Regeneron Pharmaceuticals (NasdaqGS:REGN) Secures US$80 Million Deal For GLP-1/GIP Drug Rights

Regeneron Pharmaceuticals (NasdaqGS:REGN) recently announced a strategic in-licensing agreement with Hansoh Pharmaceuticals, acquiring rights for a dual GLP-1/GIP receptor agonist, HS-20094. Concurrently, interim results from their Phase 2 COURAGE trial revealed continuing investigations of semaglutide and trevogrumab combinations, emphasizing regulatory and market complexities. Despite these developments, Regeneron’s share price fell by 17% over the past week, contrasting sharply with a 2% market rise. These announcements likely intensified concerns, countering broader market movements, given uncertainties around product acceptance, regulatory hurdles, and substantial financial commitments inherent in new agreements.

Find companies with promising cash flow potential yet trading below their fair value.

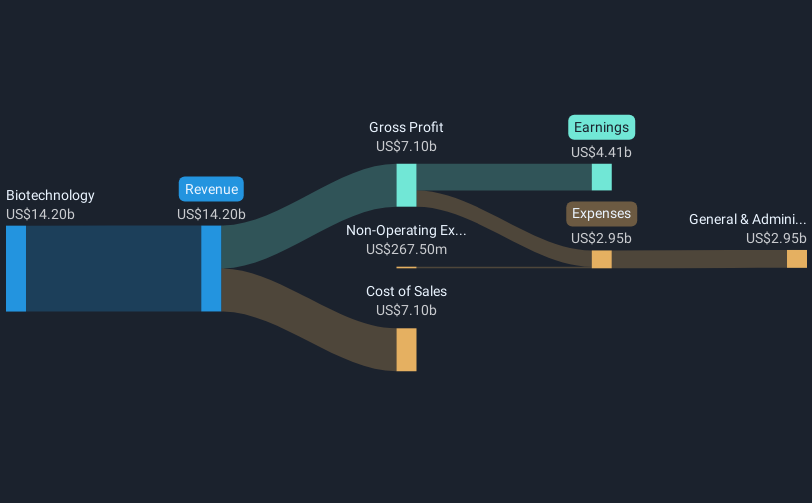

The recent in-licensing agreement with Hansoh Pharmaceuticals and updates from Regeneron's Phase 2 COURAGE trial underscore the company's commitment to expanding its drug portfolio and addressing complex market dynamics. However, these ambitious pursuits come with inherent uncertainties around product acceptance and regulatory hurdles, which may impact revenue and earnings forecasts. The acquisition's cost and financial commitments could exert additional pressure on existing resources, influencing long-term profitability. While innovative therapies promise growth, challenges remain significant as these ventures require substantial investment without guaranteed success.

Over a five-year period, Regeneron Pharmaceuticals has experienced an 18.52% decline in total returns, reflecting challenges in maintaining robust long-term growth. Over the past year, Regeneron has underperformed compared to the US Biotechs industry, which reported a lower decline of 11.5%. This suggests amplified competitive and pricing pressures on Regeneron, particularly in core segments. Despite significant pipeline and manufacturing expansion efforts, Regeneron's share price now trades at US$558.52, starkly below the consensus price target of US$749.26. This wide discrepancy highlights potential investor concerns around achieving the analysts' bullish growth assumptions.

Learn about Regeneron Pharmaceuticals' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal