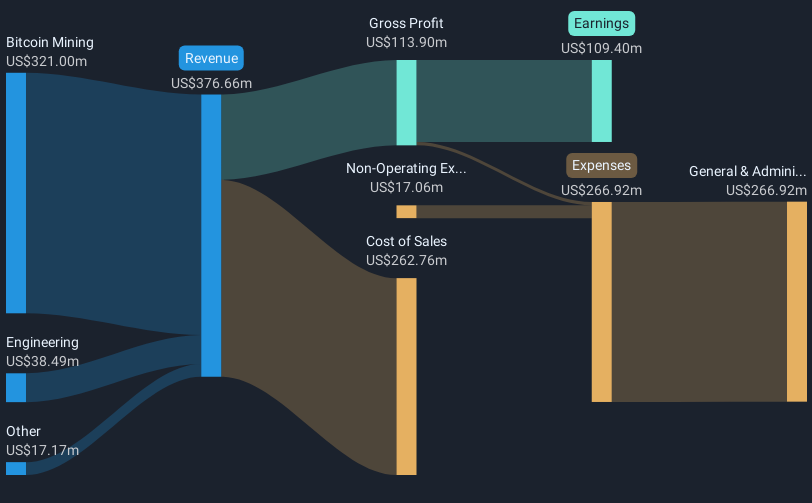

The recent announcements by Riot Platforms, including increased Bitcoin production and the appointment of Jonathan Gibbs as Chief Data Center Officer, have the potential to positively influence the company's future operations and financial outlook. Over the longer term, Riot's total shareholder return, which includes both share price appreciation and dividends, reached a substantial 229.96% over the past five years. Despite this impressive performance, over the past year, the company underperformed against the US Software industry and the broader US market, indicating potential challenges.

The heightened focus on AI and high-performance computing (HPC) capabilities could enhance revenue stability, while the decision to accumulate Bitcoin could affect earnings against the backdrop of Bitcoin market volatility. The company's share price is currently trading at a considerable discount to the consensus price target of US$16.10, suggesting potential upside if analysts' earnings and revenue forecasts materialize. However, investors should remain aware of the risks associated with Bitcoin's inherent volatility and capital expenditures required to expand operations.

Take a closer look at Riot Platforms' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal