Hilton Worldwide Holdings (NYSE:HLT) Celebrates Opening Of 1,000th Hotel Globally

Hilton Worldwide Holdings (NYSE:HLT) has reached a milestone by opening its 1,000th global hotel, showcasing significant expansion in luxury and lifestyle offerings with new locations in major cities like Paris, Cape Town, and Dallas. Over the last month, Hilton's share price increased by 3%, slightly outperforming the market's 2% rise. This growth aligns with the company's recent strategic expansion efforts and reflects positively amid a broader market uptrend. The expansion of the Small Luxury Hotels partnership and advances in Hilton's Graduate brand add further strength to Hilton's robust portfolio and contributed to its solid performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

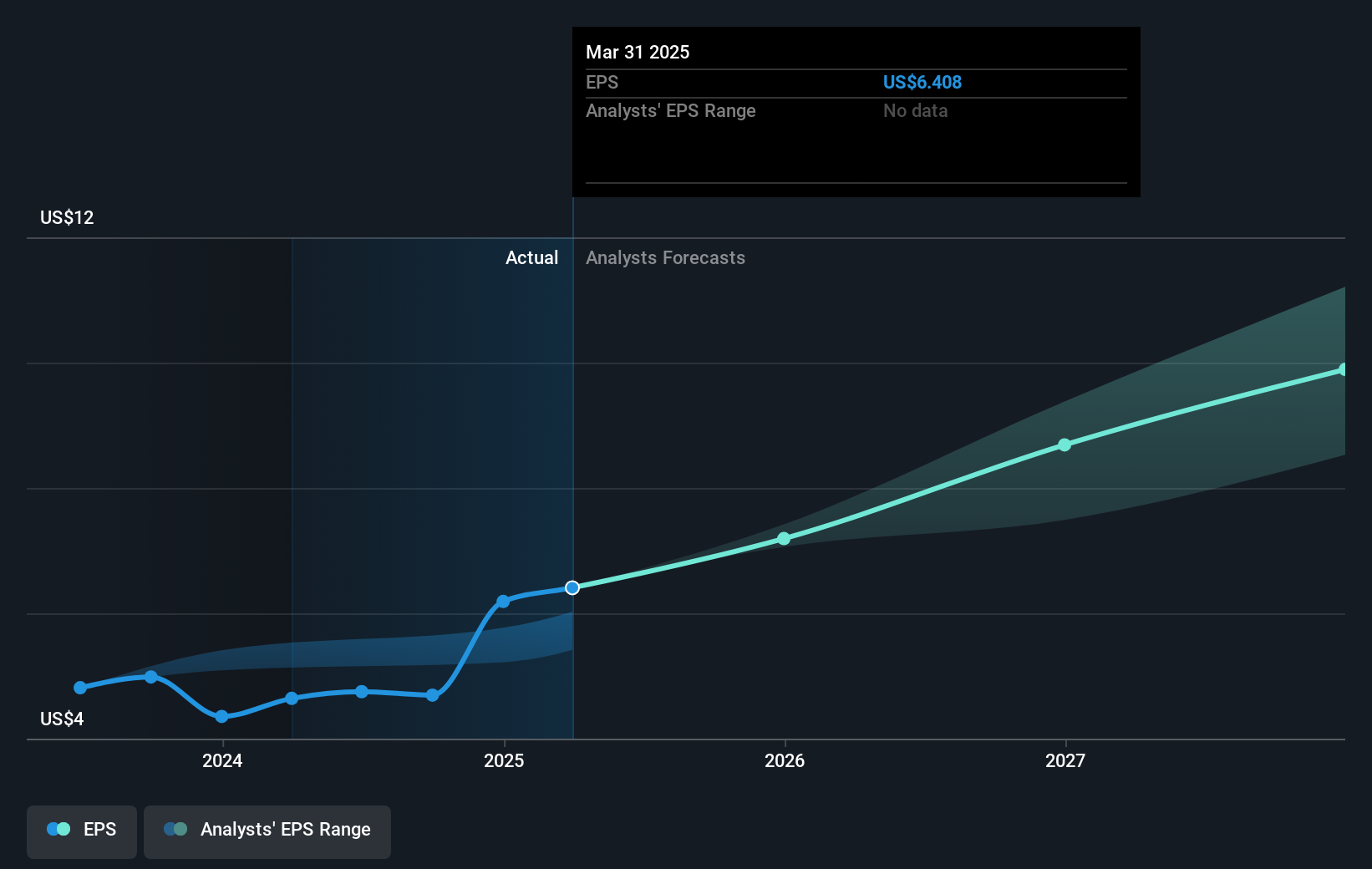

The recent opening of Hilton Worldwide Holdings' 1,000th hotel illustrates an expansion move that could fortify its presence in luxury and lifestyle markets across major cities. This development aligns with Hilton's narrative of strategic international expansion, aiming to capitalize on rising travel demand, particularly in Europe and Asia. These efforts potentially strengthen revenue and earnings forecasts, with analysts anticipating revenue growth supported by development and conversion opportunities.

Over the past five years, Hilton has achieved a substantial total return of 180.91%, reflecting significant growth in shareholder value. Compared to the broader market performance, Hilton's one-year return surpassed the US Hospitality industry, which yielded 15%. This indicates Hilton's competitive positioning and ability to outperform its peers, supported by its growth initiatives.

The current share price, following a recent uptick, is relatively close to the consensus analyst price target of US$247.23, suggesting market confidence in the company's growth prospects. However, the relatively minor discount of the share price to the target reflects a market view that the shares are fairly priced. Continued focus on expanding the luxury segment and executing on its development pipeline could bolster future earnings potential, which analysts forecast to reach US$2.4 billion by 2028. Nonetheless, economic and geopolitical factors remain considerations that could impact Hilton's expansion and earnings trajectories.

Understand Hilton Worldwide Holdings' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal