Top Dividend Stocks On TSX For Reliable Income

As the Canadian market navigates through ongoing tariff uncertainties, investors have shown resilience, with the TSX experiencing a notable rise in May alongside its U.S. counterpart. In these fluctuating times, dividend stocks remain an appealing option for those seeking reliable income, as they offer potential stability and consistent returns amidst broader economic shifts.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| IGM Financial (TSX:IGM) | 5.05% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.18% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.77% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.44% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.10% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.52% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.71% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.53% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.47% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.94% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

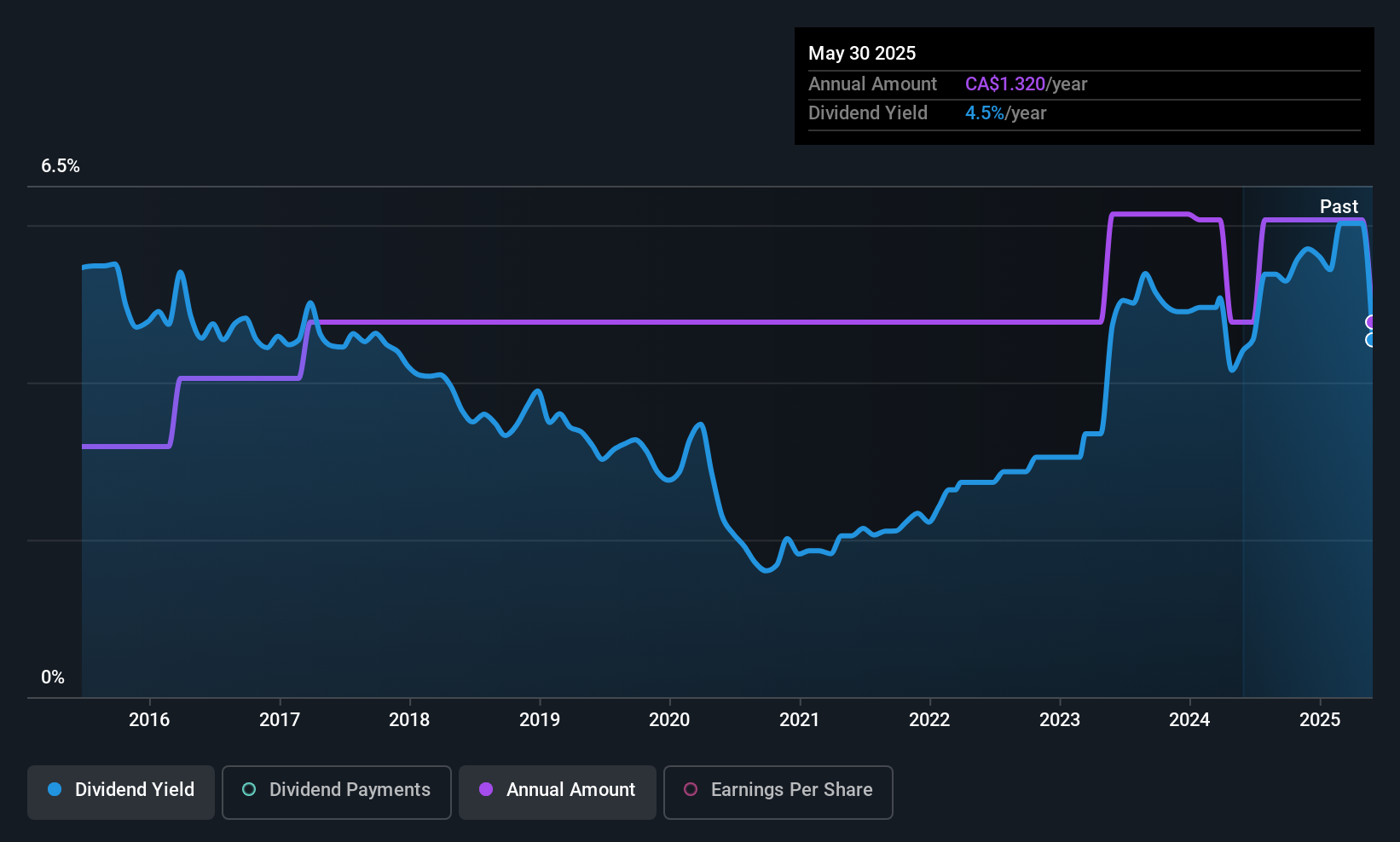

Acadian Timber (TSX:ADN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acadian Timber Corp., along with its subsidiaries, supplies forest products in Eastern Canada and the Northeastern United States, with a market cap of CA$323.04 million.

Operations: Acadian Timber Corp.'s revenue is derived from its Maine Timberlands segment, contributing CA$15.24 million, and its New Brunswick Timberlands segment, generating CA$77.31 million.

Dividend Yield: 6.5%

Acadian Timber's dividend yield of 6.47% ranks in the top 25% among Canadian dividend payers, yet its sustainability is questionable as it isn't fully covered by earnings or cash flows. Despite stable and growing dividends over the past decade, recent financial results show declining sales and net income, with Q1 2025 earnings per share dropping to CAD 0.21 from CAD 0.35 a year prior, highlighting potential challenges for future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Acadian Timber.

- Our valuation report here indicates Acadian Timber may be overvalued.

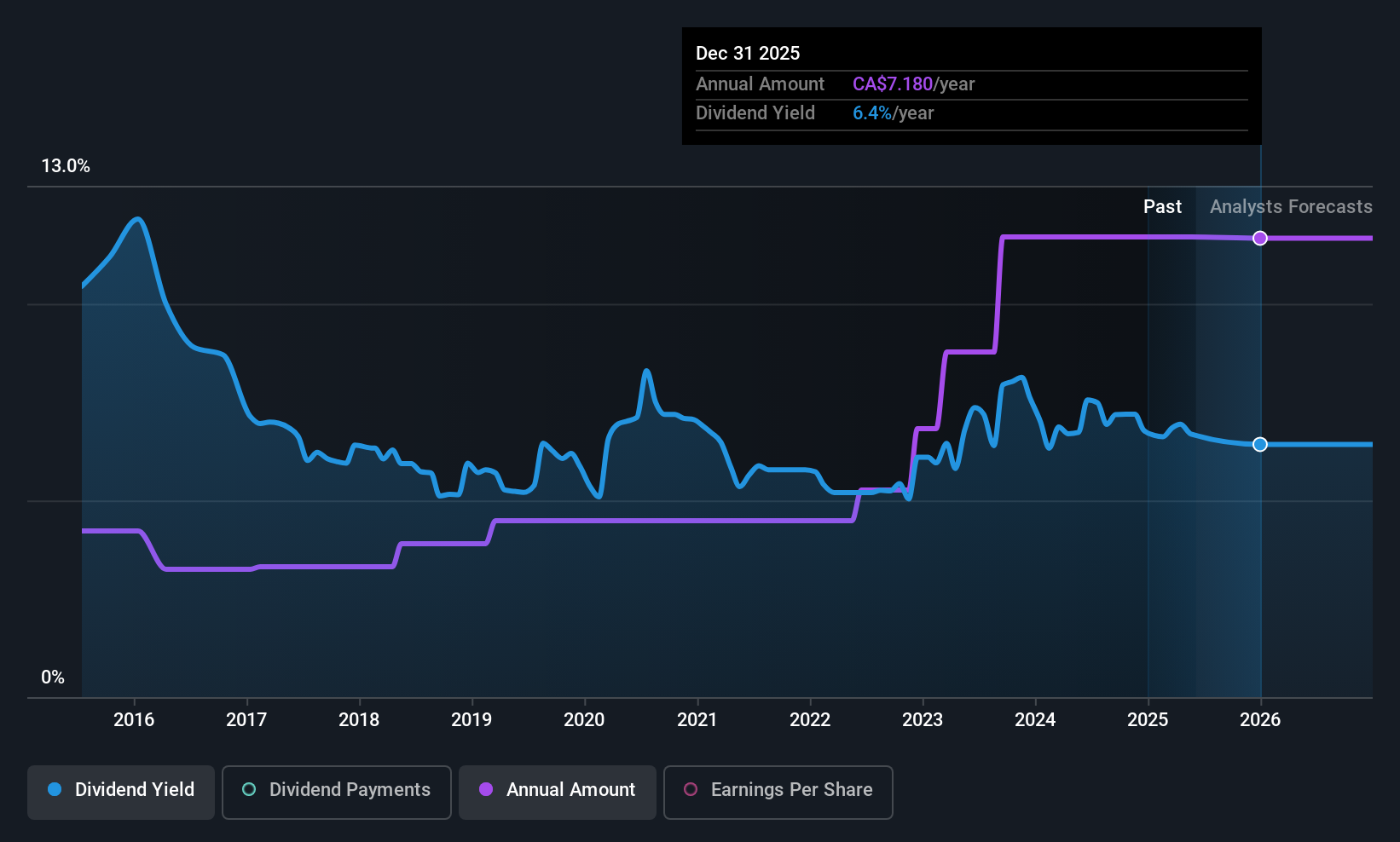

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., operating through its subsidiary Olympia Trust Company, functions as a non-deposit taking trust company in Canada with a market cap of CA$264.70 million.

Operations: Olympia Financial Group Inc. generates revenue through various segments including Health (CA$10.28 million), Corporate (CA$0.04 million), Exempt Edge (EE) (CA$1.51 million), Investment Account Services (IAS) (CA$79.09 million), Currency and Global Payments (CGP) (CA$6.80 million), and Corporate and Shareholder Services (CSS) (CA$5.12 million).

Dividend Yield: 6.4%

Olympia Financial Group's dividend yield of 6.44% places it among the top Canadian payers, with dividends covered by both earnings (73.5% payout) and cash flows (70.4%). However, its dividend history is marked by volatility and unreliability over the past decade. Recent Q1 2025 results show a slight revenue decline to C$25.39 million, with net income at C$5.4 million compared to C$5.74 million previously, indicating potential concerns for future dividend stability despite ongoing monthly payments of C$0.60 per share.

- Click here and access our complete dividend analysis report to understand the dynamics of Olympia Financial Group.

- The analysis detailed in our Olympia Financial Group valuation report hints at an deflated share price compared to its estimated value.

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Richards Packaging Income Fund, with a market cap of CA$323.17 million, designs, manufactures, and distributes packaging containers and healthcare supplies in North America.

Operations: Richards Packaging Income Fund generates revenue through its wholesale miscellaneous segment, amounting to CA$410.61 million.

Dividend Yield: 4.3%

Richards Packaging Income Fund's dividend yield of 4.29% is below the top Canadian payers, but its dividends are well-covered by earnings (44.5% payout ratio) and cash flows (40.7%). Despite a history of volatility, dividends have grown over the past decade with consistent monthly payments of C$0.11 per share recently affirmed for June 2025. However, Q1 2025 results show a decline in net income to C$5.11 million from C$8.49 million, signaling potential challenges ahead.

- Unlock comprehensive insights into our analysis of Richards Packaging Income Fund stock in this dividend report.

- Upon reviewing our latest valuation report, Richards Packaging Income Fund's share price might be too pessimistic.

Key Takeaways

- Delve into our full catalog of 28 Top TSX Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal